Nordstrom 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[34 ]

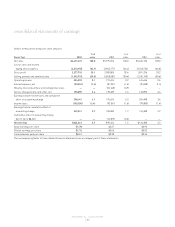

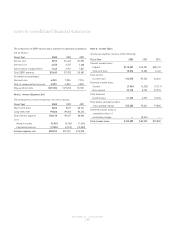

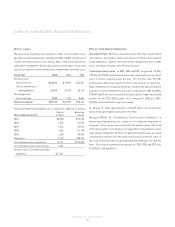

The components of SERP expense and a summary of significant assumptions

are as follows:

Fiscal Year 2003 2002 2001

Service cost $819 $1,447 $1,092

Interest cost 3,420 3,537 2,668

Amortization of adjustments 1,444 2,941 1,821

Total SERP expense $5,683 $7,925 $5,581

Assumption percentages:

Discount rate 6.25% 7.00% 7.25%

Rate of compensation increase 4.00% 4.00% 5.00%

Measurement date 10/31/03 10/31/02 12/1/01

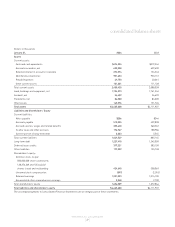

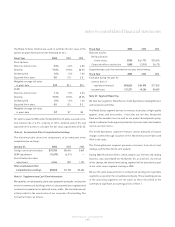

Note 5: Interest Expense, Net

The components of interest expense, net are as follows:

Fiscal Year 2003 2002 2001

Short-term debt $652 $677 $3,741

Long-term debt 99,866 89,850 83,225

Total interest expense 100,518 90,527 86,966

Less:

Interest income (5,981) (4,254) (1,545)

Capitalized interest (3,585) (4,352) (10,383)

Interest expense, net $90,952 $81,921 $75,038

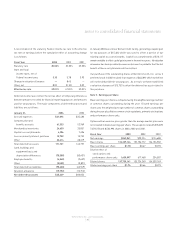

Note 6: Income Taxes

Income tax expense consists of the following:

Fiscal Year 2003 2002 2001

Current income taxes:

Federal $118,559 $76,901 $58,122

State and local 15,516 10,633 6,142

Total current

income taxes 134,075 87,534 64,264

Deferred income taxes:

Current (7,904) (4,225) (7,217)

Non-current 29,129 8,732 22,753

Total deferred

income taxes 21,225 4,507 15,536

Total before cumulative effect

of accounting change 155,300 92,041 79,800

Deferred income taxes on

cumulative effect of

accounting change —(8,541) —

Total income taxes $155,300 $83,500 $79,800

notes to consolidated financial statements