Nordstrom 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

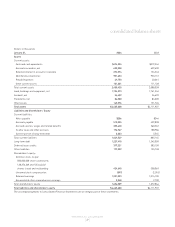

NORDSTROM, INC. and SUBSIDIARIES

[31 ]

Cash Equivalents: Cash equivalents are short-term investments with

a maturity of three months or less from the date of purchase.

As of January 31, 2004 and 2003, we have restricted cash of $7,140 and

$7,523 included in our cash balances. The restricted cash is held in a trust

for use by our Supplemental Executive Retirement Plan and Deferred

Compensation Plans.

Cash Management: Our cash management system provides for the

reimbursement of all major bank disbursement accounts on a daily basis.

Accounts payable at January 31, 2004 and 2003 includes $17,853

and $13,882 of checks not yet presented for payment drawn in excess of

cash balances.

Merchandise Inventories: Merchandise inventories are valued at the

lower of cost or market, using the retail method (first-in, first-out basis).

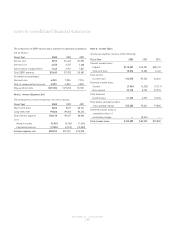

Land, Buildings and Equipment: Depreciation is computed using a

combination of accelerated and straight-line methods. Estimated useful

lives by major asset category are as follows:

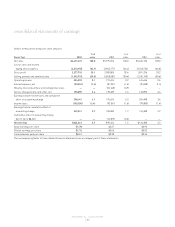

Asset Life (in years)

Buildings 5-40

Store fixtures and equipment 3-15

Leasehold improvements Shorter of life of lease or asset life

Software 3-7

Asset Impairment: We review our intangibles and other long-lived assets

annually for impairment or when circumstances indicate the carrying

value of these assets may not be recoverable.

Deferred Lease Credits: We receive developer reimbursements as

incentives to construct stores in certain developments. We capitalize

the property, plant and equipment for these stores during the construction

period in accordance with EITF Issue No. 97-10, “The Effect of Lessee

Involvement in Asset Construction.” At the end of the construction period,

developer reimbursements in excess of construction costs are recorded

as deferred lease credits and amortized as a reduction to rent expense,

on a straight-line basis over the life of the applicable lease or operating

covenant. Construction costs in excess of developer reimbursements are

recorded as prepaid rent and amortized as rent expense on a straight-

line basis over the life of the applicable lease or operating covenant.

Foreign Currency Translation: The assets and liabilities of our foreign

subsidiary have been translated to U.S. dollars using the exchange rates

effective on the balance sheet date, while income and expense accounts

are translated at the average rates in effect during the year. Resulting

translation adjustments are recorded as other comprehensive earnings.

Income Taxes: We use the asset and liability method of accounting for

income taxes. Using this method, deferred tax assets and liabilities are

recorded based on differences between financial reporting and tax basis

of assets and liabilities. The deferred tax assets and liabilities are

calculated using the enacted tax rates and laws that will be in effect

when the differences are expected to reverse. We establish valuation

allowances for tax benefits when we believe it is not likely that the related

expense will be deductible for tax purposes.

Loyalty Programs: We have customer loyalty programs in which customers

receive points for qualifying purchases. Upon the accumulation of a

certain number of points, customers receive a merchandise certificate.

Anticipated merchandise certificate redemptions are expensed as points

are earned by the customer, adjusted for expected redemption based

on historical trends. Credit customers generally earn one to three points

for every dollar charged to their Nordstrom Retail or Nordstrom VISA credit

card, and each point is worth $0.01. The related expense is recorded in

selling, general and administrative expense.

Vendor Allowances: We receive allowances from merchandise vendors

for purchase price adjustments, cooperative advertising programs and

cosmetic selling expenses. Purchase price adjustments are recorded as

a reduction of cost of sales at the point they have been earned and the related

merchandise has been sold. Allowances for cooperative advertising

programs and cosmetic selling expenses are recorded as a reduction of

selling, general and administrative expense when the advertising or

selling expense is incurred. Allowances in excess of actual costs incurred

are recorded as a reduction to cost of sales.

Fair Value of Financial Instruments: The carrying amounts of cash

equivalents and notes payable approximate fair value. See Note 13 for

the fair values of our long-term debt, including current maturities and interest

rate swap agreements.

notes to consolidated financial statements