Nordstrom 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[39 ]

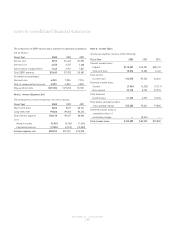

Note 13: Long-Term Debt

A summary of long-term debt is as follows:

January 31, 2004 2003

Receivable-backed PL Term, 4.82%,

due 2006 $300,000 $300,000

Senior debentures, 6.95%,

due 2028 300,000 300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Senior notes, 8.95%, due 2005 196,770 300,000

Notes payable, 6.7%, due 2005 97,500 100,000

Mortgage payable, 7.68%, due 2020 79,204 79,618

Other 18,860 17,753

Fair market value

of interest rate swap (8,091) 3,224

Total long-term debt 1,234,243 1,350,595

Less current portion (6,833) (5,545)

Total due beyond one year $1,227,410 $ 1,345,050

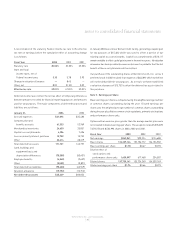

Year to date we have purchased $103,230 of our 8.95% senior notes and

$2,500 of our 6.7% medium-term notes for a total cash payment of

$120,760. Approximately $14,300 of expense has been recorded during

the year related to these purchases.

During the first quarter of 2004, we retired $196,770 of our 8.95% senior

notes for a total cash payment of $218,554. Approximately $20,781 of expense

has been recorded in the first quarter of 2004. This expense and the

related interest savings is expected to reduce first quarter earnings per

share by approximately $0.08 per share.

To manage our interest rate risk, we had outstanding at January 31, 2004

and 2003, interest rate swaps with a fair value of ($8,091) and $3,224

recorded in other liabilities and other assets, respectively. All interest rate

swaps were designated as fully effective fair value hedges. Our current

swap has a $250 million notional amount, expiring in 2009. Under the

agreement, we received a fixed rate of 5.63% and paid a variable rate based

on LIBOR plus a margin of 2.3% set at six-month intervals (3.945% at

January 31, 2004).

In 2002 and 2003, we received $4,931 and $2,341 for the sale of two

interest rate swaps. The first swap converted our $300 million, 8.95% fixed-

rate debt to variable rate, while the second swap converted our $250

million, 5.63% fixed-rate debt to variable rate. The cash proceeds from

each of the swaps will be recognized as interest income evenly over the

remaining life of the related debt.

The fair value of long-term debt, including current maturities, using

quoted market prices of the same or similar issues, was approximately

$1,336,000 and $1,443,000 at January 31, 2004 and 2003.

We own a 49% interest in a limited partnership which constructed a

new corporate office building in which we are the primary occupant.

During 2002, the limited partnership refinanced its construction loan

obligation with a mortgage secured by the property. This mortgage will

be amortized as we make rental payments to the limited partnership

over the life of the mortgage.

Required principal payments on long-term debt, excluding capital lease

obligations, the fair market value of the interest rate swap and $196,770

of debt repurchased in the first quarter of 2004, are as follows:

Year ended January 31,

2005 5,420

2006 101,613

2007 303,800

2008 3,677

2009 253,564

Thereafter 366,253

notes to consolidated financial statements