Nordstrom 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[40 ]

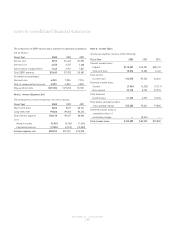

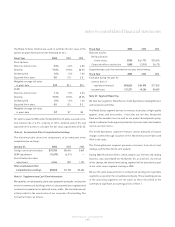

Note 14: Leases

We lease land, buildings and equipment under noncancelable lease

agreements with expiration dates ranging from 2004 to 2080. Certain leases

include renewal provisions at our option. Most of the leases provide for

additional rent payments based upon specific percentages of sales and

require us to pay for certain common area maintenance and other costs.

Fiscal Year 2003 2002 2001

Minimum rent:

Store locations $24,071 $19,609 $26,951

Offices, warehouses

and equipment 23,158 27,610 20,144

Percentage rent:

Store locations 7,920 7,776 8,047

Total rent expense $55,149 $54,995 $55,142

Future minimum lease payments as of January 31, 2004 are as follows:

Capital Operating

Year ended January 31, Leases Leases

2005 $2,398 $73,265

2006 1,932 69,522

2007 1,564 65,216

2008 1,565 61,140

2009 1,565 58,332

Thereafter 7,167 390,731

Total minimum lease payments 16,191 $718,206

Less amount representing interest 4,704

Present value of net minimum lease

payments $11,487

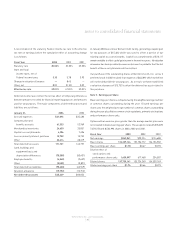

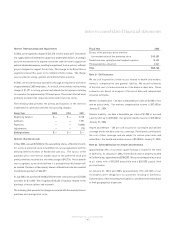

Note 15: Stock-Based Compensation

Stock Option Plan: We have a stock option plan ("the Plan") under which

stock options, performance share units and restricted stock are granted

to key employees. Options vest over periods ranging from four to eight

years, and expire ten years after the date of grant.

Performance Share Units: In 2003, 2002 and 2001 we granted 113,904,

190,396 and 273,864 performance share units, which will vest over three

years if certain financial goals are met. For the first time, 227,881

performance share units vested at 125% of their value as of January 31,

2004. Employees do not pay any monetary consideration upon vesting and

may elect to receive common stock or cash. At January 31, 2004 and 2003,

$18,657 and $4,441 were recorded in accrued salaries, wages and related

benefits for the 2001-2003 grants. As of January 31, 2004 and 2003,

284,805 and 415,640 units were outstanding.

At January 31, 2004, approximately 4,166,239 shares are reserved for

future stock option grants pursuant to the Plan.

We apply APB No. 25, "Accounting for Stock Issued to Employees," in

measuring compensation costs under our stock-based compensation

programs. Stock options are issued at the fair market value of the stock

at the date of grant. Accordingly, we recognized no compensation cost for

stock options issued under the Plan. For performance share units, we record

compensation expense over the performance period at the fair value of

the stock on the date when it is probable that the employees will earn the

units. Stock-based compensation expense for 2003, 2002 and 2001 was

$17,894, $1,130 and $3,414.

notes to consolidated financial statements