Nordstrom 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[43 ]

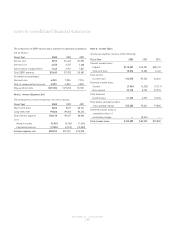

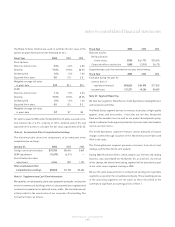

The Black-Scholes method was used to estimate the fair value of the

options at grant date based on the following factors:

Fiscal Year 2003 2002 2001

Stock Options:

Risk-free interest rate 2.9% 4.3% 4.8%

Volatility 71.0% 69.0% 68.0%

Dividend yield 1.5% 1.5% 1.3%

Expected life in years 5.0 5.0 5.0

Weighted-average fair value

at grant date $10 $14 $10

ESPP:

Risk-free interest rate 1.1% 1.9% 4.3%

Volatility 71.0% 69.0% 68.0%

Dividend yield 1.5% 1.5% 1.3%

Expected life in years 0.5 0.5 0.5

Weighted-average fair value

at grant date $7 $7 $5

For options issued in 2001 under the Nordstrom.com plans, we used a risk-

free interest rate of 4.5%, volatility of 127%, dividend yield of 0% and

expected life of 4 years to calculate the fair value at grant date of $1.56.

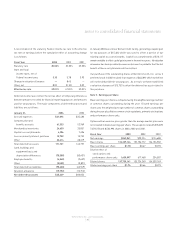

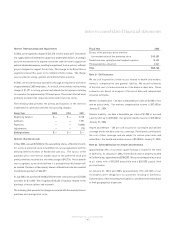

Note 16: Accumulated Other Comprehensive Earnings

The following table shows the components of accumulated other

comprehensive earnings:

January 31, 2004 2003 2002

Foreign currency translation $15,783 $8,404 $649

SERP adjustment (11,679) (6,511) —

Securitization fair value

adjustment 4,764 807 1,757

Total accumulated other

comprehensive earnings $8,868 $2,700 $2,406

Note 17: Supplementary Cash Flow Information

We capitalize certain property, plant and equipment during the construction

period of commercial buildings which is subsequently derecognized and

reclassed to prepaid rent or deferred lease credits. We also had noncash

activity related to the construction of our corporate office building. The

noncash activity is as follows:

Fiscal Year 2003 2002 2001

Noncash activity:

Reclassification

of new stores $753 $61,792 $75,555

Corporate office construction 1,880 (3,951) 36,120

Supplementary cash flow information includes the following:

Fiscal Year 2003 2002 2001

Cash paid during the year for:

Interest (net of

capitalized interest) $96,824 $84,898 $77,025

Income taxes 121,271 48,386 80,689

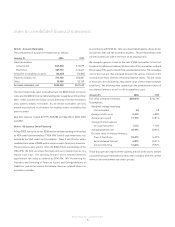

Note 18: Segment Reporting

We have four segments: Retail Stores, Credit Operations, Catalog/Internet,

and Corporate and Other.

The Retail Stores segment derives its revenues from sales of high-quality

apparel, shoes and accessories. It includes our full-line, Nordstrom

Rack and Façonnable stores as well as our product development group,

which coordinates the design and production of private label merchandise

sold in our retail stores.

The Credit Operations segment revenues consist primarily of finance

charges earned through issuance of the Nordstrom private label and

VISA credit cards.

The Catalog/Internet segment generates revenues from direct mail

catalogs and the Nordstrom.com website.

During 2003, Nordstrom Direct, which contains our Internet and catalog

business, was consolidated into Nordstrom, Inc. as a division. As a result

of this change, the Internet and catalog segment will be presented as part

of our retail stores segment starting in 2004.

We use the same measurements to compute net earnings for reportable

segments as we do for the consolidated company. The accounting policies

of the operating segments are the same as those described in the

summary of significant accounting policies in Note 1.

notes to consolidated financial statements