Nordstrom 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. and SUBSIDIARIES

[42 ]

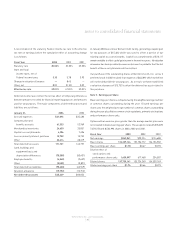

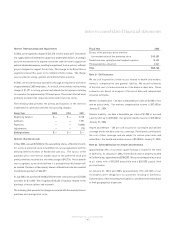

Nonemployee Director Stock Incentive Plan

The Nonemployee Director Stock Incentive Plan authorizes the grant of

stock awards to nonemployee directors. These awards may be deferred

or issued in the form of restricted or unrestricted stock, nonqualified

stock options or stock appreciation rights. We issued 15,849 and 18,981

shares of common stock for a total expense of $318 and $405 for the years

ended January 31, 2004 and 2003. An additional 10,672 shares were

deferred for a total expense of $183 in 2003. At January 31, 2004, we had

404,498 remaining shares available for issuance.

Nordstrom.com

Nordstrom.com had two stock option plans, the "1999 Plan" and the

"2000 Plan," as well as warrants issued to vendors in exchange for

services. In the third quarter of 2002, we purchased 3,608,322 options and

470,000 warrants in connection with the purchase of the minority interest

in Nordstrom.com (see Note 20) for a total cash payment of $11,802. At

January 31, 2004 and 2003, there are no outstanding options or warrants

for Nordstrom.com.

Employee Stock Purchase Plan

We offer an Employee Stock Purchase Plan as a benefit to our employees.

Employees participate through payroll deductions in amounts related to

their base compensation. At the end of each offering period, the participants

purchase shares at 85% of the lower of the fair market value at the

beginning or the end of the offering period, usually six months. We issued

647,480, 596,351 and 541,677 shares under this plan in 2003, 2002 and 2001.

As of January 31, 2004 and 2003, we had payroll deductions totaling

$3,728 and $3,000 for the purchase of shares. We have 1,548,650 shares

available for issuance at January 31, 2004.

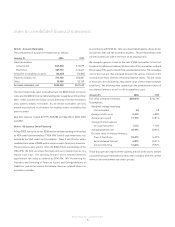

Pacesetter Stock Plan

We granted 9,528, 10,653 and 6,687 shares of common stock to key

employees under the Pacesetters stock plan in 2003, 2002 and 2001. The

Pacesetter stock plan was established in 1997 to provide additional

incentive to employees, officers, consultants or advisors to promote the

success of the business. The related expense of $164, $240 and $130 was

recorded in 2003, 2002 and 2001. An additional 1,527 shares were deferred

for a related expense of $26 in 2003. As of January 31, 2004, there are

no remaining shares available for issuance.

Grants To Executive Officers

Options and performance share units granted to our president and the other

four most highly compensated individuals were 9.3%, 8.3% and 7.9% as

a percent of total options and performance share units granted in 2003,

2002 and 2001.

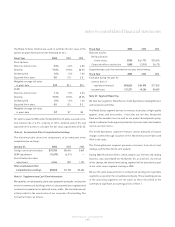

SFAS No. 123

The following table illustrates the effect on net income and earnings per

share if we had applied the fair value recognition provisions of SFAS No.

123, “Accounting for Stock-Based Compensation.”

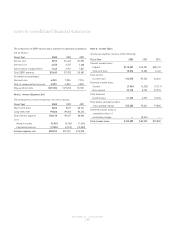

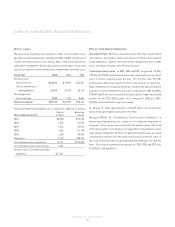

Fiscal Year 2003 2002 2001

Net earnings, as reported $242,841 $90,224 $124,688

Add: stock-based compensation

expense included in reported

net income, net of tax 9,898 2,240 2,598

Deduct: stock-based compensation

expense determined under fair

value, net of tax (23,749) (21,914) (19,850)

Pro forma net earnings $228,990 $70,550 $107,436

Earnings per share:

Basic — as reported $1.78 $0.67 $0.93

Diluted — as reported $1.76 $0.66 $0.93

Basic — pro forma $1.68 $0.52 $0.80

Diluted — pro forma $1.67 $0.52 $0.80

notes to consolidated financial statements