NetFlix 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

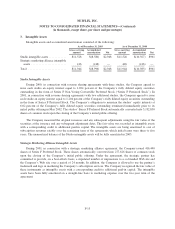

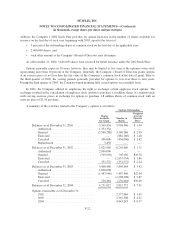

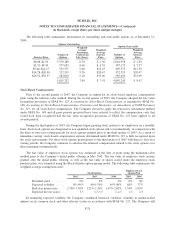

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

liabilities are presented below:

As of December 31,

2003 2004

Deferred tax assets:

Net operating loss carryforwards ........................ $40,657 $49,337

Accruals and reserves ................................. 7,602 853

Depreciation ........................................ — 843

Other .............................................. 592 14

Gross deferred tax assets .................................. 48,851 51,047

Less: valuation allowance .................................. (48,851) (51,047)

Net deferred tax assets .................................... $ — $ —

Management has established a valuation allowance for all deferred tax assets as future realization is

uncertain given the history of losses through the first quarter of 2003, limited profitable quarters to date and the

competitive landscape of online DVD rentals. The total valuation allowance for the years ended December 31,

2003 and 2004 increased by $3,621 and $2,196, respectively.

As of December 31, 2004, the Company had net operating loss carryforwards for federal and California

income tax purposes of approximately $135,958 and $64,430, respectively, to reduce future income subject to

income tax. The federal net operating loss carryforwards will expire beginning in 2012 to 2023 and the California

net operating loss carryforwards expire beginning in 2005 to 2013, if not previously utilized. As of December 31,

2004, approximately $2,903 of the valuation allowance related to benefits of excess tax deductions for stock

options which will be credited to equity when realized.

10. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible

employees may contribute up to 15 percent of their annual salary through payroll deductions, but not more than

the statutory limits set by the Internal Revenue Service. The Company matches employee contributions at the

discretion of the Board of Directors. During 2002, 2003 and 2004, the Company’s matching contributions totaled

$0, $0 and $379, respectively.

F-25