NetFlix 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

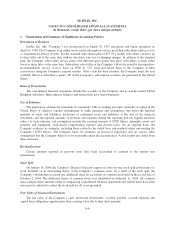

Fulfillment

Fulfillment expenses represent those costs incurred in operating and staffing the Company’s fulfillment and

customer service centers, including costs attributable to receiving, inspecting and warehousing the Company’s

DVD library. Fulfillment expenses also include credit card fees.

Technology and Development

Technology and development expenses consist of payroll and related costs incurred in testing, maintaining

and modifying the Company’s Web Site, its recommendation service, developing solutions for downloading

movies to subscribers, telecommunications systems and infrastructure and other internal-use software systems.

Technology and development expenses also include depreciation on the computer hardware and capitalized

software.

Marketing

Marketing expenses consist of payroll and related expenses and advertising expenses. Advertising expenses

include marketing program expenditures and other promotional activities, including revenue sharing expenses,

postage and packaging expenses and library amortization related to free trial periods. Advertising costs are

expensed as incurred except for advertising production costs, which are expensed the first time the advertising is

run. Advertising expense totaled approximately $32,405, $46,459, and $91,799 in 2002, 2003 and 2004,

respectively.

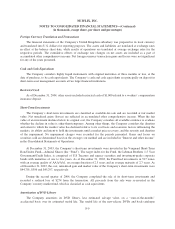

In November of 2002, the Emerging Issues Task Force (“ EITF”) reached a consensus on Issue No. 02-16,

Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor, which

addresses the accounting for cash consideration given to a reseller of a vendor’s products from the vendor. The

Company and its vendors participate in a variety of cooperative advertising programs and other promotional

programs in which the vendors provide the Company with cash consideration in exchange for marketing and

advertising of the vendor’s products. If the consideration received represents reimbursement of specific

incremental and identifiable costs incurred to promote the vendor’s product, it is recorded as an offset to the

associated marketing expense incurred. Any reimbursement greater than the costs incurred is recognized as a

reduction of cost of revenues when recognized in the Company’s statement of operations.

Income Taxes

The Company accounts for income taxes using the asset and liability method. Deferred income taxes are

recognized by applying enacted statutory tax rates applicable to future years to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and

tax credit carryforwards. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. The measurement of deferred tax assets is reduced, if

necessary, by a valuation allowance for any tax benefits for which future realization is uncertain.

Comprehensive Income (Loss)

The Company reports comprehensive income or loss in accordance with the provisions of SFAS No. 130,

“Reporting Comprehensive Income”, which establishes standards for reporting comprehensive income and its

components in the financial statements. The components of other comprehensive income (loss) consist of

unrealized gains and losses on available-for-sale securities and cumulative translation adjustments. Total

F-11