NetFlix 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial forecasting by us and financial analysts who may publish estimates of our financial results will

be difficult because of our limited operating history, and our actual results may differ from forecasts.

As a result of our growth, our limited operating history and the changing competitive landscape it is difficult

to accurately forecast our revenues, gross margin, operating expenses, number of paying subscribers, number of

DVDs shipped per day and other financial and operating data. Our inability or the inability of the financial

community to accurately forecast our operating results could cause our net income (losses) in a given quarter to

be less (greater) than expected, which could cause a decline in the trading price of our common stock. We have a

limited amount of meaningful historical financial data upon which to base planned operating expenses. We base

our current and forecasted expense levels and DVD acquisitions on our operating plans and estimates of future

revenues, which are dependent on the growth of our subscriber base and the demand for titles by our subscribers.

As a result, we may be unable to make accurate financial forecasts or to adjust our spending in a timely manner

to compensate for any unexpected shortfalls in revenues. We believe that these difficulties in forecasting are even

greater for financial analysts who may publish their own estimates of our financial results.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The primary objective of our investment activities is to preserve principal, while at the same time

maximizing income we receive from investments without significantly increased risk. Some of the securities we

invest in may be subject to market risk. This means that a change in prevailing interest rates may cause the

principal amount of the investment to fluctuate. For example, if we hold a security that was issued with a fixed

interest rate at the then-prevailing rate and the prevailing interest rate later rises, the value of our investment will

decline. To minimize this risk, we intend to maintain our portfolio of cash equivalents in a variety of securities.

Our cash equivalents are generally invested in money market funds, which are not subject to market risk because

the interest paid on such funds fluctuates with the prevailing interest rate.

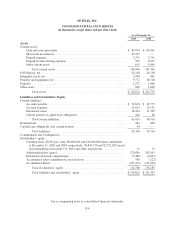

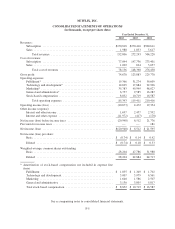

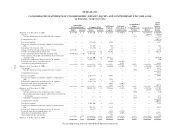

Item 8. Financial Statements and Supplementary Data

See “Financial Statements” beginning on page F-1 which are incorporated herein by reference.

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

Not applicable.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-

15(e) under the Securities Exchange Act of 1934, as amended (the Exchange Act)). Based on that evaluation, our

Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures as of

the end of the period covered by this report were effective in ensuring that information required to be disclosed

by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported

within the time periods specified in the Securities and Exchange Commission’s rules and forms.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial

reporting (as defined in Rule 13a-15(f) of the Exchange Act). Our management assessed the effectiveness of our

internal control over financial reporting as of December 31, 2004. In making this assessment, our management

used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission

(“COSO”) in Internal Control-Integrated Framework. Our management has concluded that, as of December 31,

2004, our internal control over financial reporting is effective based on these criteria.

40