NetFlix 2004 Annual Report Download - page 33

Download and view the complete annual report

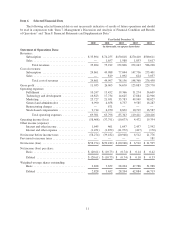

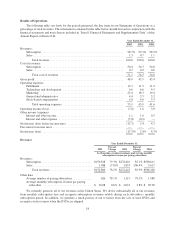

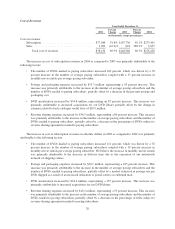

Please find page 33 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketing. Marketing expenses consist of payroll and related expenses and advertising expenses.

Advertising expenses include marketing program expenditures and other promotional activities, including

revenue sharing expenses, postage and packaging expenses and library amortization related to free trial periods.

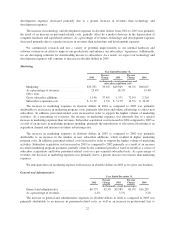

General and Administrative. General and administrative expenses consist of payroll and related expenses

for executive, finance, content acquisition and administrative personnel, as well as recruiting, professional fees

and other general corporate expenses.

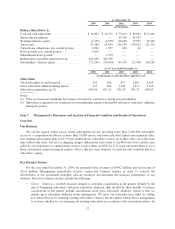

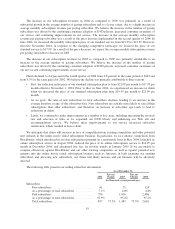

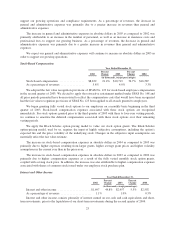

Stock-Based Compensation. During the second quarter of 2003, we adopted the fair value recognition

provisions of Statement of Financial Accounting Standards (“SFAS”) No. 123, Accounting for Stock-Based

Compensation, as amended by SFAS No. 148, Accounting for Stock-Based Compensation—Transition and

Disclosure, an Amendment of FASB Statement No. 123, for stock-based compensation. We elected to apply the

retroactive restatement method under SFAS No. 148 and all prior periods presented have been restated to reflect

the compensation costs that would have been recognized had the fair value recognition provisions of SFAS No.

123 been applied to all awards granted.

During the third quarter of 2003, we began granting stock options to our employees on a monthly basis. The

vesting periods provide for options to vest immediately, in comparison with the three to four-year vesting periods

for stock options granted prior to the third quarter of 2003. As a result of immediate vesting, all stock-based

compensation expense determined under SFAS No. 123 is fully recognized upon the grant of the stock option.

For those stock options granted prior to the third quarter of 2003 with three to four-year vesting periods, we

continue to amortize the deferred compensation related to those stock options over the remaining vesting periods.

17