NetFlix 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

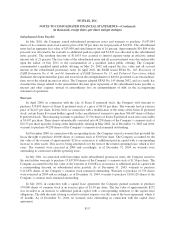

continue to monitor these and other relevant factors used to estimate expected volatility for future option grants.

In addition, the Company bases its expected life assumption on historical experience as well as the terms and

vesting periods of the options granted. Beginning with the second quarter of 2004, the Company bifurcated its

option grants into two employee groupings who have exhibited different exercise behavior and changed the

estimate of the expected life from 1.5 years for all option grants in the first quarter of 2004 to 1 year for one

group and 2.5 years for the other group in the second quarter of 2004.

The weighted-average fair value of employee stock options granted during 2002, 2003 and 2004 was $5.19,

$5.98 and $8.45 per share, respectively. The weighted-average fair value of shares granted under the employee

stock purchase plan during 2003 and 2004 was $4.43 and $10.00 per share, respectively.

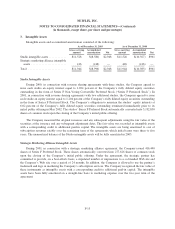

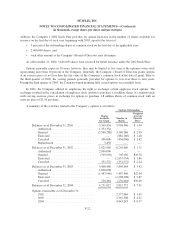

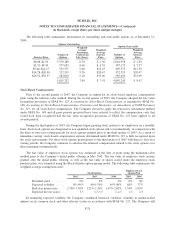

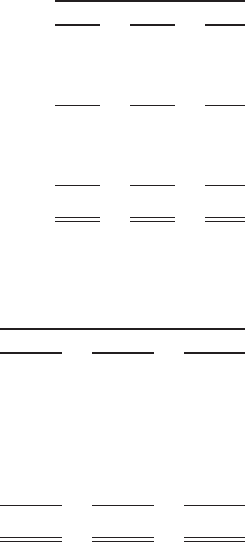

9. Income Taxes

The provision for income tax expense consists of the following:

Year Ended December 31,

2002 2003 2004

Currently payable

Federal ........................................... $— $— $ 4

State ............................................. — — 1

Total current .......................................... — — $ 5

Amounts credited to equity for realized benefit of additional tax

stockoptiondeductions................................ — — 176

Total income tax provision ............................... $— $— $181

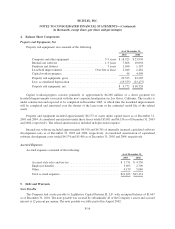

Income tax expense differed from the amounts computed by applying the U.S. federal income tax rate of 34

percent to pretax income (loss) as a result of the following:

Year Ended December 31,

2002 2003 2004

Expected tax expense (benefit) at U.S federal statutory rate

of34% ....................................... $(7,463) $ 2,214 $ 7,404

State income taxes net of federal income tax effect ....... — — 28

Valuation allowance ............................... 4,105 (5,914) (3,816)

Stock-based compensation .......................... 3,343 3,644 (3,471)

Other........................................... 15 56 36

Totalincometaxexpense........................... $ — $ — $ 181

F-24