NetFlix 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share, per share and percentages)

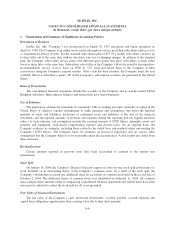

1. Organization and Summary of Significant Accounting Policies

Description of Business

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 (inception) and began operations on

April 14, 1998. The Company is an online movie rental subscription service, providing subscribers with access to

a comprehensive library of titles. For the standard subscription plan of $17.99 a month, subscribers can have up

to three titles out at the same time with no due dates, late fees or shipping charges. In addition to the standard

plan, the Company offers other service plans with different price points that allow subscribers to keep either

fewer or more titles at the same time. Subscribers select titles at the Company’s Web site aided by its proprietary

recommendation service, receive them on DVD by U.S. mail and return them to the Company at their

convenience using the Company’s prepaid mailers. After a title has been returned, the Company mails the next

available title in a subscriber’s queue. All of the Company’s subscription revenues are generated in the United

States.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned United

Kingdom subsidiary. Intercompany balances and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items

subject to such estimates and assumptions include the carrying amounts of DVD library, intangible assets and

property and equipment, stock-based compensation expense and income taxes. On an ongoing basis, the

Company evaluates its estimates, including those related to the useful lives and residual values surrounding the

Company’s DVD library. The Company bases its estimates on historical experience and on various other

assumptions that the Company believes to be reasonable under the circumstances. Actual results may differ from

these estimates.

Reclassifications

Certain amounts reported in previous years have been reclassified to conform to the current year

presentation.

Stock Split

On January 16, 2004, the Company’s Board of Directors approved a two-for-one stock split in the form of a

stock dividend on all outstanding shares of the Company’s common stock. As a result of the stock split, the

Company’s stockholders received one additional share for each share of common stock held on the record date of

February 2, 2004. The additional shares of common stock were distributed on February 11, 2004. All common

share and per-share amounts in the accompanying consolidated financial statements and related notes have been

retroactively adjusted to reflect the stock split for all years presented.

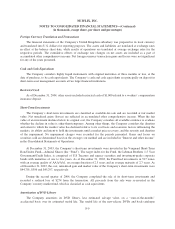

Fair Value of Financial Instruments

The fair value of the Company’s cash, short-term investments, accounts payable, accrued expenses and

capital lease obligations approximates their carrying value due to their short maturity.

F-8