NetFlix 2004 Annual Report Download - page 31

Download and view the complete annual report

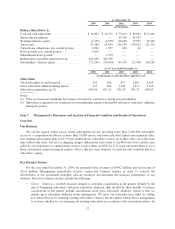

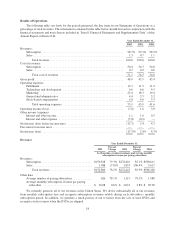

Please find page 31 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.as amended by SFAS No. 148, Accounting for Stock-Based Compensation—Transition and Disclosure, an

Amendment of FASB Statement No. 123. During 2002, 2003 and 2004, we recorded total stock-based

compensation expenses of $8.8 million, $10.7 million and $ 16.6 million, respectively. The application of SFAS

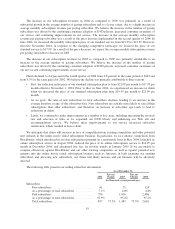

No. 123 requires significant judgment, including the determination of the expected life and volatility for stock

options. To determine the expected life, we review the historical pattern of exercises of stock options as well as

the terms and vesting periods of the options granted. Prior to the third quarter of 2003, we granted stock options,

which generally vest over three to four-year periods. Since the third quarter of 2003, we began granting fully

vested stock options to our employees on a monthly basis. As a result, we changed the expected life from 3.5

years to 1.5 years. In the second quarter of 2004, we revised our estimate of expected life based on our review of

historical patterns for exercises of stock options. We bifurcated our option grants into two employee groupings

who exhibited different exercise behavior and changed the estimate of the expected life from 1.5 years for all

option grants in the first quarter of 2004 to 1 year for one group and 2.5 years for the other group beginning in

the second quarter of 2004. In addition, our stock price has fluctuated significantly in recent periods. In

estimating expected volatility, we consider historical volatility, volatility in market-traded options on our

common stock and other relevant factors in accordance with SFAS No. 123. The Black-Scholes option-pricing

model, used by us, requires the input of highly subjective assumptions, including the option’s expected life and

the price volatility of the underlying stock. Changes in the subjective input assumptions can materially affect the

estimate of fair value of options granted.

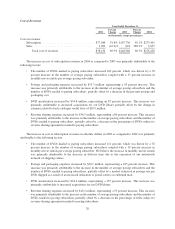

Income Taxes

We record a tax provision for the anticipated tax consequences of our reported results of operations. In

accordance with SFAS No. 109, Accounting for Income Taxes, the provision for income taxes is computed using

the asset and liability method, under which deferred tax assets and liabilities are recognized for the expected

future tax consequences of temporary differences between the financial reporting and tax bases of assets and

liabilities, and for operating losses and tax credit carryforwards. Deferred tax assets and liabilities are measured

using the currently enacted tax rates that apply to taxable income in effect for the years in which those tax assets

are expected to be realized or settled. We record a valuation allowance to reduce deferred tax assets to the

amount that is believed more likely than not to be realized.

Our deferred tax assets, primarily the tax benefits of these loss carryforwards, have been offset by a full

valuation allowance because of our history of losses through the first quarter of 2003, limited profitable quarters

to date and the competitive landscape of online DVD rentals. If we subsequently determine that some or all

deferred tax assets that were previously offset by a valuation allowance are realizable, the result would be a

positive adjustment to earnings in the period such determination is made.

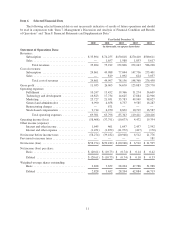

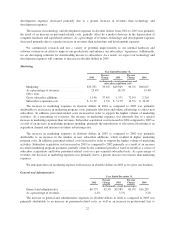

Descriptions of Statement of Operations Components

Subscription Revenues:

We generate all our subscription revenues in the United States. We derive substantially all of our revenues

from monthly subscription fees and recognize subscription revenues ratably during each subscriber’s monthly

subscription period. We record refunds to subscribers as a reduction of revenues. In addition to our standard

service of $17.99 per month, we offer other service plans with different price points that allow subscribers to

keep either fewer or more titles at the same time. As of December 31, 2004, more than 95 percent of our paying

subscribers paid $17.99 or more per month.

Cost of Subscription Revenues:

We acquire titles for our library through traditional direct purchase and through revenue sharing agreements

with content providers. Traditional buying methods normally result in higher upfront costs than titles obtained

through revenue sharing agreements. Cost of subscription revenues consists of revenue sharing expenses,

15