NetFlix 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

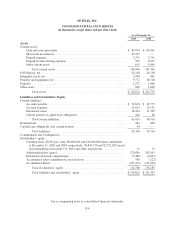

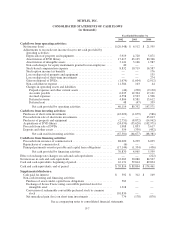

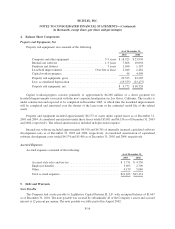

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2002 2003 2004

Cash flows from operating activities:

Netincome(loss).............................................. $(20,948) $ 6,512 $ 21,595

Adjustments to reconcile net income (loss) to net cash provided by

operating activities:

Depreciation of property and equipment .......................... 5,919 4,720 5,871

Amortization of DVD library .................................. 17,417 43,125 80,346

Amortization of intangible assets ............................... 3,141 3,146 1,987

Non-cash charges for equity instruments granted to non-employees .... 40 — —

Stock-based compensation expense ............................. 8,832 10,719 16,587

Stock option income tax benefits ............................... — — 176

Loss on disposal of property and equipment ....................... — — 135

Loss on disposal of short-term investments ....................... — — 274

Gain on disposal of DVDs ..................................... (1,674) (1,604) (2,912)

Non-cash interest expense ..................................... 11,384 103 44

Changes in operating assets and liabilities:

Prepaid expenses and other current assets ....................... (44) (290) (9,130)

Accounts payable .......................................... 6,635 12,304 17,121

Accrued expenses ......................................... 4,558 2,523 1,506

Deferred revenue .......................................... 4,806 8,581 13,612

Deferred rent ............................................. 48 (47) 359

Net cash provided by operating activities ..................... 40,114 89,792 147,571

Cash flows from investing activities:

Purchases of short-term investments ............................... (43,022) (1,679) (586)

Proceeds from sale of short-term investments ........................ — — 45,013

Purchases of property and equipment .............................. (2,751) (8,872) (14,962)

Acquisitions of DVD library ..................................... (24,070) (55,620) (102,971)

Proceeds from sale of DVDs ..................................... 1,988 1,833 5,617

Deposits and other assets ........................................ 554 (339) (492)

Net cash used in investing activities ......................... (67,301) (64,677) (68,381)

Cash flows from financing activities:

Proceeds from issuance of common stock ........................... 88,020 6,299 6,035

Repurchases of common stock ................................... (6) — —

Principal payments on notes payable and capital lease obligations ....... (17,144) (1,334) (436)

Net cash provided by financing activities ..................... 70,870 4,965 5,599

Effect of exchange rate changes on cash and cash equivalents ............. — — (222)

Net increase in cash and cash equivalents ............................. 43,683 30,080 84,567

Cash and cash equivalents, beginning of period ........................ 16,131 59,814 89,894

Cash and cash equivalents, end of period ............................. $ 59,814 $89,894 $174,461

Supplemental disclosure:

Cash paid for interest $ 592 $ 312 $ 109

Non-cash investing and financing activities:

Purchase of assets under capital lease obligations .................. 583 — —

Exchange of Series F non-voting convertible preferred stock for

intangible asset ........................................... 1,318 — —

Conversion of redeemable convertible preferred stock to common

stock.................................................... 101,830 — —

Net unrealized gain (loss) on short term investments ................ 774 (178) (870)

See accompanying notes to consolidated financial statements.

F-7