NetFlix 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

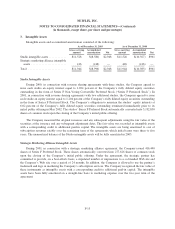

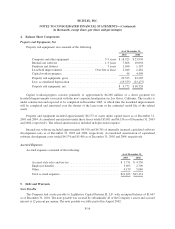

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

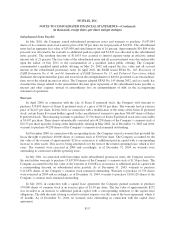

In July 2001, the Company issued a warrant to purchase 100,000 shares of Series F preferred stock at $9.38

per share to a Web portal company in connection with an integration and distribution agreement. The fair market

value of the warrants of approximately $18 was recorded as marketing expense and an increase to additional

paid-in capital. These shares automatically converted into 66,666 shares of the Company’s common stock at

$14.07 per share upon the closing of the initial public offering in May 2002. The warrant was exercised in 2004

and accordingly, as of December 31, 2004, no warrants were outstanding in connection with the integration and

distribution agreement.

The Company calculated the fair value of the warrants using the Black-Scholes valuation model with the

following assumptions: the terms of the warrants ranging from 4 to 10 years; risk-free rates between 4.92% to

6.37%; volatility of 80%; and dividend yield of 0.0%.

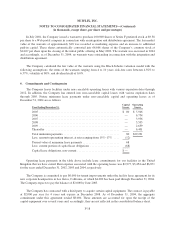

6. Commitments and Contingencies

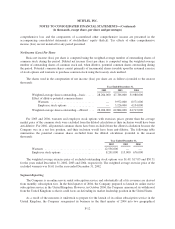

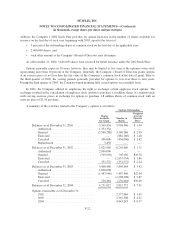

The Company leases facilities under non-cancelable operating leases with various expiration dates through

2012. In addition, the Company has entered into non-cancelable capital leases with various expiration dates

through 2005. Future minimum lease payments under non-cancelable capital and operating leases as of

December 31, 2004 are as follows:

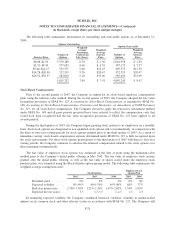

Year Ending December 31,

Capital

Leases

Operating

Leases

2005 ....................................................... $ 80 $ 5,946

2006 ....................................................... — 6,754

2007 ....................................................... — 3,956

2008 ....................................................... — 3,595

2009 ....................................................... — 2,639

Thereafter .................................................. — 6,401

Totalminimumpayments ...................................... 80 $29,291

Less: amount representing interest, at rates ranging from 15%–17% .... (12)

Present value of minimum lease payments ......................... 68

Less: current portion of capital lease obligations .................... (68)

Capital lease obligations, non-current ............................. $—

Operating lease payments in the table above include lease commitments for our facilities in the United

Kingdom that we have exited. Rent expense associated with the operating leases was $2,975, $3,454 and $6,871

for the years ended December 31, 2002, 2003 and 2004, respectively.

The Company is committed to pay $6,000 for tenant improvements under the facility lease agreement for its

new corporate headquarters in Los Gatos, California, of which $4,000 has been paid through December 31, 2004.

The Company expects to pay the balance of $2,000 by June 2005.

The Company has contracted with a third party to acquire certain capital equipment. The contract is payable

at $2,000 per year for 4 years and expires in December 2008. As of December 31, 2004, the aggregate

commitment under this agreement totaled $8,000. These amounts are accounted for upon the receipt of the

capital equipment over several years and, accordingly, they are not reflected in the consolidated balance sheet.

F-18