NetFlix 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

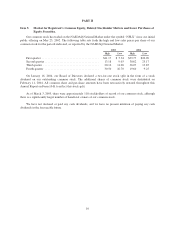

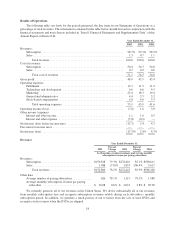

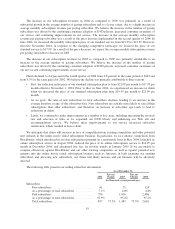

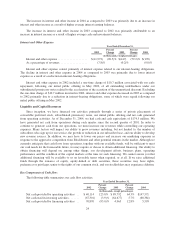

Cost of Revenues

Year Ended December 31,

2002

Percent

Change 2003

Percent

Change 2004

(in thousands, except percentages)

Cost of revenues:

Subscription ................................... $77,044 91.8% $147,736 85.1% $273,401

Sales ........................................ 1,092 (42.9)% 624 389.9% 3,057

Totalcostofrevenues ....................... $78,136 89.9% $148,360 86.3% $276,458

The increase in cost of subscription revenues in 2004 as compared to 2003 was primarily attributable to the

following factors:

• The number of DVDs mailed to paying subscribers increased 102 percent, which was driven by a 78

percent increase in the number of average paying subscribers coupled with a 13 percent increase in

monthly movie rentals per average paying subscriber.

• Postage and packaging expenses increased by $55.3 million, representing a 93 percent increase. This

increase was primarily attributable to the increase in the number of average paying subscribers and the

number of DVDs mailed to paying subscribers, partially offset by a decrease in the per-unit postage and

packaging cost.

• DVD amortization increased by $34.8 million, representing an 87 percent increase. This increase was

primarily attributable to increased acquisitions for our DVD library partially offset by the change in

estimate related to back-catalogue useful lives of $10.9 million.

• Revenue sharing expenses increased by $36.5 million, representing a 80 percent increase. This increase

was primarily attributable to the increase in the number of average paying subscribers and the number of

DVDs mailed to paying subscribers, partially offset by a decrease in the percentage of DVDs subject to

revenue sharing agreements mailed to paying subscribers.

The increase in cost of subscription revenues in absolute dollars in 2003 as compared to 2002 was primarily

attributable to the following factors:

• The number of DVDs mailed to paying subscribers increased 111 percent, which was driven by a 78

percent increase in the number of average paying subscribers coupled with a 19 percent increase in

monthly movie rentals per average paying subscriber. We believe the increase in monthly movie rentals

was primarily attributable to the decrease in delivery time due to the expansion of our nationwide

network of shipping centers.

• Postage and packaging expenses increased by $30.1 million, representing a 103 percent increase. This

increase was primarily attributable to the increase in the number of average paying subscribers and the

number of DVDs mailed to paying subscribers, partially offset by a modest reduction in postage rate per

DVD shipped as a result of an increased utilization of postal sorters on outbound mail.

• DVD amortization increased by $24.4 million, representing a 157 percent increase. This increase was

primarily attributable to increased acquisitions for our DVD library.

• Revenue sharing expenses increased by $16.1 million, representing a 55 percent increase. This increase

was primarily attributable to the increase in the number of average paying subscribers and the number of

DVDs mailed to paying subscribers, partially offset by a decrease in the percentage of titles subject to

revenue sharing agreements mailed to paying subscribers.

20