NetFlix 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

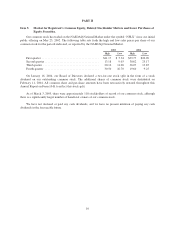

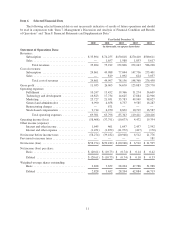

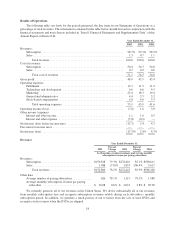

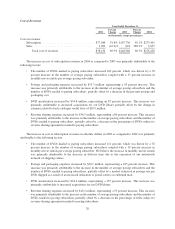

As of December 31,

2000 2001 2002 2003 2004

(in thousands)

Balance Sheet Data (1):

Cash and cash equivalents ...................... $ 14,895 $ 16,131 $ 59,814 $ 89,894 $174,461

Short-term investments ........................ — — 43,796 45,297 —

Working (deficit) capital ....................... (1,655) (6,656) 66,649 75,927 92,436

Total assets .................................. 52,488 41,630 130,530 176,012 251,793

Capital lease obligations, less current portion ....... 2,024 1,057 460 44 —

Notes payable, less current portion ............... 1,843 ————

Subordinated notes payable ..................... — 2,799 — — —

Redeemable convertible preferred stock ........... 101,830 101,830 — — —

Stockholders’ (deficit) equity .................... (73,267) (90,504) 89,356 112,708 156,283

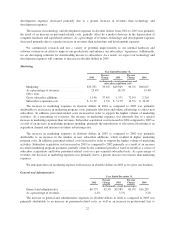

As of / Year Ended December 31,

2000 2001 2002 2003 2004

(in thousands, except subscriber acquisition cost)

Other Data:

Total subscribers at end of period ................ 292 456 857 1,487 2,610

Gross subscriber additions during period ........... 515 566 1,140 1,571 2,716

Subscriber acquisition cost (2) ................... $49.96 $37.16 $31.39 $31.79 $36.09

Notes:

(1) Prior year financial statements have been reclassified to conform to current year presentation

(2) Subscriber acquisition cost is defined as total marketing expenses divided by total gross subscriber additions

during the period.

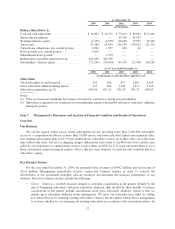

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Our Business

We are the largest online movie rental subscription service providing more than 2,600,000 subscribers

access to a comprehensive library of more than 35,000 movie, television and other filmed entertainment titles.

Our standard subscription plan of $17.99 per month allows subscribers to have up to three titles out at the same

time with no due dates, late fees or shipping charges. Subscribers select titles at our Web site (www.netflix.com)

aided by our proprietary recommendation service, receive them on DVD by U.S. mail and return them to us at

their convenience using our prepaid mailers. After a title has been returned, we mail the next available title in a

subscriber’s queue.

Key Business Metrics

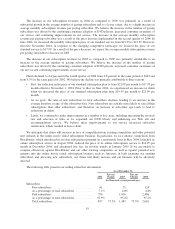

For the year ended December 31, 2004, we generated total revenues of $506.2 million and net income of

$21.6 million. Management periodically reviews certain key business metrics in order to evaluate the

effectiveness of our operational strategies, allocate resources and maximize the financial performance of our

business. These key business metrics include the following:

•Churn: Churn is a monthly measure defined as customer cancellations in the quarter divided by the

sum of beginning subscribers and gross subscriber additions, then divided by three months. Customer

cancellations in the quarter include cancellations from gross subscriber additions, which is why we

include gross subscriber additions in the denominator. We grow our subscriber base either by adding

new subscribers or by retaining existing subscribers. Churn is the key metric which allows management

to evaluate whether we are retaining our existing subscribers in accordance with our business plans. An

12