NetFlix 2004 Annual Report Download - page 32

Download and view the complete annual report

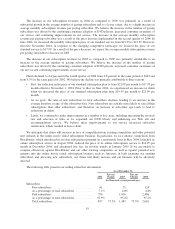

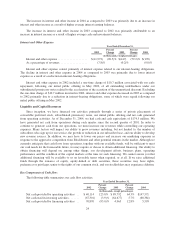

Please find page 32 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amortization of our library, amortization of intangible assets related to equity instruments issued to certain

studios in 2000 and 2001 and postage and packaging costs related to shipping titles to paying subscribers. Costs

related to free-trial subscribers are allocated to marketing expenses.

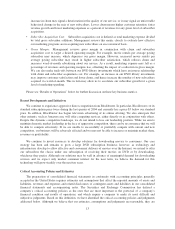

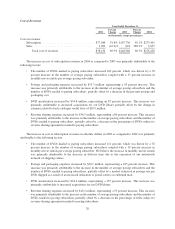

Revenue Sharing Expenses. Our revenue sharing agreements generally commit us to pay an initial upfront

fee for each DVD acquired and also a percentage of revenue earned from such DVD rentals for a defined period

of time. A portion of the initial upfront fees are non-recoupable for revenue sharing purposes and capitalized and

amortized in accordance with our DVD library amortization policy. The remaining portion of the initial upfront

fee represents prepaid revenue sharing and this amount is expensed as revenue sharing expenses as DVDs subject

to revenue sharing agreements are shipped to subscribers. Other than the initial upfront payment for DVDs

acquired, we are not obligated to pay any minimum revenue sharing fee on DVDs that are not shipped to

subscribers. We characterize these payments to the studios as revenue sharing expenses.

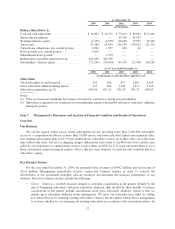

Amortization of DVD Library. On July 1, 2004, we revised the estimate of useful life for the back-

catalogue DVD library from one to three years. New releases will continue to be amortized over a one-year

period. We also revised our estimate of salvage values, on direct purchase DVDs. For those direct purchase

DVDs that we expect to sell at the end of their useful lives, a salvage value of $3.00 per DVD has been provided

effective July 1, 2004. For those DVDs that we do not expect to sell, no salvage value is provided.

Amortization of Intangible Assets. In 2000, in connection with signing revenue sharing agreements with

Columbia TriStar Home Entertainment, Dreamworks International Distribution and Warner Home Video, we

agreed to issue to each of these studios our Series F Non-Voting Preferred Stock equal to 1.204 percent of our

fully diluted equity securities outstanding. In 2001, in connection with signing revenue sharing agreements with

Twentieth Century Fox Home Entertainment and Universal Studios Home Video, we agreed to issue to each of

the two studios our Series F Non-Voting Preferred Stock equal to 1.204 percent of our fully diluted equity

securities outstanding. As of December 31, 2001, the aggregate of Series F Non-Voting Preferred Stock granted

to these five studios equaled 6.02 percent of our fully diluted equity securities outstanding. Our obligation to

maintain the studios’ equity interests at 6.02 percent of our fully diluted equity securities outstanding terminated

immediately prior to our initial public offering in May 2002. The studios’ Series F Preferred Stock automatically

converted into 3,192,830 shares of common stock upon the closing of our initial public offering. We measured

the original issuances and any subsequent adjustments using the fair value of the securities at the issuance and

any subsequent adjustment dates. The fair value was recorded as an intangible asset and is amortized to cost of

subscription revenues ratably over the remaining term of the agreements which initial terms were either three or

five years.

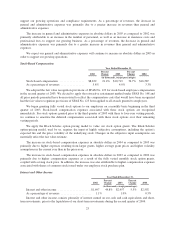

Postage and Packaging. Postage and packaging expenses consist of the postage costs to mail titles to and

from our paying subscribers and the packaging and label costs for the mailers. The rate for first-class postage was

$0.34 prior to June 29, 2002 and increased to $0.37 thereafter. It is currently anticipated that the U.S. Postal

Service will seek an increase in the rate of first class postage and that any such increase would likely be effective

starting in 2006.

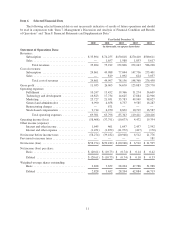

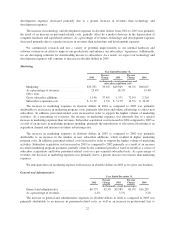

Operating Expenses:

Fulfillment. Fulfillment expenses represent those expenses incurred in operating and staffing our shipping

and customer service centers, including costs attributable to receiving, inspecting and warehousing our library.

Fulfillment expenses also include credit card fees.

Technology and Development. Technology and development expenses consist of payroll and related

expenses we incur related to testing, maintaining and modifying our Web site, our recommendation service,

developing solutions for downloading movies to subscribers, telecommunications systems and infrastructure and

other internal-use software systems. Technology and development expenses also include depreciation of the

computer hardware and capitalized software we use to run our Web site and store our data.

16