NetFlix 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

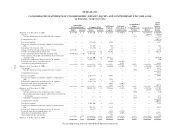

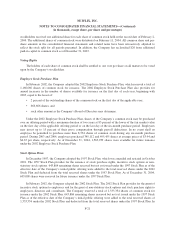

4. Balance Sheet Components

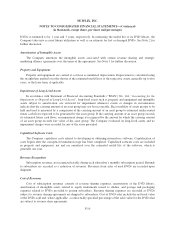

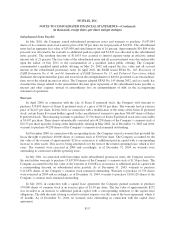

Property and Equipment, Net

Property and equipment, net consisted of the following:

As of December 31,

2003 2004

Computerandotherequipment ....................... 3-5years $ 18,325 $ 23,938

Internal-use software ............................... 1-3years 7,868 10,094

Furnitureandfixtures .............................. 3years 1,040 1,193

Leasehold improvements .................... Overlife of lease 2,046 2,482

Capital work-in-progress .................................... 46 4,498

Property and equipment, gross ................................ 29,325 42,205

Less: accumulated depreciation ............................... (19,553) (23,477)

Property and equipment, net .................................. $ 9,772 $18,728

Capital work-in-progress consists primarily of approximately $4,268 million of a down payment for

leasehold improvements associated with the new corporate headquarters in Los Gatos, California. The facility is

under construction and expected to be completed in December 2005, at which time the leasehold improvements

will be completed and amortized over the shorter of the lease term or the estimated useful life of the related

assets.

Property and equipment included approximately $6,173 of assets under capital leases as of December 31,

2003 and 2004. Accumulated amortization under these leases totaled $5,901 and $6,156 as of December 31, 2003

and 2004, respectively. The related amortization is included in depreciation expense.

Internal-use software included approximately $4,910 and $6,301 of internally incurred capitalized software

development costs as of December 31, 2003 and 2004, respectively. Accumulated amortization of capitalized

software development costs totaled $4,174 and $5,408 as of December 31, 2003 and 2004, respectively.

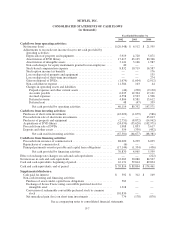

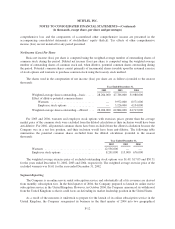

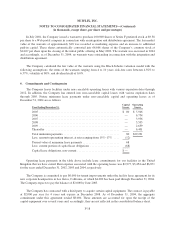

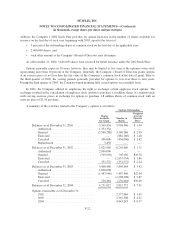

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2003 2004

Accrued state sales and use tax ................................. $ 3,751 $ 4,736

Employee benefits ........................................... 3,695 2,709

Other ..................................................... 4,179 5,686

Total accrued expenses ....................................... $11,625 $13,131

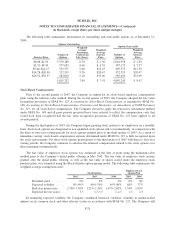

5. Debt and Warrants

Note Payable

The Company had a note payable to Lighthouse Capital Partners II, L.P. with an unpaid balance of $1,667

as of December 31, 2001. The note payable was secured by substantially all of the Company’s assets and accrued

interest at 12 percent per annum. The note payable was fully paid off in August 2002.

F-16