NetFlix 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

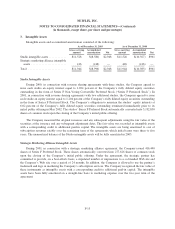

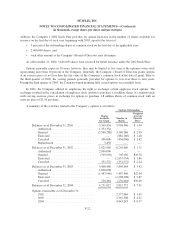

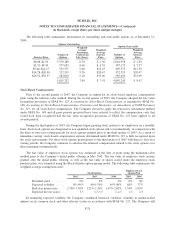

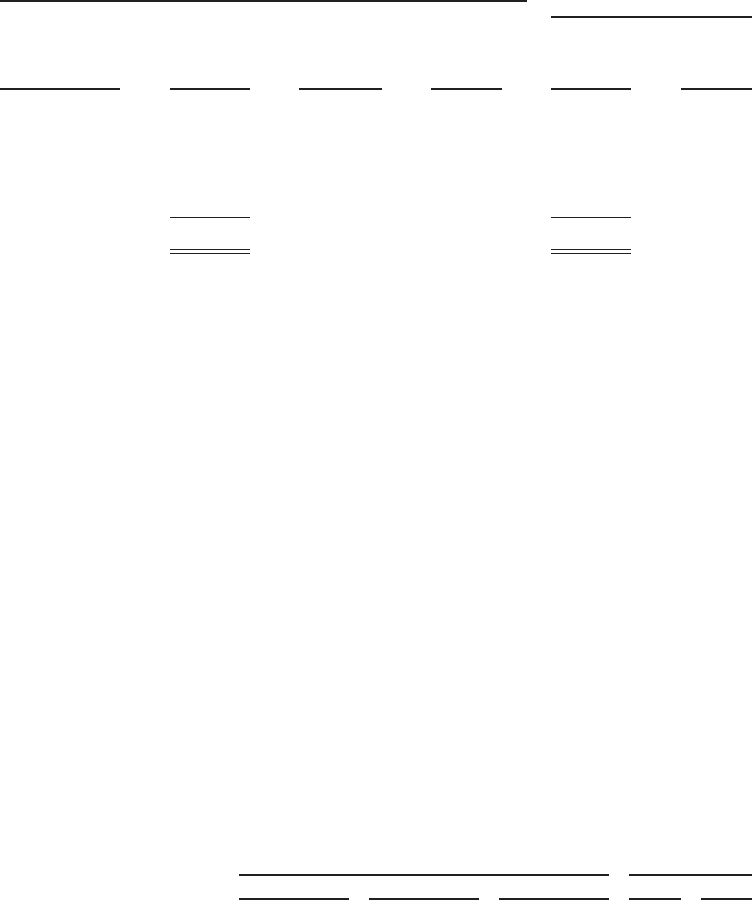

The following table summarizes information on outstanding and exercisable options as of December 31,

2004:

Options Outstanding

Exercise Price

Number of

Options

Weighted-

Average

Remaining

Contractual

Life (Years)

Weighted-

Average

Exercise

Price

Options Exercisable

Number of

Options

Weighted-

Average

Exercise

Price

$0.08–$1.50 3,570,180 6.70 $ 1.50 2,842,958 $ 1.50

$1.51–$9.43 577,659 8.46 $ 6.35 387,172 $ 7.27

$9.44–$14.27 552,375 9.28 $12.25 499,575 $12.39

$14.28–$26.90 532,519 9.26 $20.47 532,519 $20.47

$26.91–$36.37 583,019 9.18 $33.09 583,019 $33.09

5,815,752 7.60 $ 7.91 4,845,243 $ 8.97

Stock-Based Compensation

Prior to the second quarter of 2003, the Company accounted for its stock-based employee compensation

plans using the intrinsic-value method. During the second quarter of 2003, the Company adopted the fair value

recognition provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended by SFAS No.

148, Accounting for Stock-Based Compensation—Transition and Disclosure, an Amendment of FASB Statement

No. 123, for all stock-based compensation. The Company elected to apply the retroactive restatement method

under SFAS No. 148 and all prior periods presented have been restated to reflect the compensation costs that

would have been recognized had the fair value recognition provisions of SFAS No. 123 been applied to all

awards granted.

During the third quarter of 2003, the Company began granting stock options to its employees on a monthly

basis. Such stock options are designated as non-qualified stock options and vest immediately, in comparison with

the three to four-year vesting periods for stock options granted prior to the third quarter of 2003. As a result of

immediate vesting, stock-based compensation expense determined under SFAS No. 123 is fully recognized upon

the stock option grants. For those stock options granted prior to the third quarter of 2003 with three to four-year

vesting periods, the Company continues to amortize the deferred compensation related to the stock options over

their remaining vesting periods.

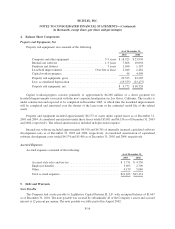

The fair value of employee stock options was estimated on the date of grant using the minimum-value

method prior to the Company’s initial public offering in May 2002. The fair value of employee stock options

granted after the initial public offering, as well as the fair value of shares issued under the employee stock

purchase plan, was estimated using the Black-Scholes option pricing model. The following table summarizes the

weighted-average assumptions used:

Stock Options

Employee Stock

Option Plan

2002 2003 2004 2003 2004

Dividend yield ......... 0% 0% 0% 0% 0%

Expected volatility ...... 0%-69% 66%-70% 65%-89% 68% 77%

Risk-free interest rate .... 2.78%-3.99% 1.21%-2.36% 1.47%-2.85% 1.34% 1.83%

Expected life (in years) . . . 3.5 1.5-3.5 1–2.5 1.3 1.3

In estimating expected volatility, the Company considered historical volatility, volatility in market-traded

options on its common stock and other relevant factors in accordance with SFAS No. 123. The Company will

F-23