NetFlix 2004 Annual Report Download - page 70

Download and view the complete annual report

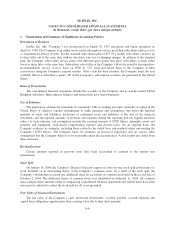

Please find page 70 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

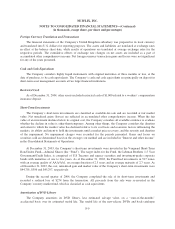

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

DVDs is estimated to be 1 year and 3 years, respectively. In estimating the useful life of its DVD library, the

Company takes into account library utilization as well as an estimate for lost or damaged DVDs. See Note 2 for

further discussion.

Amortization of Intangible Assets

The Company amortizes the intangible assets associated with certain revenue sharing and strategic

marketing alliance agreements over the terms of the agreements. See Note 3 for further discussion.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using

the straight-line method over the shorter of the estimated useful lives of the respective assets, generally up to five

years, or the lease term, if applicable.

Impairment of Long-Lived Assets

In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets”, long-lived assets such as property and equipment and intangible

assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset group may not be recoverable. Recoverability of assets groups to be

held and used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted

future cash flows expected to be generated by the asset group. If the carrying amount of an asset group exceeds

its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount

of an asset group exceeds fair value of the asset group. The Company evaluated its long-lived assets and no

impairment charges were recorded for any of the years presented.

Capitalized Software Costs

The Company capitalizes costs related to developing or obtaining internal-use software. Capitalization of

costs begins after the conceptual formulation stage has been completed. Capitalized software costs are included

in property and equipment, net and are amortized over the estimated useful life of the software, which is

generally one year.

Revenue Recognition

Subscription revenues are recognized ratably during each subscriber’s monthly subscription period. Refunds

to subscribers are recorded as a reduction of revenues. Revenues from sales of used DVDs are recorded upon

shipment.

Cost of Revenues

Cost of subscription revenues consists of revenue sharing expenses, amortization of the DVD library,

amortization of intangible assets related to equity instruments issued to studios, and postage and packaging

expenses related to DVDs provided to paying subscribers. Revenue sharing expenses are recorded as DVDs

subject to revenue sharing agreements are shipped to subscribers. Cost of DVD sales include the net book value

of the DVDs sold and, where applicable, a contractually specified percentage of the sales value for the DVDs that

are subject to revenue share agreements.

F-10