NetFlix 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and percentages)

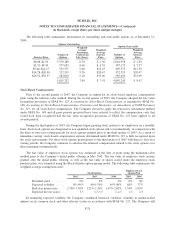

addition, the Company’s 2002 Stock Plan provides for annual increases in the number of shares available for

issuance on the first day of each year, beginning with 2003, equal to the lesser of:

• 5 percent of the outstanding shares of common stock on the first day of the applicable year;

• 2,000,000 shares; and

• such other amount as the Company’s Board of Directors may determine.

As of December 31, 2004, 3,646,003 shares were reserved for future issuance under the 2002 Stock Plan.

Options generally expire in 10 years, however, they may be limited to five years if the optionee owns stock

representing more than 10 percent of the Company. Generally, the Company’s Board of Directors grants options

at an exercise price of not less than the fair value of the Company’s common stock at the date of grant. Prior to

the third quarter of 2003, the vesting periods generally provided for options to vest over three to four years.

During the third quarter of 2003, the Company began granting fully vested options on a monthly basis.

In 2001, the Company offered its employees the right to exchange certain employee stock options. The

exchange resulted in the cancellation of employee stock options to purchase 1.8 million shares of common stock

with varying exercise prices in exchange for options to purchase 1.8 million shares of common stock with an

exercise price of $1.50 per share.

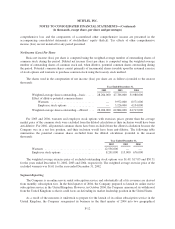

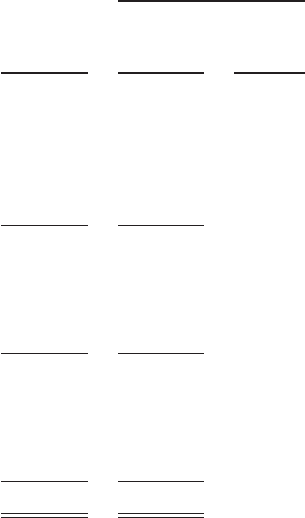

A summary of the activities related to the Company’s options is as follows:

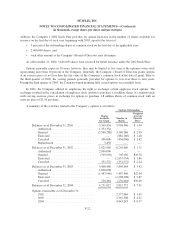

Options Outstanding

Shares

Available

for Grant

Number of

Shares

Weighted-

Average

Exercise

Price

Balances as of December 31, 2001 ............. 3,569,434 5,998,946 $ 1.49

Authorized ............................ 1,333,334 — —

Granted ............................... (3,540,286) 3,540,286 $ 2.05

Exercised ............................. — (882,166) $ 1.48

Canceled .............................. 456,006 (456,006) $ 1.82

Repurchased ........................... 3,458 — —

Balances as of December 31, 2002 ............. 1,821,946 8,201,060 $ 1.71

Authorized ............................ 2,000,000 — —

Granted ............................... (705,030) 705,030 $16.78

Exercised ............................. — (2,657,934) $ 1.86

Canceled .............................. 351,572 (351,572) $ 2.24

Balances as of December 31, 2003 ............. 3,468,488 5,896,584 $ 3.42

Authorized ............................ 2,000,000 — —

Granted ............................... (1,447,940) 1,447,940 $22.04

Exercised ............................. — (1,298,308) $ 2.87

Canceled .............................. 230,464 (230,464) $10.20

Balances as of December 31, 2004 ............. 4,251,012 5,815,752 $ 7.91

Options exercisable as of December 31:

2002 ................................. 2,577,066 $ 1.49

2003 ................................. 3,367,308 $ 4.21

2004 ................................. 4,845,243 $ 8.97

F-22