NetFlix 2004 Annual Report Download - page 42

Download and view the complete annual report

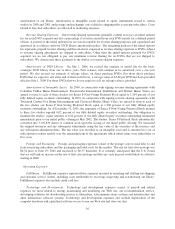

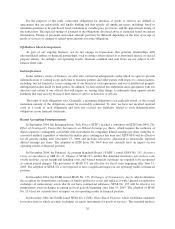

Please find page 42 of the 2004 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the purposes of this table, contractual obligations for purchase of goods or services are defined as

agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of

the transaction. The expected timing of payment of the obligations discussed above is estimated based on current

information. Timing of payments and actual amounts paid may be different depending on the time of receipt of

goods or services or changes to agreed-upon amounts for some obligations.

Off-Balance Sheet Arrangements

As part of our ongoing business, we do not engage in transactions that generate relationships with

unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special

purpose entities. Accordingly, our operating results, financial condition and cash flows are not subject to off-

balance sheet risks.

Indemnifications

In the ordinary course of business, we enter into contractual arrangements under which we agree to provide

indemnification of varying scope and terms to business partners and other parties with respect to certain matters,

including, but not limited to, losses arising out of our breach of such agreements and out of intellectual property

infringement claims made by third parties. In addition, we have entered into indemnification agreements with our

directors and certain of our officers that will require us, among other things, to indemnify them against certain

liabilities that may arise by reason of their status or service as directors or officers.

The terms of such obligations vary. Generally, a maximum obligation is not explicitly stated, so the overall

maximum amount of the obligations cannot be reasonably estimated. To date, we have not incurred material

costs as a result of such obligations and have not accrued any liabilities related to such indemnification

obligations in our financial statements.

Recent Accounting Pronouncements

In September 2004, the Emerging Issues Task Force (“EITF”) reached a consensus on EITF Issue 04-8, The

Effect of Contingently Convertible Instruments on Diluted Earnings per Share, which requires the inclusion of

shares related to contingently convertible debt instruments for computing diluted earnings per share using the if-

converted method, regardless of whether the market price contingency has been met. EITF 04-8 will be effective

for all periods ending after December 15, 2004 and includes retroactive adjustment to historically reported

diluted earnings per share. The adoption of EITF Issue No. 04-8 does not currently have an impact on our

operating results or financial position.

In November 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 151, Inventory

Costs, an amendment of ARB No. 43, Chapter 4. SFAS 151 clarifies that abnormal inventory costs such as costs

of idle facilities, excess freight and handling costs, and wasted materials (spoilage) are required to be recognized

as current period charges. The provisions of SFAS 151 are effective for fiscal years beginning after June 15,

2005. The adoption of SFAS 151 is not expected to have a significant impact on our operating results or financial

position.

In December 2004, the FASB issued SFAS No. 153, Exchanges of Nonmonetary Assets, which eliminates

the exception for nonmonetary exchanges of similar productive assets and replaces it with a general exception for

exchanges of nonmonetary assets that do not have commercial substance. SFAS No. 153 will be effective for

nonmonetary asset exchanges occurring in fiscal periods beginning after June 15, 2005. The adoption of SFAS

No. 153 does not currently have an impact on our operating results or financial position.

In December 2004, the FASB issued SFAS No. 123(R), Share-Based Payment, which establishes standards

for transactions in which an entity exchanges its equity instruments for goods or services. This standard replaces

26