Neiman Marcus 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

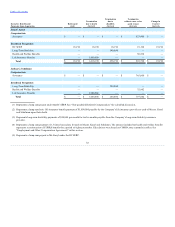

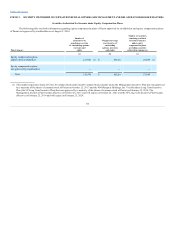

In April 2014, Parent entered into a subscription agreement with Nora Aufreiter, who is a member of the Parent Board. Pursuant to the terms of this

subscription agreement, Ms. Aufreiter purchased 750 shares of Class A Common Stock and 750 shares of Class B Common Stock for an aggregate purchase

price of $750,000.

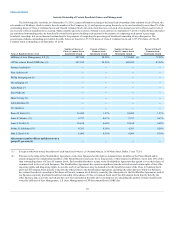

Though not formally considered by the Parent Board because we are not a listed issuer, we have evaluated the independence of the members of the

Parent Board using the independence standards of the New York Stock Exchange. We believe that Ms. Aufreiter and Messrs. Axelrod, Bourguignon, Kaplan,

Stein, Nishi, Feeney, Brotman and Gundotra are independent directors within the meaning of the listing standards of the New York Stock Exchange.

Parent’s Certificate of Incorporation and Amended and Restated By-Laws contain provisions limiting our directors’ obligations in respect of

corporate opportunities.

Although we have not adopted formal procedures for the review, approval or ratification of transactions with related persons, the Parent Board

reviews potential transactions with those parties we have identified as related parties prior to the consummation of the transaction, and we adhere to the

general policy that such transactions should only be entered into if they are approved by the Parent Board, in accordance with applicable law, and in

accordance with the restrictions on affiliate transactions in the Stockholders Agreement.

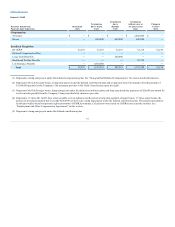

The Audit Committee pre-approves the use of audit and audit-related services following approval of the independent registered public accounting

firm’s audit plan. All services detailed in the audit plan are considered pre-approved. If, during the course of the audit, the independent registered public

accounting firm expects fees to exceed the approved fee estimate, those fees must be approved in advance by the Audit Committee.

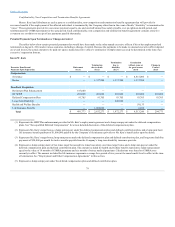

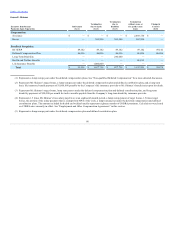

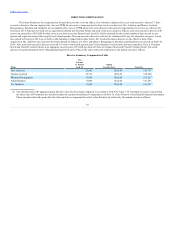

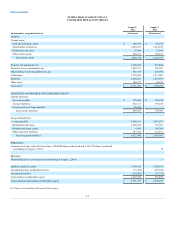

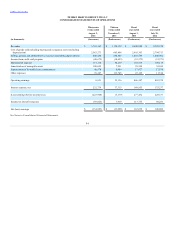

Audit Fees. The aggregate fees billed for the audits of the Company’s annual financial statements for the fiscal years ended August 2, 2014 and

August 3, 2013 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were $2,321,000 and $1,685,000,

respectively.

Audit-Related Fees. The aggregate fees billed for audit-related services for the fiscal years ended August 2, 2014 and August 3, 2013 were

$265,000 and $264,000, respectively. These fees related to accounting research and consultation services.

Tax Fees. The aggregate fees billed for tax services for the fiscal years ended August 2, 2014 and August 3, 2013 were $874,000 and $168,000,

respectively. These fees are related to tax compliance and planning.

All Other Fees. The aggregate fees billed for all other services not included above for the fiscal years ended August 2, 2014 and August 3, 2013

totaled approximately $404,000 and $46,000, respectively. These fees primarily related to permitted advisory services.

The Audit Committee has considered and concluded that the provision of permissible non-audit services is compatible with maintaining our

independent registered public accounting firm’s independence.

89