Neiman Marcus 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

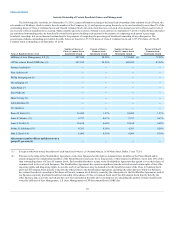

Upon completion of the Acquisition, Parent entered into the Stockholders Agreement. Pursuant to the terms of the Stockholders Agreement, each of

our Sponsors has the right to designate three members of the Parent Board and to jointly designate two independent members of the Parent Board, in each

case for so long as they or their respective affiliates own at least 25% of the then outstanding shares of Class A Common Stock. The Stockholders Agreement

also provides for the election of the current chief executive officer of Parent to the Parent Board and, to the extent permitted by applicable laws and

regulations and subject to certain exceptions, for equal representation on the boards of directors of our subsidiaries with respect to directors designated by our

Sponsors and the appointment of at least one of the directors designated by each Sponsor to each committee of the Parent Board.

In addition, certain significant corporate actions require either (i) the approval of a majority of directors on the Parent Board, including at least one

director designated by each of our Sponsors or (ii) the approval of our Sponsors, in each case subject to the requirement that the applicable Sponsor and its

affiliates own at least 25% of the then outstanding shares of Class A Common Stock. These actions include the incurrence of additional indebtedness over

$10 million in the aggregate outstanding at any time (subject to certain exceptions), the issuance or sale of any of our capital stock over $25 million in the

aggregate (subject to certain exceptions), the sale, transfer or acquisition of any assets with a value of over $10 million outside the ordinary course of

business, the declaration or payment of dividends (subject to certain exceptions), entering into any merger, reorganization or recapitalization (subject to

certain exceptions), amendments to Parent’s charter or bylaws, approval of our annual budget and other similar actions.

The Stockholders Agreement also contains significant transfer restrictions and certain rights of first offer, tag-along rights, and drag-along rights. In

addition, the Stockholders Agreement contains registration rights that, among other things, require Parent to register common stock held by the stockholders

who are parties to the Stockholders Agreement if Parent registers for sale, either for its own account or for the account of others, shares of its common stock,

subject to certain exceptions.

Under the Stockholders Agreement, certain affiliate transactions, including certain affiliate transactions between Parent, on the one hand, and our

Sponsors or any of their respective affiliates, on the other hand, require either the approval of (i) a majority of disinterested directors or (ii) the holders of a

majority of the shares of Class A Common Stock held by certain institutional stockholders who are parties to the Stockholders Agreement.

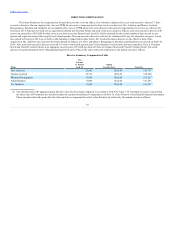

Upon completion of the Acquisition, NMG and Parent entered into management services agreements with affiliates of our Sponsors (the

Management Services Agreements). Under each of the Management Services Agreements, affiliates of our Sponsors provide NMG and Parent with certain

management and financial services. In exchange for such services, NMG and Parent have agreed to reimburse affiliates of our Sponsors for certain expenses

and provide customary indemnification. Upon completion of the Acquisition, NMG and Parent reimbursed affiliates of our Sponsors for their expenses

incurred in connection with the Acquisition in an aggregate amount of $17.4 million in fiscal year 2014.

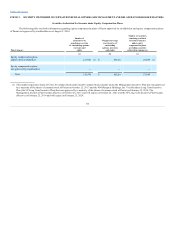

In connection with our acquisition of NMG on October 6, 2005 (the Prior Acquisition), we entered into a management services agreement with

affiliates of our Former Sponsors (the Former Sponsors’ Management Services Agreement). Under the Former Sponsors’ Management Services Agreement,

affiliates of[our Former Sponsors agreed to provide us with consulting and management advisory services in exchange for an aggregate annual management

fee equal to the lesser of (i) 0.25% of consolidated annual revenue and (ii) $10 million. The Former Sponsors’ Management Services Agreement also included

customary exculpation and indemnification provisions in favor of our Former Sponsors and their affiliates. Pursuant to the terms of the Former Sponsors’

Management Services Agreement, we paid a one-time success fee to our Former Sponsors of $48.6 million upon completion of the Acquisition and the

Former Sponsors’ Management Services Agreement automatically terminated. Management fees to the Former Sponsors in fiscal year 2014 were $2.8 million.

88