Neiman Marcus 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Acquisition has been allocated to state the acquired assets and liabilities at fair value. The purchase accounting adjustments increased the carrying value of

our property and equipment and inventory, revalued our intangible assets related to our tradenames, customer lists and favorable lease commitments and

revalued our long-term benefit plan obligations, among other things. As a result, our Successor financial statements subsequent to the Acquisition are not

necessarily comparable to our Predecessor financial statements.

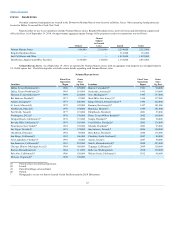

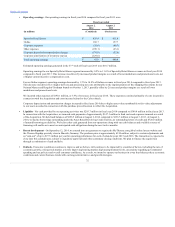

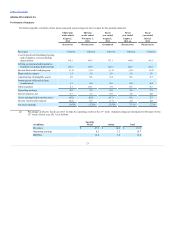

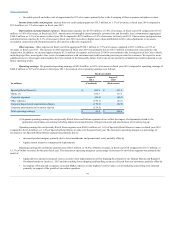

A summary of our operating results is as follows:

- Our revenues for fiscal year 2014 were $4,839.3 million, an increase of 4.1% compared to fiscal year 2013. Our revenues for fiscal

year 2013 were $4,648.2 million, an increase of 7.0% as compared to fiscal year 2012. Revenues generated in the 53rd week of fiscal year 2013

were $61.9 million. For Specialty Retail Stores, our sales per square foot increased to $579 for the fifty-two weeks ended August 2, 2014 from

$552 for the fifty-two weeks ended July 27, 2013.

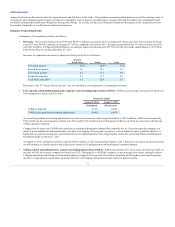

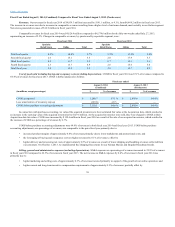

Increases in comparable revenues by quarter for fiscal year 2014 are as follows:

First fiscal quarter 4.5%

10.4%

5.7%

Second fiscal quarter 2.6

15.1

5.5

Third fiscal quarter 4.2

11.7

5.9

Fourth fiscal quarter 2.3

13.7

4.9

Total fiscal year 2014 3.4

12.9

5.5

Revenues in the 53rd week of fiscal year 2013 are not included in our calculations of comparable revenues.

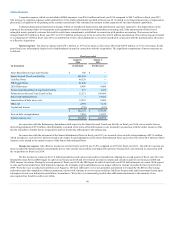

- COGS as a percentage of revenues for fiscal year

2014 compared to fiscal year 2013 were:

COGS, as reported

67.1%

64.4%

COGS, before purchase accounting adjustments

64.4%

64.4%

As a result of purchase accounting adjustments to revalue our inventories at the Acquisition date by $129.6 million, COGS were increased by

$99.0 million in the second quarter of fiscal year 2014 and by $30.6 million in the third quarter of fiscal year 2014 in connection with the sale

of the acquired inventories.

Compared to the prior year, COGS before purchase accounting adjustments remained flat, primarily due to 1) increased product margins as a

result of lower markdowns and promotional costs and 2) leveraging of buying and occupancy costs on higher revenues, partially offset by 3)

higher delivery and processing net costs attributable to the implementation of free shipping/free returns for our Neiman Marcus and Bergdorf

Goodman brands on October 1, 2013.

At August 2, 2014, on-hand inventories totaled $1,069.6 million, a 5.0% increase from August 3, 2013. Based on our current inventory position,

we will continue to closely monitor and align our inventory levels and purchases with anticipated customer demand.

- SG&A represented 22.9% of revenues in fiscal year 2014, an

increase of 0.4% of revenues compared to fiscal year 2013. The higher level of SG&A expenses, as a percentage of revenues, primarily reflects

1) higher marketing and selling costs incurred primarily in support of the growth of our online operation and 2) higher current and long-term

incentive compensation requirements, partially offset by 3) leveraging of payroll and other costs on higher revenues.

31