Neiman Marcus 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

certain transactions with affiliates and (ix) designate our subsidiaries as unrestricted subsidiaries. The PIK Toggle Notes also contain a cross-acceleration

provision in respect of other indebtedness that has an aggregate principal amount exceeding $50.0 million.

2028 Debentures. NMG has outstanding $125.0 million aggregate principal amount of its 7.125% 2028 Debentures. NMG equally and ratably

secures its 2028 Debentures by a first lien security interest on certain collateral subject to liens granted under the Senior Secured Credit Facilities constituting

(a) 1) 100% of the capital stock of certain of NMG’s existing and future domestic subsidiaries and 2) 100% of the non-voting stock and 65% of the voting

stock of certain of NMG’s existing and future foreign subsidiaries and (b) certain of NMG’s principal properties that include approximately half of NMG’s

full-line stores, in each case, to the extent required by the terms of the indenture governing the 2028 Debentures. The 2028 Debentures contain covenants

that restrict NMG’s ability to create liens and enter into sale and lease back transactions. The collateral securing the 2028 Debentures will be released upon

the release of liens on such collateral under the Senior Secured Credit Facilities and any other debt (other than the 2028 Debentures) secured by such

collateral. Capital stock and other securities of a subsidiary of NMG that are owned by NMG or any subsidiary will not constitute collateral under the 2028

Debentures to the extent such property does not constitute collateral under the Senior Secured Credit Facilities as described above. The 2028 Debentures are

guaranteed on an unsecured, senior basis by us. Our guarantee is full and unconditional. Our guarantee of the 2028 Debentures is subject to automatic

release if the requirements for legal defeasance or covenant defeasance of the 2028 Debentures are satisfied, or if NMG’s obligations under the indenture

governing the 2028 Debentures are discharged. Currently, our non-guarantor subsidiaries consist principally of Bergdorf Goodman, Inc., through which

NMG conducts the operations of its Bergdorf Goodman stores, and NM Nevada Trust, which holds legal title to certain real property and intangible assets

used by NMG in conducting its operations. The 2028 Debentures include certain restrictive covenants and a cross-acceleration provision in respect of any

other indebtedness that has an aggregate principal amount exceeding $15.0 million. Our 2028 Debentures mature on June 1, 2028.

Former Asset-Based Revolving Credit Facility. In connection with the Acquisition, we repaid all outstanding obligations of $145.0 million under

the Former Asset-Based Revolving Credit Facility and terminated the facility on October 25, 2013. This facility was replaced by the Asset-Based Revolving

Credit Facility.

Former Senior Secured Term Loan Facility. In connection with the Acquisition, we repaid the outstanding balance of $2,433.1 million under our

Former Senior Secured Term Loan Facility on October 25, 2013. This facility was replaced by the Senior Secured Term Loan Facility.

Retirement of Previously Outstanding Senior Subordinated Notes. In November 2012, we repurchased and cancelled $294.2 million principal

amount of Senior Subordinated Notes through a tender offer and redeemed the remaining $205.8 million principal amount of Senior Subordinated Notes on

December 31, 2012 (after which no Senior Subordinated Notes remained outstanding). NMG’s payments to holders of the Senior Subordinated Notes in the

tender offer and redemption (including transaction costs), taken together, aggregated approximately $510.7 million.

In connection with the retirement of the Senior Subordinated Notes, we incurred a loss on debt extinguishment of $15.6 million, which included 1)

costs of $10.7 million related to the tender for and redemption of the Senior Subordinated Notes and 2) the write-off of $4.9 million of debt issuance costs

related to the initial issuance of the Senior Subordinated Notes. The total loss on debt extinguishment was recorded in the second quarter of fiscal year 2013

as a component of interest expense.

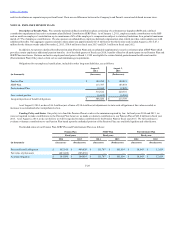

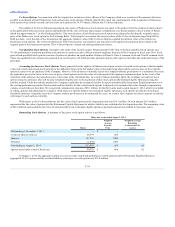

Maturities of Long-Term Debt. At August 2, 2014, annual maturities of long-term debt during the next five fiscal years and thereafter are as follows

(in millions):

2015 $ 29.4

2016 29.4

2017 29.4

2018 29.4

2019 29.4

Thereafter 4,462.9

The previous table does not reflect future excess cash flow prepayments, if any, that may be required under the Senior Secured Term Loan Facility.

F-24