Neiman Marcus 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Cash Pay Notes. We have outstanding $960.0 million aggregate principal amount of 8.00% Cash Pay Notes. Our Cash Pay Notes mature on October

15, 2021.

See Note 7 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the Cash Pay Notes.

PIK Toggle Notes. We have outstanding $600.0 million aggregate principal amount of 8.75%/9.50% PIK Toggle Notes. Our PIK Toggle Notes

mature on October 15, 2021.

See Note 7 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the Cash Pay Notes.

2028 Debentures. We have outstanding $125.0 million aggregate principal amount of 7.125% 2028 Debentures (the 2028 Debentures). Our 2028

Debentures mature on June 1, 2028.

See Note 7 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the 2028 Debentures.

Interest Rate Caps. At August 2, 2014, we had outstanding floating rate debt obligations of $2,927.9 million. We have entered into interest rate cap

agreements which cap LIBOR at 2.50% for an aggregate notional amount of $1,000.0 million from December 2012 through December 2014 and at 3.00% for

an aggregate notional amount of $1,400.0 million from December 2014 through December 2016 to hedge the variability of our cash flows related to a portion

of our floating rate indebtedness. In the event LIBOR is less than the capped rate, we will pay interest at the lower LIBOR rate. In the event LIBOR is higher

than the capped rate, we will pay interest at the capped rate.

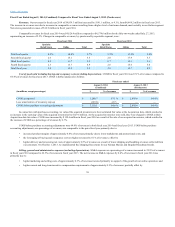

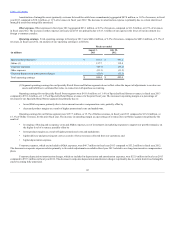

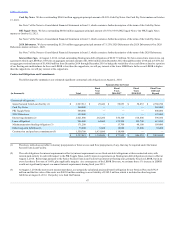

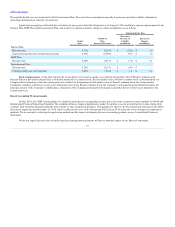

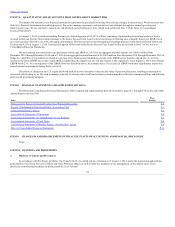

The following table summarizes our estimated significant contractual cash obligations at August 2, 2014:

Contractual obligations:

Senior Secured Term Loan Facility (1)

$ 2,927,912

$ 29,426

$ 58,853

$ 58,853

$ 2,780,780

Cash Pay Notes

960,000

—

—

—

960,000

PIK Toggle Notes

600,000

—

—

—

600,000

2028 Debentures

125,000

—

—

—

125,000

Interest requirements (2)

2,021,000

262,200

550,100

618,400

590,300

Lease obligations

906,400

64,600

122,300

105,700

613,800

Minimum pension funding obligation (3)

171,200

—

13,700

48,100

109,400

Other long-term liabilities (4)

75,200

6,600

14,000

15,200

39,400

Construction and purchase commitments (5)

1,550,700

1,431,800

118,900

—

—

$ 9,337,412

$ 1,794,626

$ 877,853

$ 846,253

$ 5,818,680

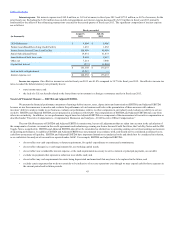

(1) The above table does not reflect voluntary prepayments or future excess cash flow prepayments, if any, that may be required under the Senior

Secured Term Loan Facility.

(2) The cash obligations for interest requirements reflect (a) interest requirements on our fixed-rate debt obligations at their contractual rates, with

interest paid entirely in cash with respect to the PIK Toggle Notes, and (b) interest requirements on floating rate debt obligations at rates in effect at

August 2, 2014. Borrowings pursuant to the Senior Secured Term Loan Facility bear interest at floating rates, primarily based on LIBOR, but in no

event less than a floor rate of 1.00%, plus applicable margins. As a consequence of the LIBOR floor rate, we estimate that a 1% increase in LIBOR

would not significantly impact our annual interest requirements during fiscal year 2015.

(3) At August 2, 2014 (the most recent measurement date), our actuarially calculated projected benefit obligation for our Pension Plan was $592.9

million and the fair value of the assets was $403.0 million resulting in a net liability of $189.9 million, which is included in other long-term

liabilities at August 2, 2014. Our policy is to fund the Pension

47