Neiman Marcus 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

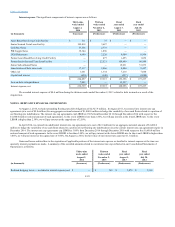

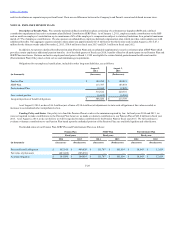

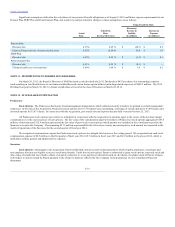

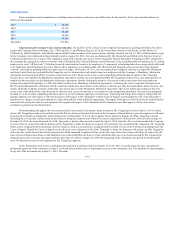

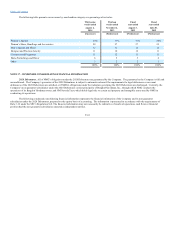

Significant assumptions utilized in the calculation of our projected benefit obligations as of August 2, 2014 and future expense requirements for our

Pension Plan, SERP Plan and Postretirement Plan, and sensitivity analysis related to changes in these assumptions, are as follows:

Pension Plan:

Discount rate

4.35%

0.25 %

$ (20.3)

$ 0.5

Expected long-term rate of return on plan assets

6.50%

(0.50)%

N/A

$ 1.9

SERP Plan:

Discount rate

4.20%

0.25 %

$ (3.2)

$ 0.1

Postretirement Plan:

Discount rate

4.25%

0.25 %

$ (0.3)

$ —

Ultimate health care cost trend rate

5.00%

1.00 %

$ 1.4

$ 0.1

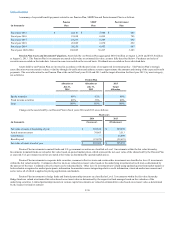

On March 28, 2012, the Board of Directors of NMG declared a cash dividend (the 2012 Dividend) of $435 per share of its outstanding common

stock resulting in total distributions to our former stockholders and certain former option holders (including related expenses) of $449.3 million. The 2012

Dividend was paid on March 30, 2012 to former stockholders of record at the close of business on March 28, 2012.

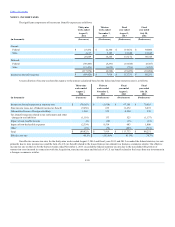

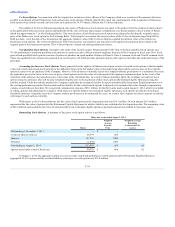

Stock Options. The Predecessor had equity-based management arrangements, which authorized equity awards to be granted to certain management

employees. At the time of the Acquisition, Predecessor stock options for 101,730 shares were outstanding, consisting of vested options for 67,899 shares and

unvested options for 33,831 shares. In connection with the Acquisition, previously unvested options became fully vested at October 25, 2013.

All Predecessor stock options were subject to settlement in connection with the Acquisition in amounts equal to the excess of the per share merger

consideration over the exercise prices of such options. The fair value of the consideration payable to holders of Predecessor stock options aggregated $187.4

million, of such amount $135.9 million represented the fair value of previously vested options which amount was included in the consideration paid by the

Sponsors to acquire the Company. The remaining $51.5 million represented the fair value of previously unvested options, such amount was expensed in the

results of operations of the Successor for the second quarter of fiscal year 2014.

We recognized compensation expense for Predecessor stock options on a straight-line basis over the vesting period. We recognized non-cash stock

compensation expense of $2.5 million in the first quarter of fiscal year 2014, $9.7 million in fiscal year 2013 and $6.9 million in fiscal year 2012, which is

included in selling, general and administrative expenses.

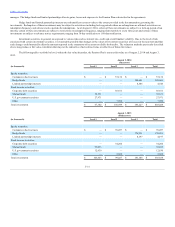

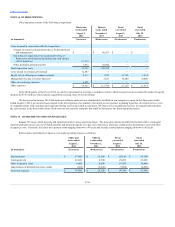

Stock Options. Subsequent to the Acquisition, Parent established various incentive plans pursuant to which eligible employees, consultants and

non-employee directors are eligible to receive stock-based awards. Under the incentive plans, Parent is authorized to grant stock options, restricted stock and

other types of awards that are valued in whole or in part by reference to, or are payable or otherwise based on, the shares of common stock of Parent. Charges

with respect to options issued by Parent pursuant to the incentive plans are reflected by the Company in the preparation of our Consolidated Financial

Statements.

F-33