Neiman Marcus 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Historically, our customers holding a proprietary credit card have tended to shop more frequently and have a higher level of spending than

customers paying with cash or third party credit cards. In fiscal years 2014 and 2013, approximately 40% of our revenues were transacted through our

proprietary credit cards.

We utilize data captured through our proprietary credit card program in connection with promotional events and customer relationship programs to

target specific customers based upon their past spending patterns for certain brands, merchandise categories and store locations.

Our merchandising functions are responsible for the determination of the merchandise assortment and quantities to be purchased for each of our

brands and, in the case of Neiman Marcus and Last Call stores, for the allocation of merchandise to each store. We currently have approximately

400 merchandise buyers and merchandise planners.

Effective April 2014, we merged the merchant and planning teams previously responsible for our Neiman Marcus stores and Neiman Marcus website.

The new combined omni-channel merchandising team is now responsible for inventory procurement for both channels. The integration of the merchandising

responsibilities for our Neiman Marcus brand represents a significant enhancement of our omni-channel capabilities and elevates our ability to deliver a

superior shopping experience to our customers.

We carry a broad selection of highly differentiated and distinctive luxury merchandise carefully curated by our highly-skilled merchandising

groups. We believe our merchandising experience and in-depth knowledge of our customers and the markets within which we operate allow us to select an

appropriate merchandise assortment that is tailored to fully address our customers’ lifestyle needs.

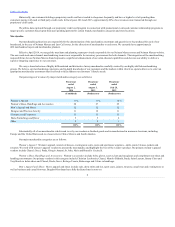

Our percentages of revenues by major merchandise category are as follows:

Women’s Apparel

31%

31%

34%

Women’s Shoes, Handbags and Accessories

28

27

25

Men’s Apparel and Shoes

12

12

12

Designer and Precious Jewelry

11

12

11

Cosmetics and Fragrances

11

11

11

Home Furnishings and Décor

5

5

6

Other

2

2

1

100%

100%

100%

Substantially all of our merchandise is delivered to us by our vendors as finished goods and is manufactured in numerous locations, including

Europe and the United States and, to a lesser extent, China, Mexico and South America.

Our major merchandise categories are as follows:

Women’s Apparel: Women’s apparel consists of dresses, eveningwear, suits, coats and sportswear separates—skirts, pants, blouses, jackets and

sweaters. We work with women’s apparel vendors to present the merchandise and highlight the best of the vendor’s product. Our primary women’s apparel

vendors include Chanel, Gucci, Prada, Giorgio Armani, St. John, Akris and Brunello Cucinelli.

Women’s Shoes, Handbags and Accessories: Women’s accessories include belts, gloves, scarves, hats and sunglasses and complement our shoes and

handbags assortments. Our primary vendors in this category include Christian Louboutin, Chanel, Manolo Blahnik, Prada, Saint Laurent, Jimmy Choo and

Tory Burch in ladies shoes and Chanel, Prada, Gucci, Bottega Veneta, Balenciaga and Celine in handbags.

Men’s Apparel and Shoes: Men’s apparel and shoes include suits, dress shirts and ties, sport coats, jackets, trousers, casual wear and eveningwear as

well as business and casual footwear. Bergdorf Goodman has a fully dedicated men’s store on

8