Neiman Marcus 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

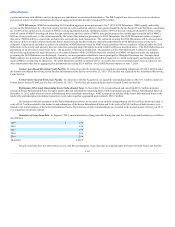

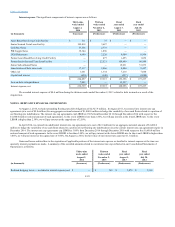

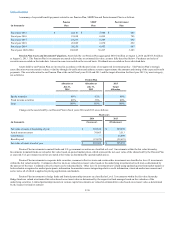

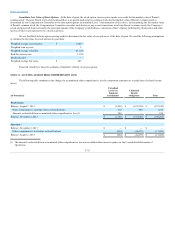

Significant components of our net deferred income tax asset (liability) are as follows:

Deferred income tax assets:

Accruals and reserves

$ 32,675

$ 25,909

Employee benefits

162,748

128,225

Other

30,316

20,298

Total deferred tax assets

$ 225,739

$ 174,432

Deferred income tax liabilities:

Inventory

$ (6,312)

$ (8,110)

Depreciation and amortization

(272,796)

(69,167)

Intangible assets

(1,405,933)

(696,056)

Other

(41,725)

(12,835)

Total deferred tax liabilities

(1,726,766)

(786,168)

Net deferred income tax liability

$ (1,501,027)

$ (611,736)

Net deferred income tax asset (liability):

Current

$ 39,049

$ 27,645

Non-current

(1,540,076)

(639,381)

Total

$ (1,501,027)

$ (611,736)

The net deferred tax liability of $1,501.0 million at August 2, 2014 increased from $611.7 million at August 3, 2013. This increase was comprised

primarily of 1) $930.5 million increase in deferred tax liabilities related to purchase accounting adjustments and 2) $41.2 million increase in deferred tax

assets related to employee benefits and other items. We believe it is more likely than not that we will realize the benefits of our recorded deferred tax assets.

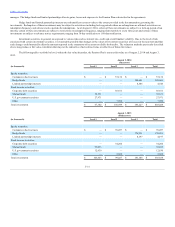

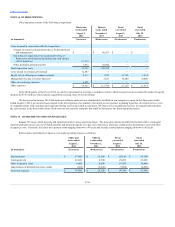

At August 2, 2014, the gross amount of unrecognized tax benefits was $2.5 million, $1.7 million of which would impact our effective tax rate, if

recognized. We classify interest and penalties as a component of income tax expense and our liability for accrued interest and penalties was $5.1 million at

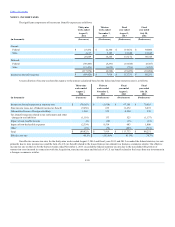

August 2, 2014 and $5.5 million at August 3, 2013. A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows:

Balance at beginning of fiscal year

$ 3,461

$ 3,564

Gross amount of decreases for prior year tax positions

(1,072)

(281)

Gross amount of increases for current year tax positions

154

178

Balance at ending of fiscal year

$ 2,543

$ 3,461

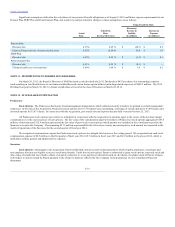

We file income tax returns in the U.S. federal jurisdiction and various state and local jurisdictions. During the second quarter of fiscal year 2013, the

Internal Revenue Service (IRS) began its audit of our fiscal year 2010 and 2011 federal income tax returns and closed its audit of our fiscal year 2008 and

2009 income tax returns. During the second quarter of fiscal year 2014, the IRS began its audit of our fiscal year 2012 federal income tax return. With respect

to state and local jurisdictions, with limited exceptions, the Company and its subsidiaries are no longer subject to income tax audits for fiscal years before

2009. We believe our recorded tax liabilities as of August 2, 2014 are sufficient to cover any potential assessments to be made by the IRS or other taxing

authorities upon the completion of their examinations and we will continue to review our recorded tax liabilities for potential audit assessments based upon

subsequent events, new information and future circumstances. We believe it is reasonably possible that additional adjustments in the amounts of our

unrecognized tax benefits could occur within the next twelve months as a result of settlements with tax authorities or expiration of statutes of limitation. At

this time, we do not believe such adjustments will have a material impact on our Consolidated Financial Statements.

Subsequent to the Acquisition, Parent and its subsidiaries, including the Company, will file U.S. federal income taxes as a consolidated group. The

Company has elected to be treated as a corporation for U.S. federal income tax purposes and all operations of Parent are conducted through the Company and

its subsidiaries. Income taxes are presented as if the Company

F-27