Neiman Marcus 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

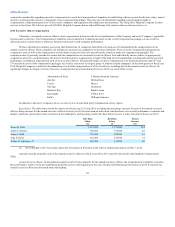

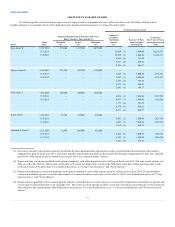

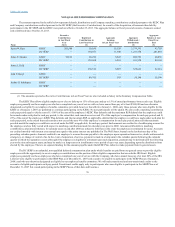

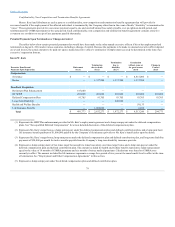

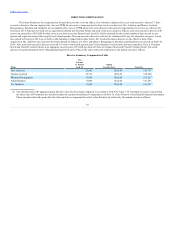

Each exercise of stock options for our named executive officers that occurred during fiscal year 2014 occurred in connection with the Acquisition.

As a result, the following table lists the value realized by our named executive officers as a result of the vesting of unvested Predecessor stock options on the

effective date of the Acquisition and the settlement and cancellation of all Predecessor stock options (other than the Co-Invest Stock Options) in exchange

for an amount equal to the excess of the per share merger consideration over the exercise prices of such stock options.

Karen W. Katz

12,966

24,808,200

James E. Skinner

7,010

13,417,384

James J. Gold

7,066

13,529,412

John E. Koryl

2,907

4,270,356

Joshua G. Schulman

1,816

2,172,126

(1) Represents the number of shares underlying Predecessor stock options that were settled and cancelled in exchange for an amount equal to the excess

of the per share merger consideration over the exercise prices of such stock options in connection with the Acquisition. Any unvested Predecessor

stock options accelerated and vested on the effective date of the Acquisition in accordance with their terms.

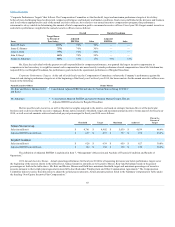

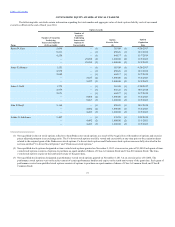

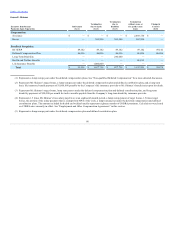

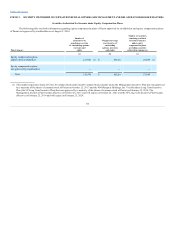

The following table sets forth certain information with respect to retirement payments and benefits under the Pension Plan and the SERP Plan for

each of our named executive officers.

Karen W. Katz

Pension Plan

25

(3)

515,000

—

SERP Plan

26

(3)

4,329,000

—

James E. Skinner

Pension Plan

7

(4)

198,000

—

SERP Plan

7

(4)

636,000

—

James J. Gold

Pension Plan

17

(4)

219,000

—

SERP Plan

17

(4)

622,000

—

John E. Koryl

Pension Plan

—

—

—

SERP Plan

—

—

—

Joshua G. Schulman

Pension Plan

—

—

—

SERP Plan

—

—

—

(1) Computed as of August 2, 2014, which is the same pension measurement date used for financial statement reporting purposes with respect to our

Consolidated Financial Statements and notes thereto.

(2) For purposes of calculating the amounts in this column, retirement age was assumed to be the normal retirement age of the later of age 65 or the fifth

anniversary of the individual’s date of hire, as defined in the Pension Plan. A description of the valuation method and all material assumptions

applied in quantifying the present value of accumulated benefit is set forth in Note 10 of the Notes to Consolidated Financial Statements.

(3) Pursuant to the terms of Ms. Katz’s employment agreement, she will be entitled to an additional one year of credit for each full year of service after she

has reached the 25-year maximum set forth in the SERP Plan with all service frozen as of December 31, 2010. In addition, if her employment is

terminated by us for any reason other than death, “disability,” “cause” or for non-renewal of her employment term, or if she terminates her

employment with us for “good reason” or “retirement” and she has not yet reached 65, her SERP Plan benefit will not be reduced solely by reason of

her failure to reach 65 as of the termination date. Ms. Katz’s employment agreement also provides that the amount credited to her under the DC SERP

shall not be less than the present value of the additional benefits she would have

74