Neiman Marcus 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Co-Invest Options. In connection with the Acquisition, certain executive officers of the Company rolled over a portion of the amounts otherwise

payable in settlement of their Predecessor stock options into stock options of Parent. Specifically, upon the consummation of the Acquisition, Predecessor

stock options were rolled over and converted into stock options for 56,979 shares of Parent (the Co-Invest Options).

The number of Co-Invest Options issued upon conversion of Predecessor stock options was equal to the product of (a) the number of shares subject

to the applicable Predecessor stock options multiplied by (b) the ratio of the per share merger consideration over the fair market value of a share of Parent,

which was approximately 3.1x (the Exchange Ratio). The exercise price of each Predecessor stock option was adjusted by dividing the original exercise

price of the Predecessor stock option by the Exchange Ratio. Following the conversion, the exercise prices of the Co-Invest Options range from $180 to

$644 per share. As of the date of the Acquisition, the aggregate intrinsic value of the Co-Invest Options equaled the intrinsic value of the rolled over

Predecessor stock options. The Co-Invest Options are fully vested and are exercisable at any time prior to the applicable expiration dates related to the

original grant of the Predecessor options. The Co-Invest Options contain sale and repurchase provisions.

Non-Qualified Stock Options. Pursuant to the terms of the incentive plans, Parent granted 81,607 time-vested non-qualified stock options and

76,385 performance-vested non-qualified stock options to certain executive officers and non-employee directors of the Company in fiscal year 2014. Each

grant of non-qualified stock options consists of options to purchase an equal number of shares of Parent’s Class A common stock and Class B common stock.

These non-qualified stock options were granted at an exercise price of $1,000 per share and such options will expire no later than the tenth anniversary of the

grant date.

Accounting for Successor Stock Options. Parent generally has the right to call shares issued upon exercise of vested stock options at the fair market

value and vested unexercised stock options for the difference between the fair market value of the underlying share and the exercise price in the event the

optionee ceases to be an employee of the Company. However, if the optionee voluntarily leaves the Company without good reason or is terminated for cause,

the repurchase price is the lesser of the exercise price of such options or the fair value of such awards at the employee termination date. In the event of the

retirement of the optionee, the repurchase price is fair value at the retirement date. As a result of these repurchase rights, the Company accounts for stock

options issued to optionees who will become retirement eligible prior to the expiration of their stock options (Retirement Eligible Optionees) using the

liability method. Under the liability method, the Company establishes the estimated liability for option awards held by Retirement Eligible Optionees over

the vesting/performance periods of such awards and the liability for the vested/earned options is adjusted to its estimated fair value through compensation

expense at each balance sheet date. We recognized compensation expense of $6.3 million for the thirty-nine weeks ended August 2, 2014, which is included

in selling, general and administrative expenses. With respect to options held by non-retirement eligible optionees, such options are effectively forfeited

should the optionee voluntarily leave the Company without good reason or be terminated for cause. As a result, the Company records no expense or liability

with respect to such options currently.

With respect to the Co-Invest Options, the fair value of such options at the Acquisition date was $36.3 million. Of such amount, $9.5 million

represented the fair value of options held by Retirement Eligible Optionees for which a liability was established at the Acquisition date. The remaining value

of $26.8 million represented the fair value of options held by non-retirement eligible optionees and such amount was credited to Successor equity.

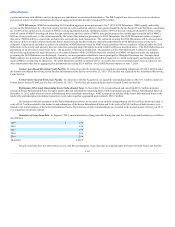

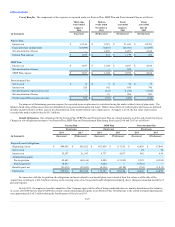

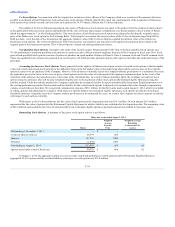

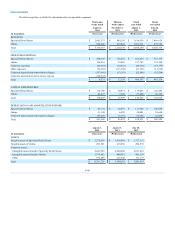

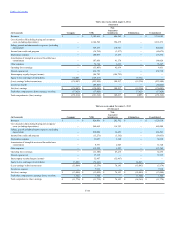

Outstanding Stock Options. A summary of Successor stock option activity is as follows:

Outstanding at November 2, 2013

—

$ —

Co-Invest Options rollover

56,979

468

Granted

157,992

1,000

Forfeited

(1,030)

1,000

Outstanding at August 2, 2014

213,941

$ 858

8.0

Options exercisable at end of fiscal year

56,979

$ 468

4.2

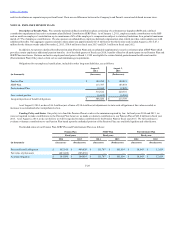

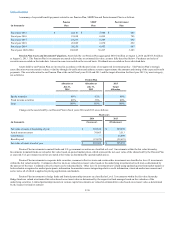

At August 2, 2014, the aggregate number of co-invest, time-vested and performance-vested options held by Retirement Eligible Optionees

aggregated 99,910 options and the recorded liability with respect to such options was $15.8 million.

F-34