Neiman Marcus 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

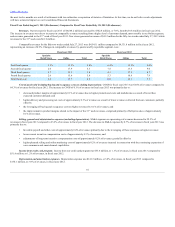

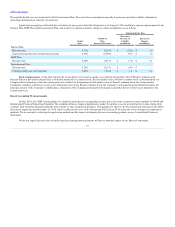

Our major sources of funds are comprised of vendor payment terms, the $800.0 million Asset-Based Revolving Credit Facility, the $2,927.9 million

Senior Secured Term Loan Facility, $960.0 million Cash Pay Notes, $600.0 million PIK Toggle Notes, $125.0 million 2028 Debentures and operating leases.

On October 25, 2013, in connection with the Acquisition, we executed the following transactions:

• repaid the $2,433.1 million outstanding under the Former Senior Secured Term Loan Facility and terminated the facility;

• repaid the obligations under the Former Asset-Based Revolving Credit Facility and terminated the facility;

• entered into the Senior Secured Term Loan Facility in an initial outstanding principal amount of $2,950.0 million;

• entered into the Asset-Based Revolving Credit Facility with a maximum committed borrowing capacity of $800.0 million; and

• incurred indebtedness in the form of 1) $960.0 million in aggregate principal amount of the Cash Pay Notes and 2) $600.0 million in aggregate

principal amount of the PIK Toggle Notes.

The purpose of the above transactions was in part to facilitate the Acquisition by the Sponsors on October 25, 2013.

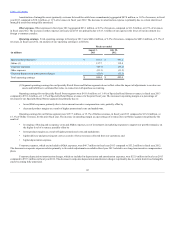

Asset-Based Revolving Credit Facility. At August 2, 2014, we had an Asset-Based Revolving Credit Facility providing for a maximum committed

borrowing capacity of $800.0 million. The Asset-Based Revolving Credit Facility matures on October 25, 2018. On August 2, 2014, we had no borrowings

outstanding under this facility, no outstanding letters of credit and $720.0 million of unused borrowing availability.

Availability under the Asset-Based Revolving Credit Facility is subject to a borrowing base. The Asset-Based Revolving Credit Facility includes

borrowing capacity available for letters of credit (up to $150.0 million, with any such issuance of letters of credit reducing the amount available under the

Asset-Based Revolving Credit Facility on a dollar-for-dollar basis) and for borrowings on same-day notice. The borrowing base is equal to at any time the

sum of (a) 90% of the net orderly liquidation value of eligible inventory, net of certain reserves, plus (b) 90% of the amounts owed by credit card processors

in respect of eligible credit card accounts constituting proceeds from the sale or disposition of inventory, less certain reserves, plus (c) 100% of segregated

cash. We must at all times maintain excess availability of at least the greater of (a) 10% of the lesser of (1) the aggregate revolving commitments and (2) the

borrowing base and (b) $50.0 million, but we are not required to maintain a fixed charge coverage ratio unless excess availability is below such levels.

See Note 7 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the Asset-Based

Revolving Credit Facility.

Senior Secured Term Loan Facility. At August 2, 2014, the outstanding balance under the Senior Secured Term Loan Facility was $2,927.9

million. The principal amount of the loans outstanding is due and payable in full on October 25, 2020.

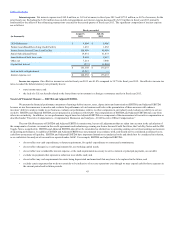

Depending on our senior secured first lien net leverage ratio as defined in the credit agreement governing the Senior Secured Term Loan Facility, we

could be required to prepay outstanding term loans from a certain portion of our annual excess cash flow, as defined in the credit agreement. Required excess

cash flow payments commence at 50% of our annual excess cash flow (which percentage will be reduced to 25% if our senior secured first lien net leverage

ratio is equal to or less than 4.0 to 1.0 but greater than 3.5 to 1.0 and will be reduced to 0% if our senior secured first lien net leverage ratio is equal to or less

than 3.5 to 1.0). We also must offer to prepay outstanding term loans at 100% of the principal amount to be prepaid, plus accrued and unpaid interest, with

the proceeds of certain asset sales under certain circumstances.

The interest rate on the outstanding borrowings pursuant to the Senior Secured Term Loan Facility was 4.25% at August 2, 2014.

See Note 7 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the Senior Secured

Term Loan Facility.

46