Neiman Marcus 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ýý

¨¨

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ý No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ý

(Note: The registrant is a voluntary filer and not subject to the filing requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934. Although not subject to these

filing requirements, the registrant has filed all reports that would have been required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months had the registrant been subject to such requirements.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer x

(Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The registrant is privately held. There is no trading in the registrant's membership units and therefore an aggregate market value based on the registrant's membership units is

not determinable.

Table of contents

-

Page 1

...-12 to Neiman Marcus Group LTD LLC (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 20-3509435 (I.R.S. Employer Identification No.) 1618 Main Street Dallas, Texas 75201 (Address of principal executive offices) (Zip code... -

Page 2

... Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related... -

Page 3

.... In addition, we operate two Bergdorf Goodman stores in landmark locations on Fifth Avenue in New York City. Neiman Marcus and Bergdorf Goodman cater to a highly affluent customer, offering distinctive luxury women's and men's apparel and accessories, handbags, cosmetics, shoes and designer and... -

Page 4

... comparable to our Predecessor financial statements. Our Market and Competitive Strengths We operate in the luxury apparel and accessories segment of the retail industry and market and sell merchandise, both in-store and online. Our luxury-branded fashion vendors include, among others, Chanel... -

Page 5

... store productivity of our Neiman Marcus and Bergdorf Goodman stores was $579 per foot for fiscal year 2014. Our shopping experience is highly differentiated. We offer our customers a curated selection of merchandise tailored to local aesthetics. Each of our stores is individually designed by market... -

Page 6

...Bergdorf Goodman Stores. Bergdorf Goodman is a premier luxury retailer in New York City well known for its high luxury merchandise, sumptuous shopping environment and landmark Fifth Avenue locations. Like Neiman Marcus, Bergdorf Goodman features high-end apparel, handbags, fashion accessories, shoes... -

Page 7

.... To complement the operations of our retail stores, our upscale direct-to-consumer retailing operation (Online) conducts online sales of fashion apparel, handbags, shoes, accessories and home furnishings through the Neiman Marcus and Bergdorf Goodman brands and online sales of home furnishings and... -

Page 8

... a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital One). Pursuant to an agreement with Capital One (the Program Agreement), Capital One offers proprietary credit card accounts to our customers under both the "Neiman Marcus" and "Bergdorf Goodman... -

Page 9

...credit cards. We utilize data captured through our proprietary credit card program in connection with promotional events and customer relationship programs to target specific customers based upon their past spending patterns for certain brands, merchandise categories and store locations. Merchandise... -

Page 10

... merchandise. Our women's and men's apparel and fashion accessories businesses are especially dependent upon our relationships with these designer resources. We monitor and evaluate the sales and profitability performance of each vendor and adjust our future purchasing decisions from time to time... -

Page 11

.... For products stored in locker stock, we can ship replenishment merchandise to the stores that demonstrate the highest customer demand. In addition, our sales associates can use the program to ship items directly to our customers, thereby improving customer service and increasing productivity. This... -

Page 12

...specialty apparel stores and online retailers. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store ambiance... -

Page 13

... applicable state and federal regulations with respect to such practices. Tdditional Information We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments, available free of charge through our website at www.neimanmarcusgroup.com... -

Page 14

... pricing strategies, including discounting of prices and/or the discounting or elimination of revenues collected for delivery and processing or other services; expansion of product or service offerings by existing competitors; entry by new competitors into markets in which we currently operate... -

Page 15

... information privacy could negatively impact our operations. The protection of our customer, employee and company data is critically important to us. We utilize customer data captured through both our proprietary credit card programs and our in-store and online activities. Our customers have a high... -

Page 16

...our company, which, if eroded, could adversely affect our customer and employee relationships. We have a reputation associated with a high level of integrity, customer service and quality merchandise, which is one of the reasons customers shop with us and employees choose us as a place of employment... -

Page 17

... through which credit is extended to customers and have a related marketing and servicing alliance with affiliates of Capital One. Pursuant to the Program Agreement, Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus" and "Bergdorf Goodman" brand names... -

Page 18

...credit card program and ultimately, our business. Credit card operations such as our proprietary program through Capital One are subject to numerous federal and state laws that impose disclosure and other requirements upon the origination, servicing and enforcement of credit accounts and limitations... -

Page 19

... property rights, our business or results of operations may be adversely affected. We and our subsidiaries currently own our tradenames and service marks, including the "Neiman Marcus" and "Bergdorf Goodman" marks. Our tradenames and service marks are registered in the United States and in various... -

Page 20

...our long-term interests. The indentures governing the Notes and the credit agreements governing our Senior Secured Credit Facilities contain a number of restrictive covenants that impose significant operating and financial restrictions on us and limit our ability to engage in acts that may be in our... -

Page 21

...capital needs or to engage in other business activities. We are a holding company with no operations and may not have access to sufficient cash to make payments on our outstanding indebtedness. We are a holding company and do not have any direct operations. Our only significant assets are the equity... -

Page 22

... each quarter point change in interest rates would result in a $9.3 million change in annual interest expense on the indebtedness under our Senior Secured Credit Facilities. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments to... -

Page 23

Table of Contents Risks Related to Our Organization and Structure Because NMG accounts for substantially all of our operations, we are subject to all risks applicable to NMG and dependent upon NMG's distributions to us. Neiman Marcus Group LTD LLC is a holding company and, accordingly, substantially... -

Page 24

... Downtown Neiman Marcus store location in Dallas, Texas. Other operating headquarters are located in Dallas, Texas and New York, New York. Properties that we use in our operations include Neiman Marcus stores, Bergdorf Goodman stores, Last Call stores and distribution, support and office facilities... -

Page 25

... table sets forth certain details regarding these stores: Bergdorf Goodman Stores Fiscal Year Operations Began Gross Store Sq. Feet Locations New York City (Main)(1) New York City (Men's)(1)* (1) * Leased. Mortgaged to secure our senior secured credit facilities and the 2028 Debentures. 1901 1991... -

Page 26

... Group LLC in Los Angeles County Superior Court by a customer, Linda Rubenstein, in connection with the Company's Last Call stores in California. Ms. Rubenstein alleges that the Company has violated various California consumer protection statutes by implementing a marketing and pricing strategy... -

Page 27

... negligence and other claims in connection with their purchases by payment cards. Melissa Frank v. The Neiman Marcus Group, LLC, et al., was filed in the United States District Court for the Eastern District of New York on January 13, 2014 but was voluntarily dismissed by the plaintiff on April... -

Page 28

... year ended July 31, 2010 (Predecessor) OPERTTING RESULTS Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation and amortization Operating earnings... -

Page 29

... (Predecessor) Fiscal year ended July 31, 2010 (Predecessor) OTHER OPERTTING DTTT Net capital expenditures (6) Depreciation expense Rent expense and related occupancy costs Change in comparable revenues (7) Number of full-line stores open at period end Sales per square foot (8) NON-GTTP FINTNCITL... -

Page 30

...Sales per square foot for fiscal year 2013 are based on revenues for the fifty-two weeks ended July 27, 2013. For an explanation of EBITDA and Adjusted EBITDA as measures of our operating performance and a reconciliation to net earnings, see Item 7, "Management's Discussion and Analysis of Financial... -

Page 31

...the Neiman Marcus and Bergdorf Goodman brand names. We report our store operations as our Specialty Retail Stores segment and our direct-to-consumer operations as our Online segment. The Company is a subsidiary of NM Mariposa Holdings, Inc., a Delaware corporation (Parent), which is owned by private... -

Page 32

... by 3) higher delivery and processing net costs attributable to the implementation of free shipping/free returns for our Neiman Marcus and Bergdorf Goodman brands on October 1, 2013. At August 2, 2014, on-hand inventories totaled $1,069.6 million, a 5.0% increase from August 3, 2013. Based on our... -

Page 33

... year 2014 compared to fiscal year 2013. This decrease was driven by 1) higher delivery and processing net costs attributable to the implementation of free shipping/free returns for our Neiman Marcus and Bergdorf Goodman brands on October 1, 2013, partially offset by 2) increased product margins as... -

Page 34

... 5.3 2.0 3.2 % Percentages related to fiscal year 2013 include the operating results of the 53 rd week. Summary financial information with respect to the 53 rd week of fiscal year 2013 is as follows: Specialty Retail (in millions) Online Total Revenues Operating earnings EBITDA $ 47.5 8.2 10... -

Page 35

... OPERATING PROFIT MARGIN Specialty Retail Stores Online Total CHANGE IN COMPARABLE REVENUES (2) Specialty Retail Stores Online Total SALES PER SQUARE FOOT (3) Specialty Retail Stores STORE COUNT Neiman Marcus and Bergdorf Goodman full-line stores: Open at beginning of period Opened during the period... -

Page 36

...derived from our retail stores open for more than fifty-two weeks, including stores that have been relocated or expanded and 2) revenues from our online operation. Comparable revenues exclude revenues of closed stores. We closed our Neiman Marcus store in Minneapolis in January 2013. The calculation... -

Page 37

... preferences; changes in the level of full-price sales; changes in the level and timing of promotional events conducted; changes in the level of delivery and processing revenues collected from our customers; our ability to successfully implement our expansion and growth strategies; and the rate of... -

Page 38

... revenues generally, including pricing and promotional strategies, product offerings and actions taken by competitors; changes in delivery and processing costs and our ability to pass such costs onto the customer; changes in occupancy costs primarily associated with the opening of new stores... -

Page 39

... Contents Agreement, Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus" and "Bergdorf Goodman" brand names. Pursuant to the Program Agreement, we receive payments from Capital One based on sales transacted on our proprietary credit cards. We recognize... -

Page 40

... by higher delivery and processing net costs of approximately 0.5% of revenues as a result of lower shipping and handling revenues collected from our customers. On October 1, 2013, we implemented free shipping/free returns for our Neiman Marcus and Bergdorf Goodman brands. Selling, general and... -

Page 41

... decrease in operating margin as a percentage of revenues for our Online segment was primarily the result of: • • higher delivery and processing net costs as a result of our implementation of free shipping/free returns for our Neiman Marcus and Bergdorf Goodman brands on October 1, 2013 and the... -

Page 42

... to $46.7 million in fiscal year 2013. The increase in corporate expenses relates primarily to 1) favorable adjustments recorded in fiscal year 2013 related to our long-term incentive compensation plans and 2) a higher level of spending in the current year related to the continued investment in and... -

Page 43

...-two weeks ended July 27, 2013 were $4,545.1 million compared to $4,331.8 million in fiscal year 2012, representing an increase of 4.9%. Changes in comparable revenues, by quarter and by reportable segment, were: Fiscal year 2013 Specialty Retail Stores Online Total Specialty Retail Stores Fiscal... -

Page 44

... in marketing expenses to support our growth strategies, on the higher level of revenues; partially offset by lower product margins as a result of higher promotional costs and markdowns; higher delivery and processing net costs as a result of lower revenues collected from our customers; and... -

Page 45

... rate primarily due to: • • state income taxes; and the lack of a U.S. tax benefit related to the losses from our investment in a foreign e-commerce retailer in fiscal year 2013. Non-GTTP Financial Measure - EBITDT and Tdjusted EBITDT We present the financial performance measures of earnings... -

Page 46

...to increases in retail prices and/or we are unable to pass such cost increases to our customers, our revenues, gross margins, and ultimately our earnings, could decrease. Foreign currency fluctuations could have a material adverse effect on our business, financial condition and results of operations... -

Page 47

... of our merchandise purchases; debt service requirements; capital expenditures for expansion and growth strategies, including new store construction, store renovations and upgrades of our management information systems; income tax payments; and obligations related to our defined benefit pension plan... -

Page 48

... borrowing base is equal to at any time the sum of (a) 90% of the net orderly liquidation value of eligible inventory, net of certain reserves, plus (b) 90% of the amounts owed by credit card processors in respect of eligible credit card accounts constituting proceeds from the sale or disposition of... -

Page 49

... that a 1% increase in LIBOR would not significantly impact our annual interest requirements during fiscal year 2015. At August 2, 2014 (the most recent measurement date), our actuarially calculated projected benefit obligation for our Pension Plan was $592.9 million and the fair value of the assets... -

Page 50

... payments. Off-Balance Sheet Trrangements We had no off-balance sheet arrangements, other than operating leases entered into in the normal course of business, during fiscal year 2014. See Note 15 of the Notes to Consolidated Financial Statements in Item 15 for more information about our operating... -

Page 51

... • Industry and Competitive Factors competitive responses to our loyalty program, marketing, merchandising and promotional efforts or inventory liquidations by vendors or other retailers; changes in the financial viability of our competitors; seasonality of the retail business; adverse weather... -

Page 52

... used in the preparation of our audited Consolidated Financial Statements. Revenues. Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues are recognized at the later of the point of sale or the delivery of goods to the customer... -

Page 53

...on our future operating performance. Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale. Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we earn in... -

Page 54

... in market royalty rates and by approximately $96 million for each 0.25% increase in the weighted average cost of capital. The assessment of the recoverability of the goodwill associated with our Neiman Marcus stores, Bergdorf Goodman stores, Last Call stores and online reporting units involves... -

Page 55

...of Contents Plan and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available information, including information provided by our actuaries. Significant assumptions utilized in the calculation of our projected benefit obligations... -

Page 56

... of this Annual Report on Form 10-K: Index Page Number Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Comprehensive (Loss) Earnings... -

Page 57

... In the ordinary course of business, we routinely enhance our information systems by either upgrading our current systems or implementing new systems. No change occurred in our internal controls over financial reporting during the quarter ended August 2, 2014 that has materially affected, or... -

Page 58

...prior service includes President and Chief Executive Officer of Specialty Retail from October 2010 to April 2014 and from May 2004 to October 2010, President and Chief Executive Officer of Bergdorf Goodman. Mr. Gold served as Senior Vice President, General Merchandise Manager of Neiman Marcus Stores... -

Page 59

... domestic and international operations and sales, site merchandising, site optimization and customer care. From June 2011 to April 2014, he served as President of Neiman Marcus Direct. From August 2009 until June 2011, he held the position of Senior Vice President, eCommerce Marketing & Analytics at... -

Page 60

... and social media is a great asset to our omni-channel brand. Shane Feeney. Mr. Feeney has served a member of our Parent Board since October 2013. He is a Managing Director and Head of Direct Private Equity at CPPIB Equity. In 2010, Mr. Feeney joined CPPIB Equity from Bridgepoint Capital Limited in... -

Page 61

... surface flooring and related accessories, and Guitar Center Holdings, Inc., a musical instruments retailer. Mr. Kaplan's previous public company board of directors experience includes Maidenform Brands, Inc., an intimate apparel retailer, where he served as the company's Chairman, GNC Holdings, Inc... -

Page 62

...key employees, (ii) reviews and evaluates our overall compensation philosophy, (iii) oversees our equity-based incentive plans and other compensation and benefit plans and (iv) prepares the compensation committee report on executive compensation included in this report. Capital Committee The members... -

Page 63

... the Chief Executive Officer, the Chief Financial Officer and the Chief Accounting Officer. Both the Code of Ethics and Conduct and the Code of Ethics for Financial Professionals may be accessed through our website at www.neimanmarcusgroup.com under the "Investor Information- Corporate Governance... -

Page 64

... the form of stock options are intended to promote sustained high performance and to align our executives' interests with those of our equity investors. The Compensation Committee believes that stock options create value for the executives if the value of our Company increases. This creates a direct... -

Page 65

...risks relating to the business. For further information, see "Risk Assessment of Compensation Policies and Programs" above. Role of Management. As part of our annual planning process, the CEO, with assistance from external consultants, develops and recommends a compensation program for all executive... -

Page 66

... performance contribution required from each of our executive officers. We generally target our direct compensation to be positioned between the 50 th and 75 th percentile levels of the compensation packages received by executives in our peer group of industry related companies. In the third quarter... -

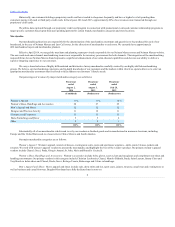

Page 67

... named executive officers. Fiscal year 2014 target annual incentives and relative performance weights for the named executive officers were as follows: Overall Target Bonus Ts Percent of Base Salary Tdjusted EBITDT Bergdorf Goodman Tdjusted EBITDT Name Sales Sales Karen W. Katz James E. Skinner... -

Page 68

...-qualified stock options and 72,206 performance vested non-qualified stock options to the named executive officers and seventeen (17) certain other executive officers pursuant to the Management Incentive Plan. Each grant of non-qualified stock options consists of options to purchase an equal number... -

Page 69

... to our executives. We believe the level of perquisites is within an acceptable range of what is offered by a group of industry related companies. The Compensation Committee believes that these benefits are aligned with the Company's desire to attract and retain highly skilled management talent for... -

Page 70

...." These agreements provide for a severance payment equal to one and one-half annual base salary of the named executive officer, payable over an eighteen month period, and reimbursement for COBRA premiums for the same period. The employment agreements of Ms. Katz and Messrs. Skinner and Gold contain... -

Page 71

...Position Karen W. Katz President and Chief Executive Officer Fiscal Year 2014 2013 2012 Salary ($) 1,070,000 1,070,000 1,070,000 750,000 720,000 720,000 Bonus ($)(1) Total ($) 26,605,283 3,974,006 9,775,605 7,743,638 1,955,262 4,784,926 James E. Skinner Executive Vice President, Chief Operating... -

Page 72

... benefit paid to highly compensated and grandfathered employees or "Rule of 65" employees as a result of the freeze of the SERP Plan. (2) Includes an annual payment of $15,000 in lieu of reimbursement for New York accommodations paid pursuant to Ms. Katz's employment contract. The employment... -

Page 73

...Under NonEquity Incentive Plan Twards (1) Name Grant Date Threshold ($) Target ($) Maximum ($) Number of Securities Underlying Options (#) Exercise Or Base Price of Option Twards ($)(5) Grant Date Fair Value of Stock and Option Twards ($)(6) Katz, Karen W. 11/21/2013 11/5/2013 11/5/2013 535,000... -

Page 74

... of the Company performed by third parties and other factors it believes are material to the valuation process. (6) For new option awards in fiscal year 2014, these amounts reflect the aggregate grant date fair value for the awards computed in accordance with ASC Topic 718. The assumptions used in... -

Page 75

... our named executive officers at the end of fiscal year 2014. Option Twards Number of Securities Underlying Unexercised Options (#) Unexercisable Name Number of Securities Underlying Unexercised Options (#) Exercisable Option Exercise Price ($) Option Expiration Date Karen W. Katz 5,699 9,211... -

Page 76

... information with respect to retirement payments and benefits under the Pension Plan and the SERP Plan for each of our named executive officers. Number of Years Credited Service (#)(1) Present Value of Tccumulated Benefit ($)(2) Payments During Last Fiscal Year ($) Name Plan Name Karen W. Katz... -

Page 77

...are paid from our general assets to supplement Pension Plan benefits and Social Security. Prior to 2008, executive, administrative and professional employees (other than those employed as salespersons) with an annual base salary at least equal to a minimum established by the Company were eligible to... -

Page 78

... at an annual rate equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter. Amounts credited to an employee's account become payable to the employee upon separation from service, death, unforeseeable emergency, or change of... -

Page 79

... the employment termination date occurs, and 2) a lump sum equal to (A) 18 times (or 12 times in the case of non-renewal by us) the monthly COBRA premium applicable to Ms. Katz, plus (B) six times the monthly premium if Ms. Katz elected coverage as a retiree under our group medical plan for retired... -

Page 80

... developed by her which relate to her employment by us or to our business. Employment Agreements with Mr. Skinner and Mr. Gold In connection with the Acquisition, we entered into new employment agreements with James E. Skinner, Executive Vice President, Chief Operating Officer, and Chief Financial... -

Page 81

... lump sum payment of two times target bonus and two times base salary, one times target bonus and a lump sum payout under the deferred compensation plan and defined contribution plan. The amount included for health and welfare benefits represents a lump-sum payment equal to the value of 18 months of... -

Page 82

...period, a lump sum payment of target bonus, 1.5 times target bonus, the portion of the salary payment that is exempt from 409A of the Code, a lump sum payout under the deferred compensation and defined contribution plans. The amount included for health and welfare benefits represents eighteen months... -

Page 83

...1.5 times target bonus, the portion of the salary payment that is exempt from 409A of the Code, a lump sum payout under the defined contribution plan. The amount included for health and welfare benefits represents eighteen months of COBRA premiums. Calculations were based on COBRA rates currently in... -

Page 84

...payment of 1.5 times base salary for each of Messrs. Koryl and Schulman. The amount included for health and welfare benefits represents a continuation of COBRA benefits for a period of eighteen months. Calculations were based on COBRA rates currently in effect. See "Employment and Other Compensation... -

Page 85

... date of the Acquisition. Ms. Aufreiter was elected to the Parent Board on January 29, 2014, and Messrs. Bourguignon, Brotman and Gundotra were elected on April 30, 2014. Also, each non-executive director received 393 time-vested stock options and 393 performance-vested stock options to purchase... -

Page 86

... 2, 2014. Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) Plan Category Weighted-average exercise price of... -

Page 87

... Certain Beneficial Owners and Management The following table sets forth, as of September 19, 2014, certain information relating to the beneficial ownership of the common stock of Parent, the sole member of Holdings, which in turn is the sole member of the Company, by (i) each person or group known... -

Page 88

...address of Messrs. Kaplan and Stein is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. Mr. Kaplan is a Senior Partner of Ares Management GP and a Senior Partner of Ares Management, Co-Head of its Private Equity Group and a member of its board of managers... -

Page 89

... or which will become exercisable within 60 days of September 19, 2014. Consists of 4,303 shares of Class A Common Stock and Class B Common Stock issuable to Mr. Schulman upon the exercise of options which are currently exercisable or which will become exercisable within 60 days of September 19... -

Page 90

... members of the Parent Board, in each case for so long as they or their respective affiliates own at least 25% of the then outstanding shares of Class A Common Stock. The Stockholders Agreement also provides for the election of the current chief executive officer of Parent to the Parent Board... -

Page 91

...for the audits of the Company's annual financial statements for the fiscal years ended August 2, 2014 and August 3, 2013 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were $2,321,000 and $1,685,000, respectively. Audit-Related Fees. The aggregate fees... -

Page 92

... and Plan of Merger, dated as of October 24, 2013, among Neiman Marcus Group LTD Inc., NM Mariposa Holdings, Inc. and Mariposa Merger Sub LLC. Certificate of Formation of the Company, dated as of October 28, 2013. Incorporated herein by reference to the Company's Current Report on Form 8-K dated... -

Page 93

...27, 1998, between The Neiman Marcus Group, Inc. and The Bank of New York, as trustee. Form of 7.125% Senior Debentures Due 2028, dated May 27, 1998. Incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended August 1, 2009. Incorporated herein by reference... -

Page 94

...Holdings, Inc. Management Equity Incentive Plan. Second Amended and Restated Credit Card Program Agreement, dated as of July 15, 2013, by and among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., and Capital One, National Association. (1) Second Amended and Restated Servicing Agreement, dated... -

Page 95

... of Contents 10.24 10.25 Management Services Agreement, dated October 25, 2013, by and among NM Mariposa Holdings, Inc., The Neiman Marcus Group, Inc. and CPPIB Equity Investments Inc. Director Services Agreement, dated January 29, 2014, by and between NM Mariposa Holdings, Inc. and Nora Aufreiter... -

Page 96

... Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Comprehensive (Loss) Earnings Consolidated Statements of Cash Flows Consolidated Statements of Member Equity / Stockholders... -

Page 97

... of our internal controls over financial reporting as of August 2, 2014. KAREN W. KATZ President and Chief Executive Officer JAMES E. SKINNER Executive Vice President, Chief Operating Officer and Chief Financial Officer T. DALE STAPLETON Senior Vice President and Chief Accounting Officer F-2 -

Page 98

... material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Neiman Marcus Group LTD LLC's internal control over financial reporting as of August 2, 2014, based on criteria established... -

Page 99

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Neiman Marcus Group LTD LLC as of August 2, 2014 (Successor) and August 3, 2013 (Predecessor), and the related (i) consolidated statements of operations and consolidated statements of... -

Page 100

...3, 2013) Successor: Membership unit (1 unit issued and outstanding at August 2, 2014) Additional paid-in capital Accumulated other comprehensive loss Accumulated deficit Total member/stockholders' equity Total liabilities and member/stockholders' equity See Notes to Consolidated Financial Statements... -

Page 101

... year ended Tugust 3, 2013 (Predecessor) Fiscal year ended July 28, 2012 (Predecessor) Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense... -

Page 102

...nine weeks ended Tugust 2, 2014 (in thousands) (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Fiscal year ended July 28, 2012 (Predecessor) Net (loss) earnings Other comprehensive (loss) earnings: Change in unrealized loss on financial... -

Page 103

...taxes Non-cash charges related to the Acquisition Other 279,077 7,882 3,613 (117,874) 145,062 4,931 188,608 Changes in operating assets and liabilities: Merchandise inventories Other current assets Other assets Accounts payable and accrued liabilities Deferred real estate credits Payment of deferred... -

Page 104

Non-cash activities: Equity contribution from management $ 26,756 $ - $ - $ - See Notes to Consolidated Financial Statements. F-8 -

Page 105

...earnings BALANCE AT AUGUST 3, 2013 Stock-based compensation expense Stock option exercises and other Comprehensive loss: Net loss Adjustments for fluctuations in fair market value of financial instruments, net of tax of $396 Reclassification to earnings, net of tax of $145 Change in unfunded benefit... -

Page 106

... Total member equity Successor: Equity contributions Comprehensive loss: Net loss Adjustments for fluctuations in fair market value of financial instruments, net of tax of ($616) Change in unfunded benefit obligations, net of tax of ($10,623) Total comprehensive loss BALANCE AT AUGUST 2, 2014 See... -

Page 107

... store and online operations principally under the Neiman Marcus and Bergdorf Goodman brand names. References to "we," "our" and "us" are used to refer to the Company or to the Company and its subsidiaries, as appropriate to the context. On October 25, 2013, the Company (formerly Neiman Marcus Group... -

Page 108

.... Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale. Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we earn in connection with the sales of the... -

Page 109

...of the discount rate used to reduce such projected future cash flows to their net present value could materially increase or decrease any related impairment charge. We believe our estimates are appropriate based upon current market conditions and the best information available at the assessment date... -

Page 110

... our Consolidated Balance Sheets. Revenues. Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues are recognized at the later of the point of sale or the delivery of goods to the customer. Revenues associated with gift cards are... -

Page 111

...a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital One). Pursuant to our agreement with Capital One (the Program Agreement), Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus" and "Bergdorf Goodman... -

Page 112

...of August 2, 2014, we have recorded purchase accounting adjustments to increase the carrying value of our property and equipment and inventory, to revalue intangible assets for our tradenames, customer lists and favorable lease commitments and to revalue our long-term benefit plan obligations, among... -

Page 113

... equity holders (including $26.8 million management rollover) Capitalized transaction costs Total consideration paid to effect the Acquisition Net assets acquired at historical cost Adjustments to state acquired assets at fair value: 1) Increase carrying value of merchandise inventories 2) Increase... -

Page 114

...Consolidated Balance Sheets: Fair Value Hierarchy (in thousands) Tugust 2, 2014 (Successor) Tugust 3, 2013 (Predecessor) Other long-term assets: Interest rate caps Level 2 $ 1,132 $ 29 The fair value of the interest rate caps are estimated using industry standard valuation models using market... -

Page 115

... components of accrued liabilities are as follows: Tugust 2, 2014 (in thousands) (Successor) Tugust 3, 2013 (Predecessor) Accrued salaries and related liabilities Amounts due customers Self-insurance reserves Interest payable Sales returns reserves Sales taxes Other Total $ 81,079 125,950 38,732... -

Page 116

... of any incremental term loans may be used for working capital and general corporate purposes. At August 2, 2014, borrowings under the Asset-Based Revolving Credit Facility bore interest at a rate per annum equal to, at our option, either (a) a base rate determined by reference to the highest of... -

Page 117

... in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by the Company or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by the Company and... -

Page 118

... in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by the Company or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by the Company and... -

Page 119

... in accordance with applicable SEC rules. As a result, the collateral under the Senior Secured Term Loan Facility will include shares of capital stock or other securities of subsidiaries of the Company or any subsidiary guarantor only to the extent that the applicable value of such securities... -

Page 120

... Debentures are discharged. Currently, our non-guarantor subsidiaries consist principally of Bergdorf Goodman, Inc., through which NMG conducts the operations of its Bergdorf Goodman stores, and NM Nevada Trust, which holds legal title to certain real property and intangible assets used by NMG in... -

Page 121

... applicable portions of the interest rate caps are reclassified to interest expense at the time our quarterly interest payments are made. A summary of the recorded amounts related to our interest rate caps reflected in our Consolidated Statements of Operations is as follows: Thirty-nine weeks ended... -

Page 122

... the thirty-nine weeks ended August 2, 2014 and fiscal years 2013 and 2012 exceeded the federal statutory tax rate primarily due to state income taxes and the lack of a U.S. tax benefit related to the losses from our investment in a foreign e-commerce retailer. Our effective income tax rate on the... -

Page 123

... current year tax positions Balance at ending of fiscal year $ 3,461 (1,072) 154 2,543 $ 3,564 (281) 178 3,461 $ $ We file income tax returns in the U.S. federal jurisdiction and various state and local jurisdictions. During the second quarter of fiscal year 2013, the Internal Revenue Service... -

Page 124

... 2010, benefits offered to all participants in our Pension Plan and SERP Plan were frozen. Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits (Postretirement Plan) if they meet certain service and minimum age requirements... -

Page 125

... the market related value of plan assets. At August 2, 2014, the fair value of plan assets exceeded the market related value by $8.1 million. Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the end of each fiscal year. Changes in... -

Page 126

... benefit payments. The asset allocation for our Pension Plan at the end of fiscal years 2014 and 2013 and the target allocation for fiscal year 2015, by asset category, are as follows: Pension Plan Tllocation at July 31, 2014 Tllocation at July 31, 2013 2015 Target Tllocation Equity securities... -

Page 127

..., the Pension Plan's assets at fair value as of August 2, 2014 and August 3, 2013. Tugust 2, 2014 (Successor) (in thousands) Level 1 Level 2 Level 3 Total Equity securities: Common/collective trusts Hedge funds Limited partnership interests Fixed income securities: Corporate debt securities Mutual... -

Page 128

... rates used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by our Pension Plan and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available... -

Page 129

... related to changes in these assumptions, are as follows: Using Sensitivity Rate Sensitivity Rate Increase/(Decrease) (Decrease)/ Increase in Liability (in millions) Increase in Expense (in millions) Tctual Rate Pension Plan: Discount rate Expected long-term rate of return on plan assets SERP Plan... -

Page 130

... the vesting/performance periods of such awards and the liability for the vested/earned options is adjusted to its estimated fair value through compensation expense at each balance sheet date. We recognized compensation expense of $6.3 million for the thirty-nine weeks ended August 2, 2014, which is... -

Page 131

... price equals or exceeds the fair market value of Parent's common stock. Because Parent is privately held and there is no public market for its common stock, the fair market value of Parent's common stock is determined by our Compensation Committee at the time option grants are awarded (Level... -

Page 132

... systems. In the thirty-nine weeks ended August 2, 2014, we incurred costs related to the investigation of a criminal cyber-attack on our systems, including legal fees, investigative fees, costs of communications with customers and credit monitoring services provided to customers. We expect to incur... -

Page 133

... against the Company, Newton Holding, LLC, TPG Capital, L.P. and Warburg Pincus LLC in the United States District Court for the Central District of California by Sheila Monjazeb, individually and on behalf of other members of the general public similarly situated. On July 12, 2010, all defendants... -

Page 134

... negligence and other claims in connection with their purchases by payment cards. Melissa Frank v. The Neiman Marcus Group, LLC, et al., was filed in the United States District Court for the Eastern District of New York on January 13, 2014 but was voluntarily dismissed by the plaintiff on April... -

Page 135

... Call stores. The Online segment conducts online and supplemental print catalog operations under the Neiman Marcus, Bergdorf Goodman, Last Call and Horchow brand names. Both the Specialty Retail Stores and Online segments derive their revenues from the sales of high-end fashion apparel, accessories... -

Page 136

... reportable segments: Thirty-nine weeks ended Tugust 2, 2014 (in thousands) (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Fiscal year ended July 28, 2012 (Predecessor) REVENUES Specialty Retail Stores Online Total OPERATING EARNINGS... -

Page 137

... revenues by merchandise category as a percentage of net sales: Thirty-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Fiscal year ended July 28, 2012 (Predecessor) Women's Apparel Women's Shoes, Handbags... -

Page 138

...cash equivalents Merchandise inventories Other current assets Total current assets Property and equipment, net Goodwill Intangible assets, net Other assets Investments in subsidiaries Total assets LITBILITIES TND MEMBER EQUITY Current liabilities: Accounts payable Accrued liabilities Current portion... -

Page 139

...Cash and cash equivalents Merchandise inventories Other current assets Total current assets Property and equipment, net Goodwill Intangible assets, net Other assets Investments in subsidiaries Total assets LITBILITIES TND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities... -

Page 140

... Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Amortization of intangible assets and favorable lease commitments Other expenses Operating (loss) earnings Interest expense, net Intercompany royalty charges (income) Equity in... -

Page 141

..., general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Amortization of intangible assets and favorable lease commitments Other expenses Operating earnings Interest expense, net Intercompany royalty charges (income) Equity in (earnings... -

Page 142

...) Equity in loss (earnings) of subsidiaries Changes in operating assets and liabilities, net Net cash provided by (used for) operating activities CTSH FLOWS-INVESTING TCTIVITIES Capital expenditures Acquisition of Neiman Marcus Group LTD LLC Investment in foreign e-commerce retailer Net cash (used... -

Page 143

...e-commerce retailer Deferred income taxes Other Intercompany royalty income payable (receivable) Equity in loss (earnings) of subsidiaries Changes in operating assets and liabilities, net Net cash provided by operating activities CTSH FLOWS-INVESTING TCTIVITIES Capital expenditures Net cash used for... -

Page 144

... income payable (receivable) Equity in (earnings) loss of subsidiaries Changes in operating assets and liabilities, net Net cash provided by operating activities CTSH FLOWS - INVESTING TCTIVITIES Capital expenditures Investment in foreign e-commerce retailer Net cash used for investing activities... -

Page 145

... income payable (receivable) Equity in (earnings) loss of subsidiaries Changes in operating assets and liabilities, net Net cash provided by operating activities CTSH FLOWS - INVESTING TCTIVITIES Capital expenditures Investment in foreign e-commerce retailer Net cash used for investing activities... -

Page 146

... agreement to acquire the MyTheresa.com global online luxury website and the Theresa flagship specialty store in Munich, Germany. The purchase price is approximately â,¬150 million, subject to certain adjustments and an "earn-out" of up to â,¬27.5 million per year for operating performance for each... -

Page 147

... authorized. NEIMAN MARCUS GROUP LTD LLC By: /S/ JAMES E. SKINNER James E. Skinner Executive Vice President, Chief Operating Officer and Chief Financial Officer Dated: September 25, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 148

... Charged to Other Tccounts Balance at End of Period Column D Column E Description Deductions Reserve for estimated sales returns Thirty-nine weeks ended August 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Year ended August 3, 2013 (Predecessor) Year ended July 28, 2012... -

Page 149

... EXECUTION VERSION FIRST AMENDMENT TO AGREEMENT AND PLAN OF MERGER , dated as October 24, 2013 (this "Amendment"), is made by and among NM Mariposa Holdings, Inc., a Delaware corporation ("Parent"), Mariposa Merger Sub LLC, a Delaware limited liability company ("Merger Sub"), and Neiman Marcus Group... -

Page 150

...form, or by other electronic means intended to preserve the original graphic and pictorial appearance of a document, will have the same effect as physical delivery...effect. This Amendment shall apply and be effective only with respect to ...referred to herein. After the date hereof, any reference to the... -

Page 151

...this Amendment, or caused this Amendment to be duly executed by their respective authorized officers, as of the date first above written. NEIMAN MARCUS GROUP LTD INC. By:/s/ JAMES E. SKINNER Name: James E. Skinner Title: Executive Vice President, Chief Operating Officer and Chief Financial Officer -

Page 152

NM MARIPOSA HOLDINGS, INC. By:/s/ ADAM STEIN Name: Adam Stein Title: Authorized Signatory MARIPOSA MERGER SUB LLC By:/s/ ADAM STEIN Name: Adam Stein Title: Authorized Signatory -

Page 153

... and Plan of Merger, dated as of September 9, 2013 (the "Merger Agreement"), by and among Holdings, Mariposa Merger Sub LLC and Neiman Marcus Group LTD Incm, a Delaware corporation; and WHEREAS, concurrently with the execution of this Agreement, ACOF Operating Manager IV, LLC and CPPIB Equity... -

Page 154

..., directly or indirectly caused by, related to, based upon, or arising out of the rendering of any advice or performance of any services by any Indemnified Party for Holdings or any of its subsidiaries, in each case, except for any such loss, claim, damage or liability resulting from the gross... -

Page 155

... a director of officer of Holdings, and no Person shall be deemed to be an Affiliate of another Person solely by virtue of the fact that both Persons own shares of stock in Holdingsm "Business Day" shall mean any day other than a Saturday, a Sunday or a day on which banks in the City of New York are... -

Page 156

... each of the partners, members, directors, officers, employees, agents and controlling persons of Manager or any of its Related Personsm "Person" means an individual, a corporation, a general or limited partnership, a limited liability company, a joint stock company, an association, a trust or any... -

Page 157

... set forth below, or at such other address or facsimile number as such party shall have furnished to the other party in writing: (i) If to Manager: ACOF Operating Manager III, LLC c/o Ares Management LLC 2000 Avenue of the Stars Los Angeles, California 90067 Facsimile: (310) 201-4170 Email: stein... -

Page 158

... c/o Ares Management LLC 2000 Avenue of the Stars Los Angeles, California 90067 Facsimile: (310) 201-4170 Email: stein@aresmgmtmcom frankel@aresmgmtmcom Attention: Adam Stein Kevin Frankel and NM Mariposa Holdings, Incm c/o Canada Pension Plan Investment Board One Queen Street East, Suite 2500 PmOm... -

Page 159

... of Manager and the Manager Related Parties have had, and from time to time may have, outside activities or interests that conflict or may conflict with the best interests of Holdings and its subsidiaries (collectively, "Outside Activities"), including corporate, business, employment and investment... -

Page 160

... directed by Manager, such waived portion will revert to Holdings and Neiman Marcusm No waiver on any one occasion or with respect to any period ... Business Daym References to a Person are also to its permitted successors and assignsm In the event that any claim is made by any Person relating ... -

Page 161

... of the parties hereto, the Manager Related Parties, the Indemnified Parties and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever... -

Page 162

...to be executed by their duly authorized officers on the date first appearing abovem NM MARIPOSA HOLDINGS, INC. By: /s/ BRENDA SANDERS Name: Brenda Sanders Title: Secretary THE NEIMAN MARCUS GROUP, INC. By: /s/ BRENDA SANDERS Name: Brenda Sanders Title: Secretary ACOF OPERATING MANAGER III, LLC... -

Page 163

... and Plan of Merger, dated as of September 9, 2013 (the "Merger Agreement"), by and among Holdings, Mariposa Merger Sub LLC and Neiman Marcus Group LTD Incm, a Delaware corporation; and WHEREAS, concurrently with the execution of this Agreement, ACOF Operating Manager III, LLC and CPPIB Equity... -

Page 164

..., directly or indirectly caused by, related to, based upon, or arising out of the rendering of any advice or performance of any services by any Indemnified Party for Holdings or any of its subsidiaries, in each case, except for any such loss, claim, damage or liability resulting from the gross... -

Page 165

... a director of officer of Holdings, and no Person shall be deemed to be an Affiliate of another Person solely by virtue of the fact that both Persons own shares of stock in Holdingsm "Business Day" shall mean any day other than a Saturday, a Sunday or a day on which banks in the City of New York are... -

Page 166

... each of the partners, members, directors, officers, employees, agents and controlling persons of Manager or any of its Related Personsm "Person" means an individual, a corporation, a general or limited partnership, a limited liability company, a joint stock company, an association, a trust or any... -

Page 167

... set forth below, or at such other address or facsimile number as such party shall have furnished to the other party in writing: (i) If to Manager: ACOF Operating Manager IV, LLC c/o Ares Management LLC 2000 Avenue of the Stars Los Angeles, California 90067 Facsimile: (310) 201-4170 Email: stein... -

Page 168

... c/o Ares Management LLC 2000 Avenue of the Stars Los Angeles, California 90067 Facsimile: (310) 201-4170 Email: stein@aresmgmtmcom frankel@aresmgmtmcom Attention: Adam Stein Kevin Frankel and NM Mariposa Holdings, Incm c/o Canada Pension Plan Investment Board One Queen Street East, Suite 2500 PmOm... -

Page 169

... of Manager and the Manager Related Parties have had, and from time to time may have, outside activities or interests that conflict or may conflict with the best interests of Holdings and its subsidiaries (collectively, "Outside Activities"), including corporate, business, employment and investment... -

Page 170

... directed by Manager, such waived portion will revert to Holdings and Neiman Marcusm No waiver on any one occasion or with respect to any period ... Business Daym References to a Person are also to its permitted successors and assignsm In the event that any claim is made by any Person relating ... -

Page 171

... of the parties hereto, the Manager Related Parties, the Indemnified Parties and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever... -

Page 172

... to be executed by their duly authorized officers on the date first appearing abovem NM MARIPOSA HOLDINGS, INC. By: /s/ BRENDA SANDERS Name: Brenda Sanders Title: Secretary THE NEIMAN MARCUS GROUP, INC. By: /s/ BRENDA SANDERS Name: Brenda Sanders Title: Secretary ACOF OPERATING MANAGER IV, LLC... -

Page 173

... Plan of Merger, dated as of September 9, 2013 (the "Merger Agreement"), by and among Holdings, Mariposa Merger Sub LLC and Neiman Marcus Group LTD Incm, a Delaware corporation; and WHEREAS, concurrently with the execution of this Agreement, ACOF Operating Manager III, LLC and ACOF Operating Manager... -

Page 174

..., directly or indirectly caused by, related to, based upon, or arising out of the rendering of any advice or performance of any services by any Indemnified Party for Holdings or any of its subsidiaries, in each case, except for any such loss, claim, damage or liability resulting from the gross... -

Page 175

... a director of officer of Holdings, and no Person shall be deemed to be an Affiliate of another Person solely by virtue of the fact that both Persons own shares of stock in Holdingsm "Business Day" shall mean any day other than a Saturday, a Sunday or a day on which banks in the City of New York are... -

Page 176

... each of the partners, members, directors, officers, employees, agents and controlling persons of Manager or any of its Related Personsm "Person" means an individual, a corporation, a general or limited partnership, a limited liability company, a joint stock company, an association, a trust or any... -

Page 177

...made at the address or facsimile number set forth below, or at such other address or facsimile number as such party shall have furnished to the other party in writing: (i) If to Manager: CPPIB Equity Investments Incm c/o Canada Pension Plan Investment Board One Queen Street East, Suite 2500 PmOm Box... -

Page 178

... c/o Ares Management LLC 2000 Avenue of the Stars Los Angeles, California 90067 Facsimile: (310) 201-4170 Email: stein@aresmgmtmcom frankel@aresmgmtmcom Attention: Adam Stein Kevin Frankel and NM Mariposa Holdings, Incm c/o Canada Pension Plan Investment Board One Queen Street East, Suite 2500 PmOm... -

Page 179

... of Manager and the Manager Related Parties have had, and from time to time may have, outside activities or interests that conflict or may conflict with the best interests of Holdings and its subsidiaries (collectively, "Outside Activities"), including corporate, business, employment and investment... -

Page 180

... directed by Manager, such waived portion will revert to Holdings and Neiman Marcusm No waiver on any one occasion or with respect to any period ... Business Daym References to a Person are also to its permitted successors and assignsm In the event that any claim is made by any Person relating ... -

Page 181

... of the parties hereto, the Manager Related Parties, the Indemnified Parties and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever... -

Page 182

...NEIMAN MARCUS GROUP, INC. By: /s/ BRENDA SANDERS Name: Brenda Sanders Title: Secretary CPPIB EQUITY INVESTMENTS INC. By: /s/ SHANE FEENEY Name: Shane Feeney Title: Vice President, Head of Direct Private Equity By: /s/ ANDRE BOURBONNAIS Name: Andre Bourbonnais Title: Senior Vice President, Private... -

Page 183

... those services as (a) are required of a director under the General Corporation Law of Delaware and all other applicable state and federal laws and regulations, (b) are customarily associated with and are incident to the position of a director and (c) the Company may, from time to time, reasonably... -

Page 184

... the actual number of days you serve as a Director in any quarter. In addition, the Company may from time to time grant you options to purchase common stock of the Company in accordance with, and subject to, one or more option award agreements and equity incentive plans. The Company shall reimburse... -

Page 185

... All information acquired from or on behalf of the Company or any of its affiliates, or otherwise in connection with your service as a Director (including prior to the date hereof), is confidential and you shall not directly or indirectly release, communicate, disclose or use such information for... -

Page 186

... non-contractual disputes or claims and the legal relationships between the parties hereto) will be brought in any federal court of appropriate jurisdiction located in the State of New York or any state court of appropriate jurisdiction located in New York county. Each party submits to and accepts... -

Page 187

Please indicate your acceptance of these terms by signing and returning the attached copy of this letter to the Chief Executive Officer. Yours sincerely, David Kaplan, Chairman of the Board For and on behalf of the Company /s/ DAVID KAPLAN I confirm and agree to the terms of my appointment as a ... -

Page 188

... those services as (a) are required of a director under the General Corporation Law of Delaware and all other applicable state and federal laws and regulations, (b) are customarily associated with and are incident to the position of a director and (c) the Company may, from time to time, reasonably... -

Page 189

... the actual number of days you serve as a Director in any quarter. In addition, the Company may from time to time grant you options to purchase common stock of the Company in accordance with, and subject to, one or more option award agreements and equity incentive plans. The Company shall reimburse... -

Page 190

... Board. CONFIDENTIALITY All information acquired from or on behalf of the Company or any of its affiliates, or otherwise in connection with your service as a Director (including prior to the date hereof), is confidential and you shall not directly or indirectly release, communicate, disclose or use... -

Page 191

... non-contractual disputes or claims and the legal relationships between the parties hereto) will be brought in any federal court of appropriate jurisdiction located in the State of New York or any state court of appropriate jurisdiction located in New York county. Each party submits to and accepts... -

Page 192

Please indicate your acceptance of these terms by signing and returning the attached copy of this letter to the Chief Executive Officer. Yours sincerely, David Kaplan, Chairman of the Board For and on behalf of the Company /s/ DAVID KAPLAN I confirm and agree to the terms of my appointment as a ... -

Page 193

... those services as (a) are required of a director under the General Corporation Law of Delaware and all other applicable state and federal laws and regulations, (b) are customarily associated with and are incident to the position of a director and (c) the Company may, from time to time, reasonably... -

Page 194

... the actual number of days you serve as a Director in any quarter. In addition, the Company may from time to time grant you options to purchase common stock of the Company in accordance with, and subject to, one or more option award agreements and equity incentive plans. The Company shall reimburse... -

Page 195

... Board. CONFIDENTIALITY All information acquired from or on behalf of the Company or any of its affiliates, or otherwise in connection with your service as a Director (including prior to the date hereof), is confidential and you shall not directly or indirectly release, communicate, disclose or use... -

Page 196

... non-contractual disputes or claims and the legal relationships between the parties hereto) will be brought in any federal court of appropriate jurisdiction located in the State of New York or any state court of appropriate jurisdiction located in New York county. Each party submits to and accepts... -

Page 197

Please indicate your acceptance of these terms by signing and returning the attached copy of this letter to the Chief Executive Officer. Yours sincerely, David Kaplan, Chairman of the Board For and on behalf of the Company /s/ DAVID KAPLAN I confirm and agree to the terms of my appointment as a ... -

Page 198

... 12.1 Neiman Marcus Group LTD LLC Computation of Ratio of Earnings to Fixed Charges (Unaudited) Thirty-nine weeks ended (in thousands, except ratios) August 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended August 3, 2013 (Predecessor) Fiscal year ended July... -

Page 199

EXHIBIT 21.1 NEIMAN MARCUS GROUP LTD LLC SUBSIDIARIES OF THE COMPANY JURISDICTION OF SUBSIDIARY/AFFILIATE INCORPORATION STOCKHOLDER Bergderf Geedman, Inc. Bergderf Graphics, Inc. BergderfGeedman.cem, LLC BG Preductiens, Inc. Maripesa Berrewer, Inc. NEMA Beverage Cerperatien NEMA Beverage Helding ... -

Page 200

... of Chief Executive Officer Pursuant to Rule 13a-14(a) and Rule 15d-14(a) I, Karen W. Katz, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Neiman Marcus Group LTD LLC; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state... -

Page 201

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Date: September 25, 2014 /s/ JAMES E. SKINNER James E. Skinner Executive Vice President, Chief Operating Officer and Chief Financial Officer -

Page 202

... (ii) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Dated: September 25, 2014 /S/ KAREN W. KATZ Karen W. Katz President and Chief Executive Officer Dated: September 25, 2014 /s/ JAMES E. SKINNER... -

Page 203