Mazda 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

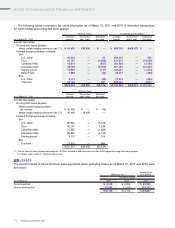

14 INCOME TAXES

The effective tax rate reflected in the consolidated statement of operations for the year ended March 31, 2011 differs

from the statutory tax rate for the following reasons. For the year ended March 31, 2010, since loss before income

taxes was reported, the information on the reconciliation from statutory tax rate to effective tax rate is not provided in

accordance with the applicable provisions of Japanese GAAP.

For the year ended March 31 2011

Statutory tax rate 40.4%

Equity in net income of affiliated companies (31.8)

Valuation allowance 453.8

Dividend received from foreign subsidiaries eliminated in consolidation 9.1

Other 0.1

Effective tax rate 471.6%

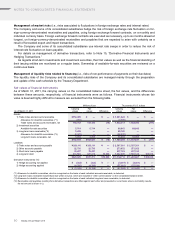

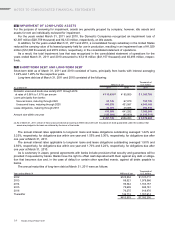

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards and accumulated tempo-

rary differences between assets and liabilities for financial accounting purposes and those for tax purposes. The sig-

nificant components of deferred tax assets and liabilities as of March 31, 2011 and 2010 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2011 2010 2011

Deferred tax assets:

Allowance for doubtful receivables ¥ 1,981 ¥ 2,060 $ 23,867

Employees’ severance and retirement benefits 30,723 32,970 370,157

Loss on impairment of long-lived assets 9,866 11,183 118,867

Accrued bonuses and other reserves 27,797 25,316 334,904

Inventory valuation 7,111 4,759 85,675

Valuation loss on investment securities, etc. 1,182 1,202 14,241

Net operating loss carryforwards 92,015 82,569 1,108,614

Other 55,409 56,159 667,578

Total gross deferred tax assets 226,084 216,218 2,723,904

Less valuation allowance (123,598) (59,949) (1,489,133)

Total deferred tax assets 102,486 156,269 1,234,771

Deferred tax liabilities:

Reserves under Special Taxation Measures Law (5,906) (6,225) (71,157)

Other (6,607) (2,477) (79,602)

Total deferred tax liabilities (12,513) (8,702) (150,759)

Net deferred tax assets ¥ 89,973 ¥147,567 $ 1,084,012

The net deferred tax assets are included in the following accounts in the consolidated balance sheet:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2011 2010 2011

Current assets—Deferred taxes ¥58,307 ¥ 60,311 $ 702,494

Investments and other assets—Deferred taxes 32,558 88,182 392,265

Current liabilities—Other current liabilities (54) (71) (651)

Long-term liabilities—Other long-term liabilities (838) (855) (10,096)

Net deferred tax assets ¥89,973 ¥147,567 $1,084,012

Mazda Annual Report 201 1 67