Mazda 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT REVIEW

Review of Operations

(Operating Environment)

Although the Mazda Group’s operating environment continued to

show a gradual recovery during the March 201 1 fiscal year,

supported by economic growth in Asia and other emerging

markets, conditions remain unstable because of concerns

including financial instability in Europe triggered by the Greek

debt crisis and rising crude oil prices. In Japan, the decline in

production following the end of economic stimulus measures has

been halted, with exports and production gradually increasing,

and capital investment is recovering, but difficulties including the

yen’s continued appreciation remain. In addition, the Great East

Japan Earthquake that struck on March 1 1 had a major impact on

the domestic economy, leading to reduced manufacturing activity

and depressed consumer sentiment. Against this backdrop, the

Mazda Group implemented a variety of measures to improve

earnings, including efforts to improve costs and raise efficiency,

while at the same time increasing sales in emerging markets and

improving the model mix.

(Global Sales Volume)

By market, Mazda’s domestic sales declined by 7%, to 206,000

units, reflecting a decline in demand as government subsidy

programs ended and from the effect of the Great East Japan

Earthquake, and this was despite solid sales of the new Premacy

(overseas name: Mazda5). Overseas, North American sales rose

12%, to 342,000 units, with a net increase from the introduction

of the Mazda2 (Japanese name: Demio) during the year, and

strong sales of the CX-7 and CX-9. In Europe, sales in Russia

turned around to record growth, but overall demand declined and

sales were 12% lower, at 212,000 units. With solid sales of leading

models including the Mazda3 (Japanese name: Axela) and

Mazda6 (Japanese name: Atenza), sales in China grew 20%, to

236,000 units. Sales in other markets rose 20%, to 277,000

units, on solid results in ASEAN markets and in Australia. As a

result, global sales volume totaled 1,273,000 units, for a 7%

increase from the previous year.

Consolidated wholesales for the year rose 14%, to 1.10

million units.

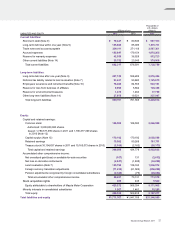

(Net Sales)

Despite the continued trend of a stronger yen relative to other

major currencies, higher sales volume resulted in a ¥161.7

billion (7%) increase in net sales, to ¥2,325.7 billion.

Consolidated net sales broke down as ¥1,784.2 billion overseas,

for a ¥195.2 billion (12%) increase, and ¥541.5 billion in Japan,

marking a ¥33.5 billion (6%) decline.

By product, vehicles sales rose ¥133.7 billion (8%), to

¥1,707.3 billion, on increased shipment volumes and despite

the yen’s continued appreciation against major currencies.

Sales of knockdown parts for overseas production rose ¥17.4

billion (14%), to ¥141.9 billion, on solid shipments to China.

Sales of parts declined ¥9.2 billion (4%), to ¥217.2 billion, and

other sales grew ¥19.9 billion (8%), to ¥259.3 billion.

(Operating Income)

Operating income rose ¥14.4 billion (152%), to ¥23.8 billion.

This growth was the result of various measures to improve

earnings, including ¥1 1.2 billion of cost improvements, increased

sales in emerging markets, and an improved model mix. The

effect of sales volumes and the model mix offset the roughly

¥5.0 billion negative impact from the earthquake, making an

additional ¥35.7 billion contribution. The yen’s appreciation

had a ¥43.7 billion negative foreign exchange impact.

Selling, general and administrative expenses were reduced

by ¥5.6 billion (1%), to ¥438.2 billion. Although expenses

increased with stepped-up advertising for the introduction of

new models and development for the introduction of new-

generation products, cost improvements in all areas more

than absorbed these increases.

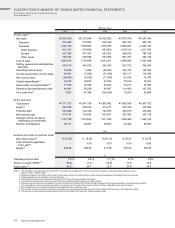

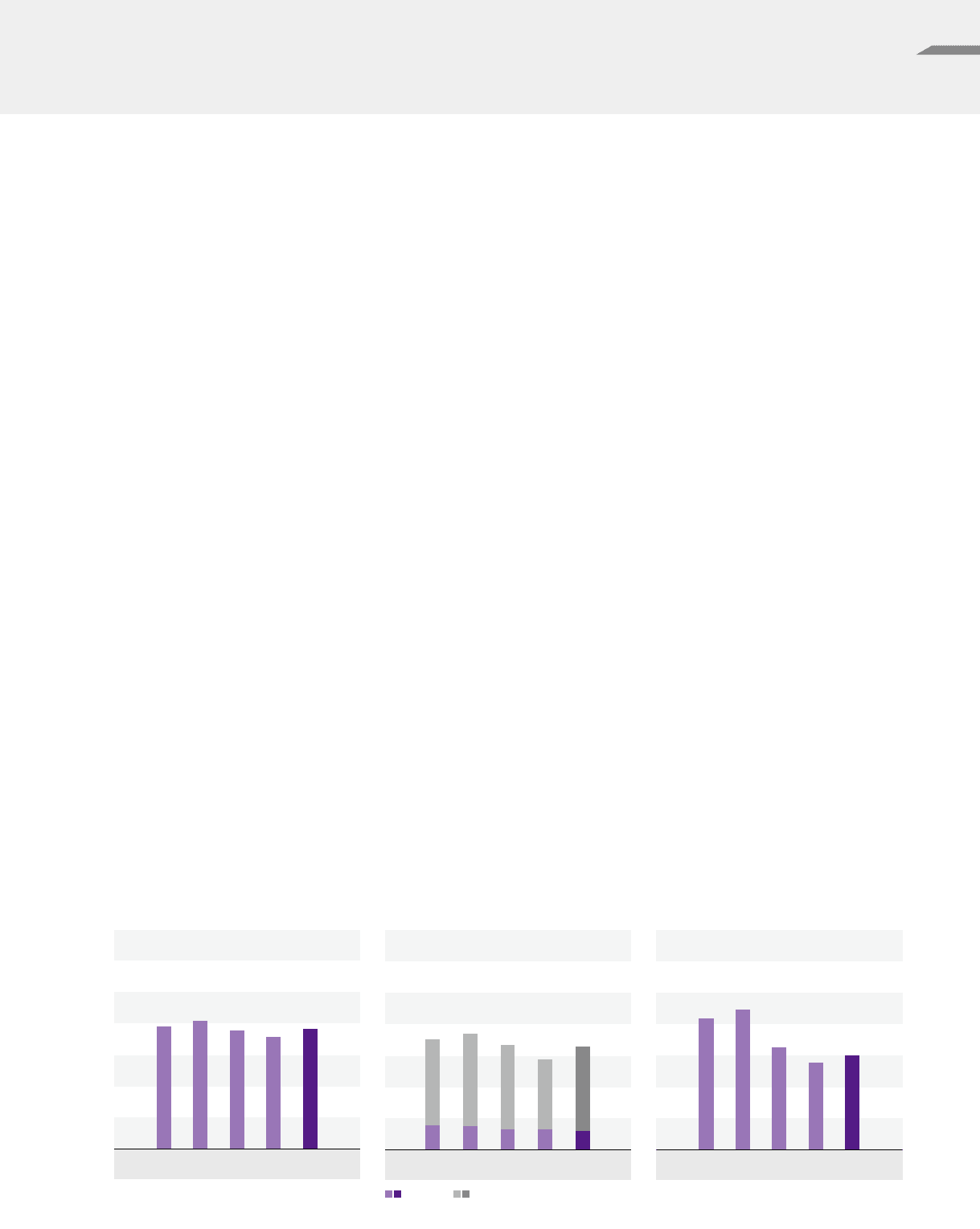

2007

Global sales volume

Thousands of units

2008 2009 2010 2011

1,302 1,363

1,261 1,193 1,273

(Years ended March 31)

2007 2008 2009 2010 2011

1,177

913

264

983

257

896

220

744

219

894

206

1,240

1,116

963

1,100

Consolidated wholesales

Thousands of units

(Years ended March 31)

2007 2008 2009 2010 2011

3,247.5 3,475.8

2,535.9

2,163.9 2,325.7

Net sales

Billions of yen

(Years ended March 31)

Domestic Overseas

Mazda Annual Report 201 1 41