Mazda 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTERVIEW WITH THE CFO

Kiyoshi Ozaki

Representative Director

Executive Vice President and CFO

Q1

Despite the effect of the earthquake, Mazda recorded

a ¥14.4 billion increase in operating income for the

March 201 1 fiscal year. What were the factors behind

this growth?

With the further strengthening of the yen and the Great East

Japan Earthquake occurring at the end of the period, the

March 201 1 fiscal year was a very difficult year for automakers.

Nevertheless, despite a more than ¥40 billion negative impact

from the yen’s appreciation and the effect of the earthquake,

Mazda was able to record profit growth with a ¥14.4 billion

increase in operating income. There were two major reasons

for this. The first was strong global sales. Sales declined in

Japan on a fall in demand due to the end of government

subsidy programs and from the effect of the earthquake, but

we were able to record steady growth in sales volume in the

United States, China, ASEAN countries including Thailand, and

Australia. The other reason was the success of ongoing cost

improvements. In the area of variable costs, despite being faced

with higher raw material prices, we were able to accelerate cost

innovation initiatives to more than absorb the increase and

improve costs by ¥1 1.2 billion. In terms of fixed costs, marketing

expenses increased by ¥5.6 billion from stepped-up advertising

activities for new model launches, but by pursuing cost

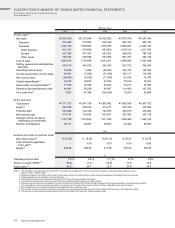

YoY +14.4 2011

9.5

+35.7

(43.7)

(5.6)

+16.7 23.8

+11.2

2010

Volume & Mix Foreign

exchange

Cost

improvements

Marketing

expenses

Others

Operating income change for the March 2011 fiscal year

Billions of yen

(Years ended March 31)

Includes the

decrease of about

¥5.0 billion due to

the impact of the

earthquake

U.S. dollar (20.7)

Euro (20.7)

Other (2.3)

improvement activities in all areas, we were able to improve

fixed costs by ¥16.7 billion. The fact that we were able to make

solid progress in terms of both sales and costs led to the

increase in operating income.

On the other hand, we recorded extraordinary losses on

damages from the Great East Japan Earthquake and a reserve

for business losses at an affiliated company in North America.

In addition, with the earthquake occurring just before the end

of the fiscal year and the uncertain impact on results in the

March 2012 fiscal year, we carefully examined the likelihood of

recovery of our deferred tax assets, and conservatively wrote

off a portion of those assets. As a result, we recorded a net

loss of ¥60.0 billion. This was our third consecutive net loss,

but operating income has shown a steady improvement over

the past two years, indicating that the momentum of our

business activities did not slow.

Q2

What is Mazda’s current financial position?

Despite the recording of a net loss, we were able to maintain

our equity ratio at the 24% level. Nevertheless, this is not yet

in line with our competitors, and it goes without saying that

further improvement of our financial position is an important

management issue going forward.

To strengthen our financial position, we need to accumulate

profit and at the same time streamline the balance sheet.

In terms of profit, major growth can be expected from the

global launch of new products equipped with SKYACTIV

TECHNOLOGY in the March 2012 fiscal year. Due to the timing

of the launch, there will not be a full-year contribution, but we

expect to see a boost from the second half of the fiscal year.

With regard to the balance sheet, the amount of investment

will increase over the short term from the introduction of

SKYACTIV vehicles and the proactive expansion of our

business in emerging markets. Going forward, we will reduce

inventories to the maximum extent possible, while in principle

strengthening our financial position over the long term

through the accumulation of profit.

Operating income Improve Worsen

38 Mazda Annual Report 201 1