Mazda 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

offset the effect of the strong yen and high raw material prices,

while at the same time proceeding with a steady pace of

investment for the future.

What do you see as the main points for enhancing

corporate value going forward?

Mazda’s Framework for Medium- and Long-Term Initiatives looks

ahead to the March 2016 fiscal year, and includes five primary

initiatives. These are the initiatives that we intend to pursue, but

in terms of enhancing future corporate value, the main items at

this time are “sales method innovation” and “cost innovation.”

We are aiming to achieve “sales method innovation” through

the effective promotion of SKYACTIV TECHNOLOGY-equipped

vehicles. First, we want all employees, distributors, dealers, and

suppliers to fully understand SKYACTIV TECHNOLOGY. We must

understand SKYACTIV TECHNOLOGY ourselves before we can

effectively convey the appeal of this remarkable technology to

individual customers. Advertising is of course one method of

conveying SKYACTIV’s appeal, but we believe the best method is

to have customers test-drive the vehicles. We want customers in

Japan and major overseas markets as well to actually drive

these vehicles to experience first-hand their high level of driving

performance, combined with fuel economy and other superior

environmental features. In addition, we will offer these new

products at prices that are affordable for a wider range of

customers compared with hybrid and electric vehicles. By

providing superior technology at an affordable price, we plan to

raise transaction prices in order to draw the line at unnecessary

price competition. By continuing to carry out and strengthen the

programs to enhance brand value that we have implemented to

date in major markets, including the curtailing of incentives,

introduction of certified used car programs, and reinforcement

of sales networks, while at the same time implementing global

“sales method innovation” based on the introduction of

SKYACTIV TECHNOLOGY, we are aiming for maximum results.

With regard to “cost innovation,” we are first working to

improve the cost of vehicles produced in Japan. We also plan to

raise our overseas parts procurement ratio to 30% from 20%.

In addition, we will expand overseas production in emerging

markets going forward, and we will work to improve costs and

reduce exchange rate risk by raising the percentage of local

procurement.

There have been several macro environmental changes

since the financial crisis in the fall of 2008, including the yen’s

prolonged appreciation, sharply higher prices for raw

materials, and the effect of the earthquake. SKYACTIV

TECHNOLOGY, the proprietary technology that we have been

developing during that time, is about to debut. This will lead to

solid enhancement of Mazda’s brand value globally, and

accelerate our efforts in rapidly growing emerging markets.

The road to achieving the March 2016 fiscal year targets of

¥170.0 billion in operating income with ROS of 5% or more

under our Medium- and Long-Term Outlook will not always be

easy going, but I am convinced that moving forward one step

at a time with the actions we need to take now is the only

course for enhancing corporate value.

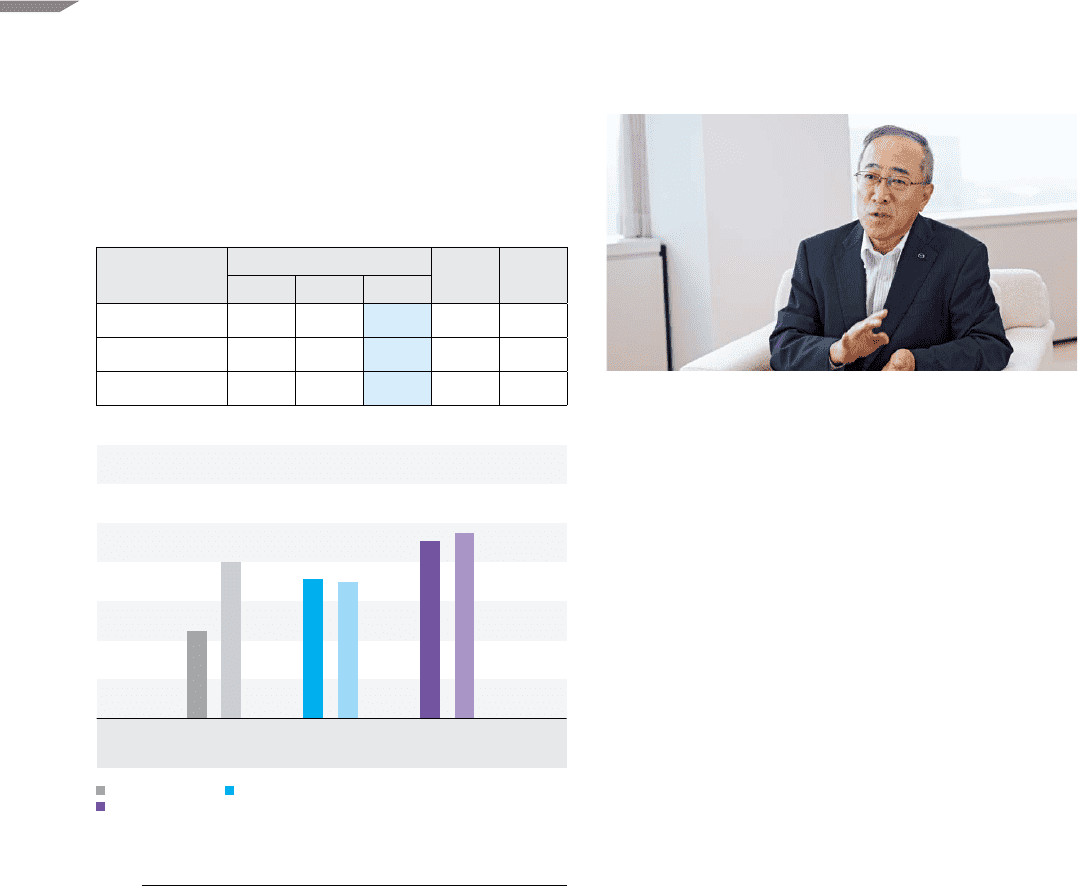

2011 2012

Outlook

2011 2012

Outlook

2011 2012

Outlook

44.7

80.0

71.6 70.0

91.0 95.0

Capital expenditures / Depreciation and amortization /

Research and development costs

Billions of yen

(Years ended March 31)

Capital expenditures Depreciation and amortization

Research and development costs

INTERVIEW WITH THE CFO

March 2012 fiscal year March 201 1

fiscal year

Increase /

(decrease)

First half Second half Full year

Net sales 960.0 1,230.0 2,190.0 2,325.7 (135.7)

Operating income (20.0) 40.0 20.0 23.8 (3.8)

Net income (35.0) 36.0 1.0 (60.0) 61.0

Outlook for the March 2012 fiscal year Billions of yen

40 Mazda Annual Report 201 1