Mazda 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liabilities

1) Trade notes and accounts payable, 2) Other accounts payable, and 3) Short-term loans payable

These payables are settled within short periods of time. Hence, their carrying values approximate their fair values.

Accordingly, carrying values are used as the fair values of these payables.

4) Long-term debt

a) Bonds payable

The fair value of bonds issued by the Company and its consolidated subsidiaries is based on the market price

where such a price is available. Otherwise, the sum of the present value of principal and interest payments is

used as the fair value of bonds payable. The discount rates used in computing the present value reflect the

time to maturity of the bonds as well as credit risk.

b) Long-term loans payable and c) Lease obligations

The fair value of these liabilities is calculated by the sum of the principal and interest payments discounted to

present value, using the imputed interest rate that would be required to newly execute a similar borrowing or

lease transaction.

For some long-term loans payable with variable interest rates, interest rate swaps are used as a hedge

against interest rate fluctuations. When such interest rate swaps meet certain hedging criteria, the net amount

to be paid or received under the interest rate swap contract is added to or deducted from the interest on the

long-term loans payable. In such cases, the resulting net interest on the long-term loans payable is used in cal-

culating the present value.

Derivative instruments

Refer to Note 15, “Derivative Financial Instruments and Hedging Transactions.”

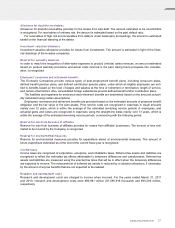

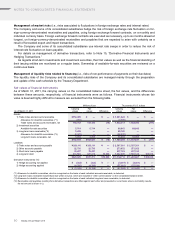

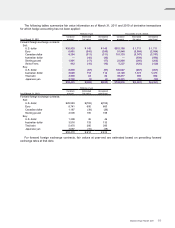

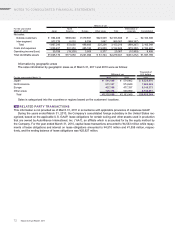

Scheduled amounts of receivables were as follows:

Millions of yen Thousands of U.S. dollars

As of March 31, 2011

Within

1 year

Over 1 year,

within

5 years

Over 5 years,

within

10 years

Over

10 years

Within

1 year

Over 1 year,

within

5 years

Over 5 years,

within

10 years

Over

10 years

Trade notes and accounts receivable ¥153,521 ¥ 977 ¥ — ¥ — $1,849,651 $11,771 $ — $ —

Long-term loans receivable 150 4,336 569 350 1,807 52,241 6,855 4,217

¥153,671 ¥5,313 ¥569 ¥350 $1,851,458 $64,012 $6,855 $4,217

For the schedule of repayment of long-term debt after the consolidated balance sheet date, refer to Note 9,

“Short-Term Debt and Long-Term Debt.”

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

62 Mazda Annual Report 201 1