Mazda 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

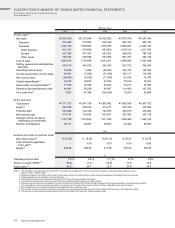

Financial Position

Total assets as of March 31, 201 1, stood at ¥1,771.8 billion. This

represented a ¥176.0 billion decline from the end of the

previous fiscal year, reflecting a decrease in cash and deposits

from the repayment of borrowings, and a partial write-off of

deferred tax assets. Cash and cash equivalents decreased

¥23.5 billion, to ¥322.8 billion. Inventories were reduced ¥13.9

billion, to ¥197.0 billion. Net property, plant and equipment

decreased ¥39.4 billion, to ¥786.2 billion.

Total short- and long-term interest-bearing debt decreased

¥29.1 billion, to ¥693.0 billion, from the repayment of

borrowings and a reduction in lease obligations. Net interest-

bearing debt—interest-bearing debt minus the ¥322.8 billion of

cash and cash equivalents—decreased ¥5.7 billion, to ¥370.2

billion, and the net debt-to-equity ratio stood at 86%. Total

liabilities at the fiscal year-end stood at ¥1,341.2 billion, which

was ¥96.7 billion less than at the end of the previous fiscal

year, on a decrease in trade notes and accounts payable

associated with the decline in production volume from the

Great East Japan Earthquake.

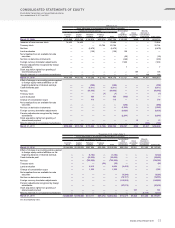

With the recording of a net loss for the year, equity decreased

¥79.3 billion, to ¥430.5 billion as of the fiscal year-end. Equity

per share decreased ¥44.68, to ¥242.24, from ¥286.92 at the

end of the previous fiscal year. Equity used for the calculation

of the equity ratio (i.e., equity less minority interests and stock

acquisition rights) decreased ¥79.1 billion, to ¥428.8 billion, for a

1.9 percentage point decline in the equity ratio, to 24.2%.

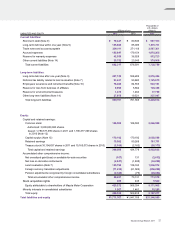

Cash Flows

(Cash Flow from Operating Activities)

Operating activities during the year generated net cash in the

amount of ¥15.3 billion. Income before income taxes was ¥16.1

billion, while depreciation and amortization totaled ¥71.6

billion, and the decline in production at domestic plants from

the impact of the Great East Japan Earthquake reduced trade

notes and accounts payable by ¥61.1 billion.

(Cash Flow from Investing Activities)

Investing activities used net cash in the amount of ¥13.7 billion,

the main item being outlays of ¥32.2 billion for the acquisition

of property, plant and equipment.

(Cash Flow from Financing Activities)

Financing activities used net cash in the amount of ¥14.4

billion, with the repayment of interest-bearing debt and the

previous fiscal year-end’s dividend payment exceeding the

amount of funds procured through corporate bonds and long-

term borrowings.

Free cash flow—the sum of operating cash flow and investing

cash flow—was positive in the amount of ¥1.6 billion.

Fund procurement consisted of ¥91.8 billion of long-term

borrowings during the year, and a ¥20.0 billion corporate bond

issue in January 201 1.

2007 2008 2009 2010 2011

1,907.8

479.9

1,985.6

554.2

414.7 509.8 430.5

24.8 27.8

22.9

1,801.0

1,947.8

1,771.8

26.1 24.2

Total assets / Equity / Equity ratio

Billions of yen / %

(As of March 31)

2007 2008 2009 2010 2011

474.7

232.2

505.0

281.1

532.6

375.8 370.2

753.4 722.1 693.0

Financial debt / Net financial debt

Billions of yen

(As of March 31)

2007 2008 2009 2010 2011

116.4

21.0

103.0

10.2

111.6

67.4

15.3 1.6

(95.4)

(67.4)

(61.8)

(129.2)

(44.3)

(13.7)

(92.8)

Cash flows

Billions of yen

(Years ended March 31)

Total assets Equity Equity ratio Financial debt Net financial debt Cash flows from operating activities

Cash flows from investing activities

Free cash flow

Mazda Annual Report 201 1 47