Mazda 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

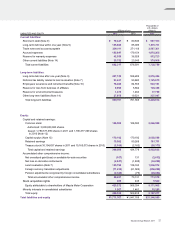

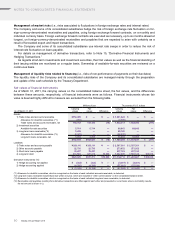

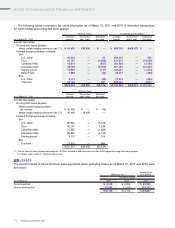

The financial instruments in the following table are excluded from “Assets 2) Investment securities” in the left

table because measuring the fair value of these instruments is deemed highly difficult: market prices of these instru-

ments are not available and future cash flows from these instruments are not contracted.

Millions of yen

Thousands of

U.S. dollars

As of March 31, 2011 Carrying values Carrying values

Available-for-sale securities

Non-listed equity securities ¥ 3,251 $ 36,169

Investment in securities of affiliated companies 81,177 978,036

¥84,428 $1,017,205

Basis of measuring fair value of financial instruments

The fair values of some financial instruments are based on market prices. When market prices are unavailable, the

fair values are based on reasonably estimated values. The estimated values may vary depending on the assump-

tions and variables used in the estimation.

Assets

1) Trade notes and accounts receivable

The fair values of these receivables are calculated by grouping the receivables according to their time to maturity,

and then by discounting the amount of those receivables by group to present values. The discount rates used in

computing the present values reflect the time to maturity as well as credit risk.

2) Short-term investments and investment securities

Short-term investments consist mainly of certificates of deposit of creditworthy financial institutions and are settled

within short periods of time. Hence, their carrying values approximate their fair values. Accordingly, carrying values

are used as the fair values of these investments.

As for listed stocks included in investment securities, their quoted prices on the stock exchange are used as their

fair values.

For notes on securities by classification, refer to “Securities” under Note 2, “Significant Accounting Policies,” and

Note 5, “Securities.”

3) Long-term loans receivable

Long-term loans receivable consist of variable interest loans. As such, the interest rates on these loans reflect the

market rates of interest within short periods of time. Also, the credit standings of borrowers of these loans have not

changed significantly since the execution of these loans. Accordingly, the carrying values are used as the fair values

of these loans receivable.

For loans receivable at a high risk, the fair value is calculated mainly based on amounts estimated to be collect-

ible through collateral and guarantees.

Mazda Annual Report 201 1 61