Mazda 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Steady progress is also being made in strengthening the

sales network. The number of showrooms was increased by 48

over the course of the year, to 312. Going forward, we will

continue to expand our presence along the coast, while at the

same time accelerate showroom openings in inland regions.

March 2012 Fiscal Year Forecast

Our estimate for total demand is for a roughly 10% increase, to

20.00 million units. Nevertheless, the growth rate has been

slowing during the first half of 201 1 from the steep rise in gasoline

prices and regulation for new vehicles registration in Beijing, so

we will be closely watching developments going forward.

We are planning for a 14% increase in sales volume, to

270,000 units, with a 0.1 percentage point increase in market

share, to 1.4%. To reach this, we will work to increase sales

volume by introducing a new Mazda3, and continue to

proactively expand our sales network and carry out sales

promotion activities closely tied to local regions. In addition,

beginning with the move to local production of the new

Mazda3, we will consider increasing production capacity to the

400,000-unit level. We also intend to expand the sales network

to more than 370 showrooms, focusing on rapidly growing

inland regions, within 201 1.

(Other Markets)

Overview of March 201 1 Fiscal Year Results and March

2012 Fiscal Year Forecast

Mazda’s sales volume in other markets rose 20%, to 277,000

units. This strong result included record sales volume in

Australia, Thailand, Indonesia, Malaysia, and Chile. Our plan

for the March 2012 fiscal year is for sales of 280,000 units.

Results and forecasts for Mazda’s major countries in this

segment are as follows.

Australia

Total demand in the March 201 1 fiscal year rose 6%, to

1,032,000 units. Mazda’s sales grew 8%, to a record 87,000

units, on strong sales of the Mazda2, Mazda3, and CX-7. Our

market share also rose 0.2 percentage points, to a record 8.4%.

We expect total demand in the March 2012 fiscal year to

grow 1%, to 1,041,000 units. Our sales plan is for a 4% increase,

to 90,000 units, with a market share of 8.6%. We will work to

achieve this plan through launches of a new Mazda3 with

SKYACTIV TECHNOLOGY and a new BT-50 produced at

AutoAlliance (Thailand) from the second quarter.

Thailand

Total demand in the March 201 1 fiscal year rose 43%, to 871,000

units. Led by strong sales of the Mazda2 and BT-50, Mazda’s

sales volume grew 1 13%, to a record 38,000 units. Our market

share also rose 1.4 percentage points, to a record 4.4%. The

launch of a Mazda2 sedan at the end of the previous fiscal year

gave our B-segment lineup both a five-door hatchback and a

sedan, enhancing Mazda’s market presence and brand value.

For the March 2012 fiscal year, we are forecasting a 2%

decline in total demand, to 856,000 units. Our sales plan is for

a 9% increase, to 42,000 units, with a 4.9% market share.

With our brand strength having been established by the

current Mazda3, we are looking to further increase sales with

the addition of a new Mazda3.

Israel

Total demand rose 26%, to 230,000 units. Mazda’s sales

volume grew 1%, to 32,000 units, on solid sales of the Mazda3

and the Mazda2 sedan. This also marked the 15th consecutive

year (calendar year basis) in which Mazda ranked No.1 in Israel

for automobile sales volume. Our market share declined 3.4

percentage points, to 13.8%.

We expect total demand in the March 2012 fiscal year to

decline 13%, to 200,000 units. Our sales plan is for a 7%

decline, to 30,000 units.

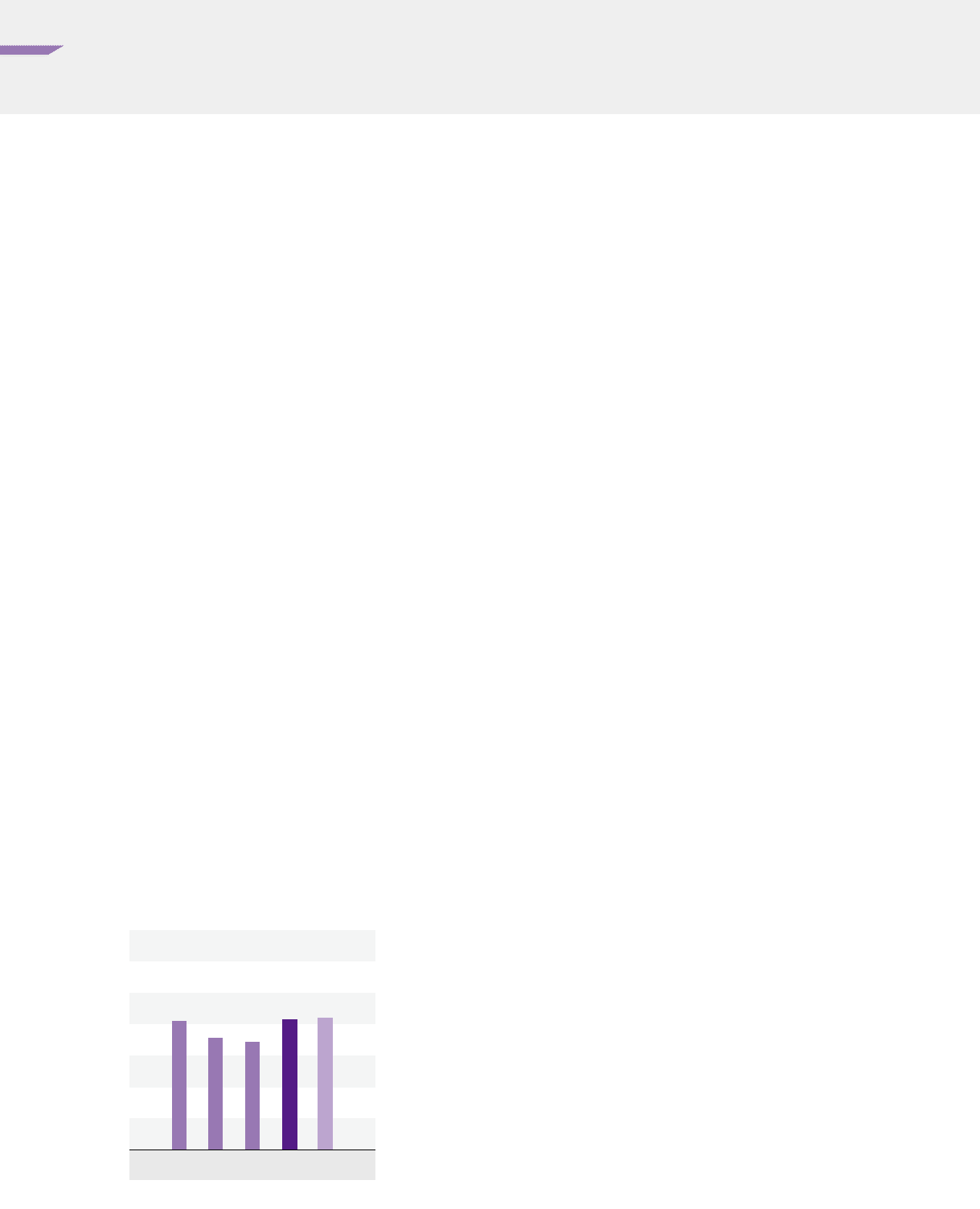

2008 2009 2010 2011 2012

273

238 230

277 280

Sales volume in other markets

Thousands of units

(Years ended March 31)

(Outlook)

MANAGEMENT REVIEW

46 Mazda Annual Report 201 1