Mazda 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mazda’s sales volume declined 12%, to 212,000 units,

reflecting lower demand in major countries with the exception

of Russia and intensification of sales competition. In the major

countries for Mazda, sales volume declined in the United

Kingdom on structural changes in demand and a weaker

economic environment. In Germany, however, despite weak

demand following the end of scrapping incentives, Mazda

increased its market share, boosted by sales of the new

Mazda5 and CX-7. In Russia, improvements of our product

supply and our enhanced product strength, combined with a

recovery in demand, led to a 29% increase in sales volume.

In terms of products, the Mazda2 is the most mass-market

car in Europe, but nevertheless the sales were negatively

impacted by a decline in the segment demand and price

increases due to the yen’s appreciation. On the other hand,

sales of the new diesel CX-7, introduced in the previous year,

rose by a solid 52%. In addition, we have begun to introduce

diesel versions of the new Mazda5, following the gasoline

model introduced in October 2010, and this has led to an

increase in both sales volume and market share in major

markets including Germany.

March 2012 Fiscal Year Forecast

We are forecasting roughly flat total demand for Europe as a

whole. The European economy remains weak in general, but

we are looking for a gradual recovery in total demand in

countries including Germany and Austria. We also expect

demand in Russia to recover to pre-economic-crisis levels.

Our sales plan is for a 5% decline, to 202,000 units. In

Germany, we expect sales to be roughly flat at 46,000 units, and

in Russia we are planning for a 38% increase to 40,000 units.

In terms of sales, we will work to attract customers and

increase residual value through the aggressive introductions

of limited-edition vehicles and measures to enhance brand

value. Particularly in Russia, where demand continues to grow,

we aim to further increase sales by effectively developing

resources on business. We will continue to improve and

strengthen our sales network, and at the same time launch

campaigns for the introduction of SKYACTIV TECHNOLOGY.

Through these efforts, we aim to raise the overall level of

European sales by further bolstering Mazda’s strengths in

major markets, and improving business efficiency.

(China)

Overview of March 201 1 Fiscal Year Results

Total demand grew 18%, to 18.40 million. High growth was

maintained on the expansion of models eligible for “eco-car”

incentives, and a rush in demand before the end of tax

reductions at the end of 2010 and the implementation of

regulation for new vehicles registration in Beijing.

Mazda achieved record sales, led by main models including

the Mazda3 and Mazda6, for 20% growth to a record 236,000

units. By market on a calendar year basis, China has surpassed

Japan and the United States as Mazda’s largest market. We

maintained our market share at the previous year’s 1.3% level.

The reasons for the strong sales of the Mazda3 are the

building of a production structure to address growing demand

by the transfer of production from Chongqing to the Nanjing

Plant, and the Mazda3’s certification for the eco-car subsidy

program. The reasons for the strong sales of the Mazda6 are

the success of a strategy of concurrently selling the current

and the previous model, and of sales promotion activities held

in connection with test drive events and motor shows. In

addition, the introduction of the Mazda8 in December 2010

helped to strengthen the product lineup and expand the

customer base.

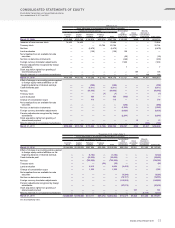

2008 2009 2010 2011 2012

327 322

1.5 1.7

1.3

239

212 202

1.2

Sales volume in Europe

Thousands of units / %

(Years ended March 31)

(Outlook) 2008 2009 2010 2011 2012

101

135

1.1 1.4

1.3

196

236

270

1.3

Sales volume in China

Thousands of units / %

(Years ended March 31)

(Outlook)

Sales volume Market share Sales volume Market share

Mazda Annual Report 201 1 45