Mazda 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of OperationsMessages from Management Mazda’s Environmental and

Safety Technology

Corporate Information Financial Section

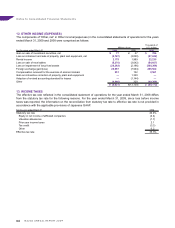

Thousands of U.S. dollars

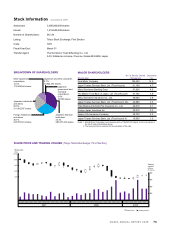

For the year ended March 31, 2009 North America Europe Other areas Total

International sales $7,118,367 $6,667,163 $5,761,062 $19,546,592

Notes: 1) International sales include exports by Mazda Motor Corporation and its domestic consolidated subsidiaries as well as sales (other than exports to Japan) by

overseas consolidated subsidiaries.

2) Method of segmentation and principal countries or regions belonging to each segment

a) Method: Segmentation by geographic adjacency

b) Principal countries or regions belonging to each segment

North America ...... U.S.A. and Canada

Europe ................. Russia, Germany and U.K.

Other areas .......... Australia, China and Thailand

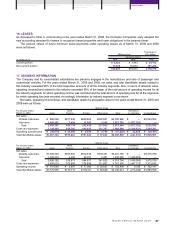

18. RELATED PARTY TRANSACTIONS

(Additional Information)

Commencing in the year ended March 31, 2009, the Company and its consolidated subsidiaries adopted ASBJ

Statement No. 11, Accounting Standard for Related Party Disclosures, and its Implementation Guidance—ASBJ

Guidance No. 13, Guidance on Accounting Standard for Related Party Disclosures—both issued on October 17,

2006. Prior to the year ended March 31, 2009, only those transactions between the Company and its related parties

were considered for disclosure as material related party transactions. Commencing in the year ended March 31,

2009, as a result of adopting these new standards, in addition to the transactions considered for disclosure in the prior

years, those transactions between the Company’s consolidated subsidiaries and the Company’s related parties are

also considered for disclosure as material related party transactions.

During the year ended March 31, 2009, the Company purchased treasury stock from Ford Motor Company (“Ford”).

Prior to November 19, 2008, Ford had owned one-third of the Company’s voting interest, and the Company had been

an (equity method-applied) affiliate of Ford. On November 19, 2008, Ford sold part of its shares of the Company’s

common stock, and of the total shares sold by Ford, the Company purchased 96,802,000 shares at ¥184 ($1.88) per

share, or a total amount of ¥17,812 million ($181,755 thousand), through ToSTNeT-3 Off-Hour Trading System of the

Tokyo Stock Exchange. As a result, the Company is no longer an (equity method-applied) affiliate of Ford. However,

Ford still remains a major shareholder of and, as such, a related party to the Company. As of March 31, 2009, Ford

had a 14.9% voting interest of the Company.

During the year ended March 31, 2009, the Company’s consolidated foreign subsidiaries in Europe liquidated

their receivables with FCE Bank plc. (“FCE”), a subsidiary in Europe of Ford. The total amount of transactions during

the year was ¥393,490 million ($4,015,204 thousand). To the extent the transactions are subject to the guarantee

extended to FCE by the Company’s subsidiaries, the amount received is accounted for as financial liability and

reported as short-term debt in the consolidated balance sheet; otherwise, the transactions are accounted for as sale

of receivables. The balance of short-term debt in the consolidated balance sheet as of March 31, 2009 was ¥5,472

million ($55,837 thousand).

During the year ended March 31, 2009, the Company’s consolidated foreign subsidiary in the United States

recognized, based on the applicable U.S. GAAP, lease obligations for certain tooling used in production that is owned

by AutoAlliance International, Inc. (“AAI”), an affiliate which is accounted for by the equity method by the Company.

The total amount of transaction was ¥32,069 million ($327,235 thousand), and the ending balance of lease obligations

was ¥27,187 million ($277,418 thousand). The actual payments of lease obligations are made through the Company.

The Company issued guarantees of loans and letters of undertaking to provide guarantees to certain creditors

of AAI. As of March 31, 2008, guarantees of loans and letters of undertaking covered ¥16,480 million of AAI’s

obligations.

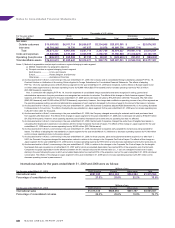

19. SUPPLEMENTARY CASH FLOW INFORMATION

Assets and liabilities related to finance lease transactions that were newly recognized in the year ended March 31,

2009 amounted to ¥34,291 million ($349,908 thousand) and ¥34,400 million ($351,020 thousand), respectively.

Also, for the year ended March 31, 2008, assets and liabilities related to finance lease transactions that were newly

recognized amounted to ¥38,743 million and ¥39,906 million, respectively.

For the year ended March 31, 2008, exercise of bonds with stock acquisition rights increased common stock by

¥555 million, increased capital surplus by ¥555 million, and decreased bonds with stock acquisition rights by ¥1,110

million.

69