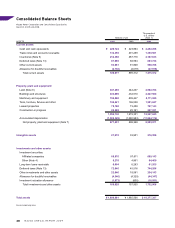

Mazda 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

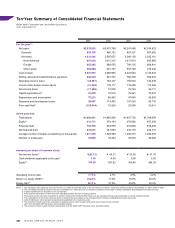

Management’s Discussion and Analysis

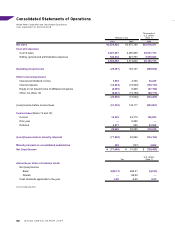

Highlights of the March 2009 Fiscal Year

● Reflecting a global contraction in automobile demand, net sales declined 27.0% to ¥2,535.9 billion; operating

income declined ¥190.5 billion to a ¥28.4 billion operating loss; and net income declined ¥163.3 billion for a

¥71.5 billion net loss.

● Global sales volume was down 7.5%, at 1,261,000 units.

● The dividend was reduced by ¥3, to ¥3 per share.

Overview of the Mazda Group

The consolidated financial statements for the March 2009 fiscal year include the accounts of Mazda Motor

Corporation, 54 consolidated subsidiaries (26 overseas and 28 in Japan) and 14 equity-method affiliates

(5 overseas and 9 in Japan).

Business Conditions

With the global financial crisis that started in the United States having spread to the real economy, both the

domestic economy and overseas economies deteriorated rapidly from the second half of 2008. A global

contraction in automobile demand and a sharply stronger yen during the second half of the fiscal year made the

economic environment surrounding the Mazda Group even more difficult, to a degree not seen in the past.

In addition to wages remaining depressed throughout the March 2009 fiscal year, a major global recession in

the second half of the year, triggered by the U.S. financial crisis, led to major deterioration in consumer sentiment

and corporate earnings, and the size of the domestic automobile industry shrank 12%, to 4.7 million units. Total

demand in the United States contracted 25%, to 11.9 million units, while Europe (including Russia) saw a 12%

decline, to 18.54 million units. The Chinese market, on the other hand, grew 2%, to 9.45 million units.

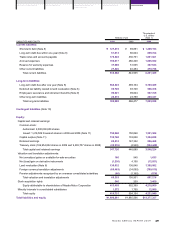

Consolidated Financial Results

Given this difficult operating environment, Mazda has implemented emergency measures in all areas—

production, sales and development—in response to the economic crisis, while continuing to pursue the mid-term

strategy laid out in the Mazda Advancement Plan. First, production was adjusted to bring inventories to appropriate

levels, all costs including labor and advertising were reviewed, and cost reductions were implemented.

In terms of capital expenditures, priority is being given to targeted investment in forward-looking technology

development programs such as next-generation products and environmental technologies, and less urgent

plans have been postponed. Cost Innovation initiatives are also being accelerated, and we have moved toward

a streamlined and lean management structure.

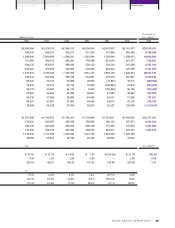

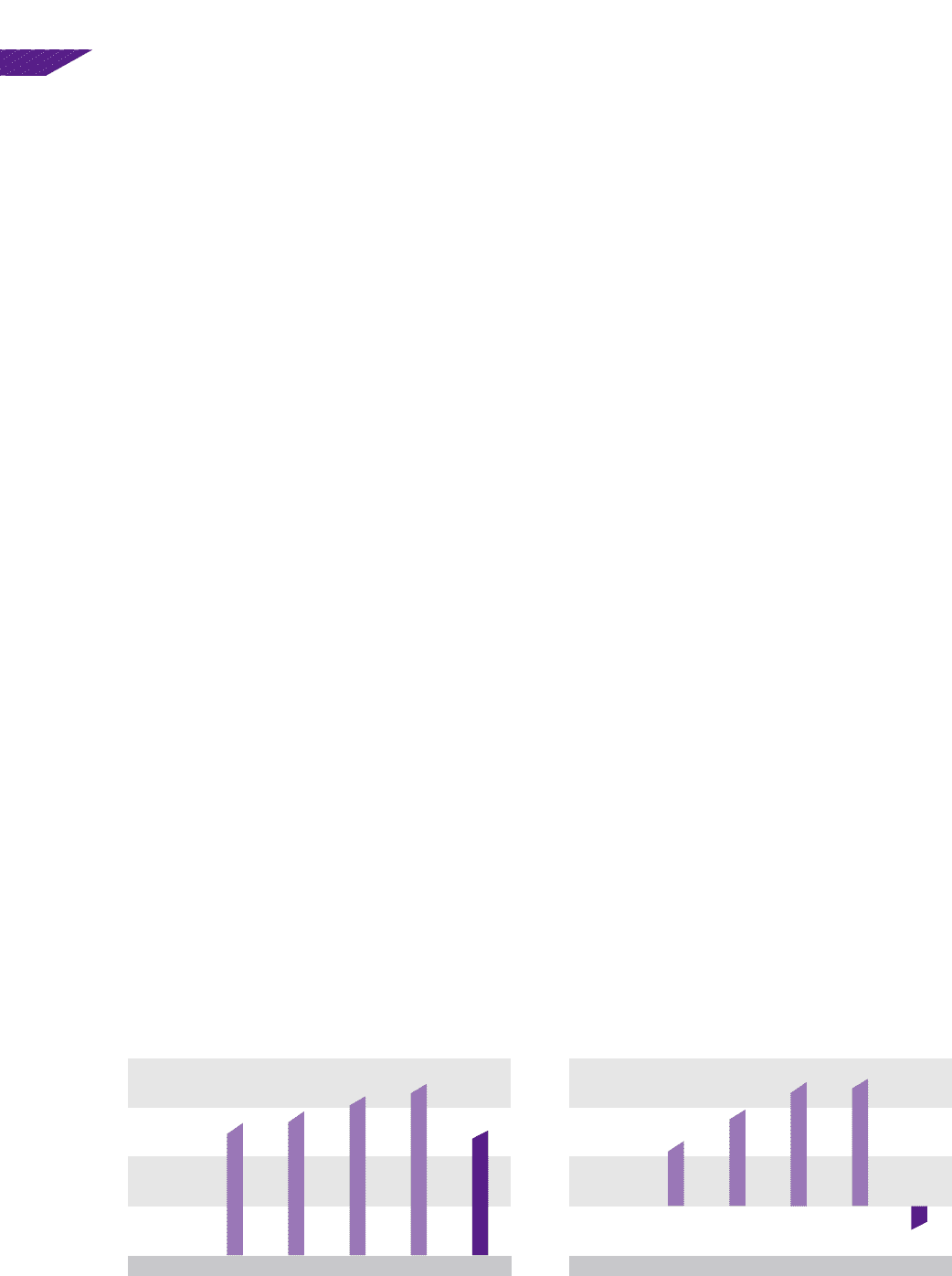

2,695.6

3,247.5

3,475.8

2,535.9

2,919.8

)'', )''- )''. )''/ )''0

(Billions of yen)

(Years ended

March 31)

E\kjXc\j

82.9

123.4

162.1

28.4

158.5

)'', )''- )''. )''/ )''0

(Years ended

March 31)

(Billions of yen)

Fg\iXk`e^`eZfd\cfjj

40