Mazda 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

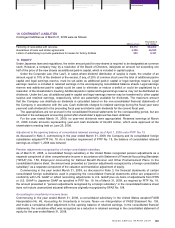

Income taxes

Income taxes comprise corporation, enterprise, and inhabitants taxes. Deferred tax assets and liabilities are

recognized to reflect the estimated tax effects attributable to temporary differences and carryforwards. Deferred tax

assets and liabilities are measured using the enacted tax rates that will be in effect when the temporary differences

are expected to reverse. The measurement of deferred tax assets is reduced by a valuation allowance, if necessary,

by the amount of any tax benefits that are not expected to be realized.

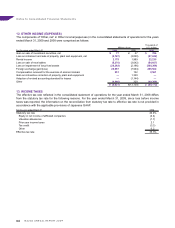

Research and development costs

Research and development costs are charged to income when incurred. For the years ended March 31, 2009 and

2008, research and development costs were ¥95,967 million ($979,255 thousand) and ¥114,400 million, respectively.

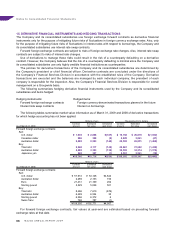

Derivatives and hedge accounting

Derivative financial instruments are mainly stated at fair value, and changes in the fair value are recognized as

gains or losses unless derivative financial instruments are used for hedging purposes and meet criteria for hedge

accounting.

If derivative financial instruments are used as hedges and meet certain hedging criteria, recognition of gains or

losses resulting from changes in the fair value of derivative financial instruments is deferred until the related losses or

gains on the hedged items are recognized.

Also, if interest rate swap contracts are used as hedges and meet certain hedging criteria, the net amount to be

paid or received under the interest rate swap contract is added to or deducted from the interest on the assets or

liabilities for which the swap contract was executed.

Amounts per share of common stock

The computations of net income or loss per share of common stock are based on the average number of shares

outstanding during each fiscal year. Diluted net income per share of common stock is computed based on the average

number of shares outstanding during each fiscal year after giving effect to the diluting potential of common stock to be

issued upon the exercise of stock acquisition rights and stock options.

For the year ended March 31, 2009, only information on net loss per share of common stock is provided without

information on diluted net loss per share of common stock to reflect the diluting effect in accordance with the

applicable provisions of Japanese GAAP.

Cash dividends per share represent amounts applicable for the respective years on an accrual basis.

Reclassifications

Certain amounts in the prior year’s consolidated financial statements have been reclassified to conform to this year’s

presentation.

3. ADOPTION OF NEW ACCOUNTING STANDARDS AND ACCOUNTING CHANGES

Practical Solution on Unification of Accounting Policies Applied to Foreign Subsidiaries for Consolidated Financial

Statements

As discussed in Note 1, commencing in the year ended March 31, 2009, the Company and its consolidated foreign

subsidiaries adopted PITF No. 18, and made necessary adjustments in preparing the consolidated financial

statements.

In principle, Japanese GAAP requires that accounting policies and procedures applied by a parent company and

its consolidated subsidiaries, including consolidated foreign subsidiaries, be unified (in terms of Japanese GAAP)

for the purpose of preparing consolidated financial statements. However, prior to the year ended March 31, 2009,

in preparing the consolidated financial statements, as a tentative measure, for consolidated foreign subsidiaries,

Japanese GAAP allowed a parent company to use the accounts of consolidated foreign subsidiaries maintained in

conformity with the generally accepted accounting principles prevailing in the respective countries of domicile, without

reflecting reconciling adjustments from accounting principles of various countries to Japanese GAAP.

PITF No. 18, which became effective as of April 1, 2008, revised the tentative measure. Under the revised

tentative measure, PITF No. 18 allows a parent company to prepare consolidated financial statements, using

consolidated foreign subsidiaries’ financial statements which reflect adjustments to reconcile from the accounting

principles of the respective countries of domicile to either IFRS or U.S. GAAP as necessary.

Notes to Consolidated Financial Statements

56