Mazda 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

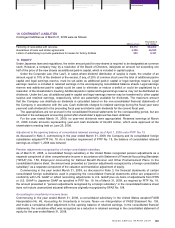

Accounting for leases

Commencing in the year ended March 31, 2008, the Domestic Companies early adopted ASBJ Statement No. 13,

Accounting Standard for Lease Transaction, and ASBJ Guideline No. 16, Guidance on Accounting Standard for Lease

Transaction, originally issued by the Business Accounting Deliberation Council on June 17, 1993 and by the Japanese

Institute of Certified Public Accountants on January 18, 1994, respectively, and both revised by the ASBJ on March

30, 2007. Early adoption of ASBJ Statement No. 13 and ASBJ Guideline No. 16 is permitted as of the beginning of a

fiscal year that begins on or after April 1, 2007.

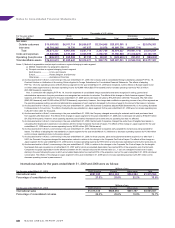

The effects of adopting the new standards on the consolidated balance sheet as of March 31, 2008 were to

increase property, plant and equipment and intangible assets by ¥33,862 million and ¥15 million, respectively, and to

increase current liabilities and long-term liabilities by ¥12,448 million and ¥22,505 million, respectively. In addition, the

effects of adopting the new standards on the consolidated statement of operations for the year ended March 31, 2008,

were to increase operating income by ¥1,199 million and to decrease income before income taxes by ¥918 million.

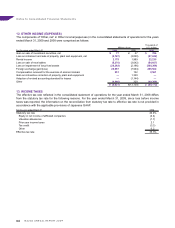

Prior to the year ended March 31, 2008, in the consolidated statements of cash flows, all payments of lease fees

were included in the cash flows from operating activities. Commencing in the year ended March 31, 2008, however,

those portions that constitute payment of lease obligations are included in the cash flows from financing activities.

Also, prior to the year ended March 31, 2008, proceeds from sale and leaseback transactions were included in the

cash flows from investing activities. Commencing in the year ended March 31, 2008, however, proceeds from sale

and leaseback transactions are included in the cash flows from financing activities by taking the financing nature of

the transactions into consideration.

The effects of adopting the new standards on the consolidated statement of cash flows for the year ended March

31, 2008 were to increase cash flows from operating activities by ¥13,890 million, to decrease cash flows from

investing activities by ¥8,794 million, and to decrease cash flows from financing activities by ¥5,096 million.

The effects of adopting the new standards on the segment information are discussed in the applicable section of

the notes to the consolidated financial statements.

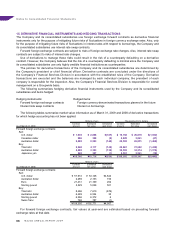

Prior to the year ended March 31, 2008, in the consolidated balance sheets, leased properties related to finance

lease transactions by a consolidated foreign subsidiary were included in tools, furniture, fixtures, and other of property,

plant and equipment. Commencing in the year ended March 31, 2008, however, these leased properties are included

in leased properties of property, plant and equipment, as the Domestic Companies adopted the revised accounting

standards for leases as discussed earlier, which resulted in increased materiality of leased properties.

As of March 31, 2008, the balance of the leased properties in property, plant and equipment amounted to

¥1,384 million.

Depreciation of property, plant and equipment

Commencing in the year ended March 31, 2008, for those property, plant and equipment that were acquired on or

after April 1, 2007, the Domestic Companies changed the depreciation method in accordance with the applicable

revisions to the Corporate Tax Code of Japan, promulgated on March 30, 2007.

The effects of this change on the consolidated statement of operations for the year ended March 31, 2008 were to

decrease operating income by ¥910 million and income before income taxes by ¥912 million.

The effects of adopting the new standards on the segment information are discussed in the applicable section of

the notes to the consolidated financial statements.

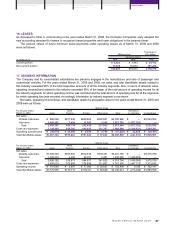

Adoption of new accounting standard by a consolidated foreign subsidiary

Prior to the year ended March 31, 2008, among the consolidated foreign subsidiaries, CCA prepared its financial

statements based on the accounting principles generally accepted in Colombia to reflect adjustments for the

country’s inflationary economy and changing prices. On May 7, 2007, however, the federal government of Colombia

promulgated a decree to abolish such adjustments from the country’s accounting principles. As a result, commencing

in the year ended March 31, 2008, CCA’s financial statements do not reflect such adjustments.

In the consolidated statement of operations for the year ended March 31, 2008, the effects of adopting the new

standard on operating income was none and those on income before income taxes were immaterial.

Notes to Consolidated Financial Statements

58