Mazda 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of OperationsMessages from Management Mazda’s Environmental and

Safety Technology

Corporate Information Financial Section

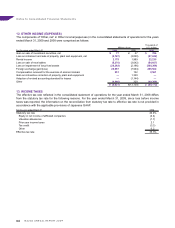

10. CONTINGENT LIABILITIES

Contingent liabilities as of March 31, 2009 were as follows:

Thousands of

Millions of yen U.S. dollars

Factoring of receivables with recourse ¥4,312 $44,000

Guarantees of loans and similar agreements 4,508 46,000

Letters of undertaking to provide guarantees for leases for factory facilities 525 5,357

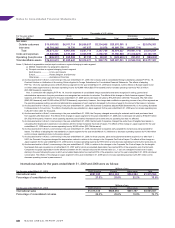

11. EQUITY

Under Japanese laws and regulations, the entire amount paid for new shares is required to be designated as common

stock. However, a company may, by a resolution of the Board of Directors, designate an amount not exceeding one

half of the price of the new shares as additional paid-in capital, which is included in capital surplus.

Under the Corporate Law (“the Law”), in cases where dividend distribution of surplus is made, the smaller of an

amount equal to 10% of the dividend or the excess, if any, of 25% of common stock over the total of additional paid-in

capital and legal earnings reserve, must be set aside as additional paid-in capital or legal earnings reserve. Legal

earnings reserve is included in retained earnings in the accompanying consolidated balance sheets. Legal earnings

reserve and additional paid-in capital could be used to eliminate or reduce a deficit or could be capitalized by a

resolution of the shareholder’s meeting. Additional paid-in capital and legal earnings reserve may not be distributed as

dividends. Under the Law, all additional paid-in capital and legal earnings reserve may be transferred to other capital

surplus and retained earnings, respectively, which are potentially available for dividends. The maximum amount

that the Company can distribute as dividends is calculated based on the non-consolidated financial statements of

the Company in accordance with the Law. Cash dividends charged to retained earnings during the fiscal year were

year-end cash dividends for the preceding fiscal year and interim cash dividends for the current fiscal year.

The appropriations are not accrued in the consolidated financial statements for the corresponding period, but are

recorded in the subsequent accounting period after shareholder’s approval has been obtained.

For the year ended March 31, 2009, no year-end dividends were appropriated. Retained earnings at March

31, 2008 include amounts representing year-end cash dividends of ¥4,228 million, which were approved at the

shareholder’s meeting held on June 25, 2008.

Adjustment to the opening balance of consolidated retained earnings as of April 1, 2008 under PITF No. 18

As discussed in Note 3, commencing in the year ended March 31, 2009, the Company and its consolidated foreign

subsidiaries adopted PITF No. 18. As a transition requirement of PITF No. 18, the balance of consolidated retained

earnings as of April 1, 2008 was reduced.

Pension adjustments recognized by a foreign consolidated subsidiary

As of March 31, 2008, a consolidated foreign subsidiary in the United States recognized pension adjustments as a

separate component of other comprehensive income in accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans. In the

consolidated balance sheet, the amount was presented as “pension adjustments recognized by a foreign consolidated

subsidiary” as a separate component of the valuation and translation adjustment of equity.

Commencing in the year ended March 31, 2009, as discussed in Note 3, the financial statements of certain

consolidated foreign subsidiaries used in preparing the consolidated financial statements either are prepared in

conformity with U.S. GAAP or reflect reconciling adjustments to U.S. GAAP plus six items of adjustments from IFRS

or U.S. GAAP to Japanese GAAP as specified in PITF No. 18. As of March 31, 2009, as required by PITF No. 18,

the amount presented in “pension adjustments recognized by a foreign subsidiary” in the consolidated balance sheet

does not include unamortized actuarial differences originally recognized by SFAS No. 158.

Accounting for uncertainty in income taxes

Commencing in the year ended March 31, 2008, a consolidated subsidiary in the United States adopted FASB

Interpretation No. 48, Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109,

and made a cumulative-effect adjustment to the opening balance of retained earnings. In the consolidated financial

statements, the cumulative-effect was recognized as a reduction in retained earnings in the consolidated statement of

equity for the year ended March 31, 2008.

63