Mazda 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

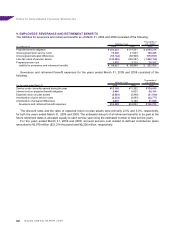

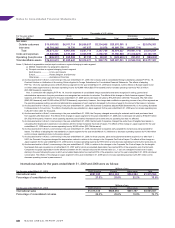

9. EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

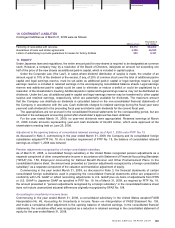

The liabilities for severance and retirement benefits as of March 31, 2009 and 2008 consisted of the following:

Thousands of

Millions of yen U.S. dollars

As of March 31 2009 2008 2009

Projected benefit obligation ¥ 302,253 ¥ 311,051 $ 3,084,214

Unrecognized prior service costs 19,428 21,633 198,245

Unrecognized actuarial differences (95,144) (66,966) (970,857)

Less fair value of pension assets (143,292) (169,587) (1,462,164)

Prepaid pension cost 7,676 3,713 78,327

Liability for severance and retirement benefits ¥ 90,921 ¥ 99,844 $ 927,765

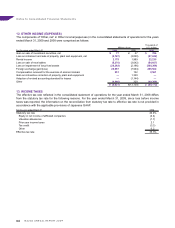

Severance and retirement benefit expenses for the years ended March 31, 2009 and 2008 consisted of the

following:

Thousands of

Millions of yen U.S. dollars

For the years ended March 31 2009 2008 2009

Service costs—benefits earned during the year ¥12,195 ¥11,262 $124,439

Interest cost on projected benefit obligation 6,486 6,623 66,184

Expected return on plan assets (5,589) (5,946) (57,030)

Amortization of prior service costs (2,232) (2,095) (22,777)

Amortization of actuarial differences 8,030 6,159 81,939

Severance and retirement benefit expenses ¥18,890 ¥16,003 $192,755

The discount rates and the rates of expected return on plan assets were primarily 2.0% and 3.0%, respectively,

for both the years ended March 31, 2009 and 2008. The estimated amount of all retirement benefits to be paid at the

future retirement dates is allocated equally to each service year using the estimated number of total service years.

For the years ended March 31, 2009 and 2008, accrued pension cost related to defined contribution plans

amounted to ¥2,079 million ($21,214 thousand) and ¥2,226 million, respectively.

Notes to Consolidated Financial Statements

62